It’s Time to Shift the Focus of the Deficit Debate

The Congressional Budget Office’s latest report on the budget outlook revealed (perhaps unintentionally) that fixating on Congress and the President as the central players in the federal deficit drama is a mistake. According to the CBO, the path the federal budget deficit will follow over the next 10 years is just as much (if not more so) a question of Federal Reserve policy.

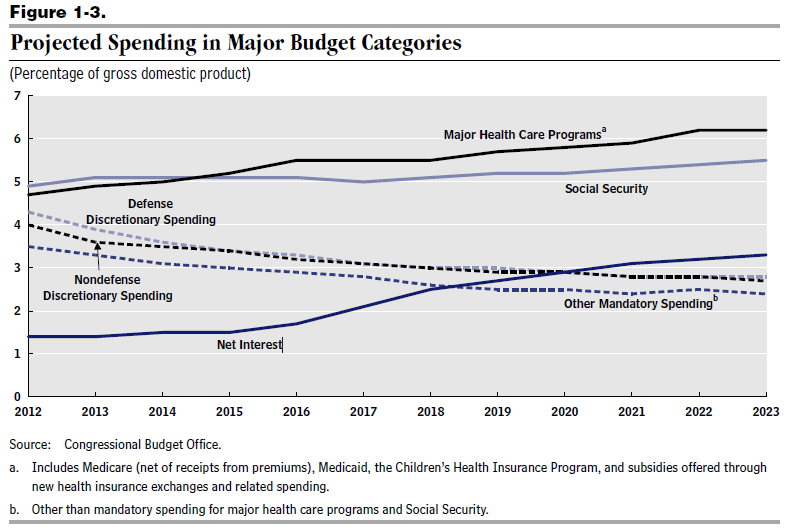

Here’s CBO’s latest 10-year outlook for the federal budget:

As you can see, the fastest rising category of spending is not “Social Security,” or even “major healthcare programs,” but rather “net interest,” which CBO projects will grow from 1.4 percent of GDP to 3.3 percent of GDP by 2023 (“a percentage that has been exceeded only once in the past 50 years,” they note).

But the rise in the dark blue line at the bottom of the figure is not the result of some impersonal, inescapable force — it represents a prediction about Fed policy. The increase in interest payments is expected to come primarily from a rise in interest rates, rather than a rise in debt levels (as you can see if you look at CBO’s Table 1-6, the debt-to-GDP ratio is reasonably stable over this period).

Interest rates are a policy variable. This growth in debt-service costs, in other words, represents a choice. The question of whether or not it’s the right choice should receive a lot more attention in our popular discussions, alongside the obsession with “grand bargains” and the rest. We’re often told (in a near inversion of the truth) that rising budget deficits are the biggest near-term threat to the US economy. But if you look at what the CBO’s projection says about our collective priorities, what we see here is a decision to allow interest rates to rise at the expense of the deficit.

Whether this particular model is accurate is one question. As the report points out, slight changes in interest rates can make a huge difference to the future budget path: “If interest rates on all types of Treasury securities were 1 percentage point higher or lower each year from 2014 through 2023 and all other economic variables were unchanged, cumulative outlays projected for the 10-year period would be about $1.1 trillion higher or lower (excluding the additional costs of servicing the federal debt).” (p. 29)

However, given some model of the interactions between unemployment, inflation, interest rates, and budget deficits, the question of what particular tradeoffs we are making, or should make, needs to be brought to the fore. One issue raised by the CBO’s projection is the Fed’s apparent commitment to place a 2 percent ceiling on inflation. Is maintaining this ceiling worth it, given the price that needs to be paid in terms of a more elevated unemployment rate and increased political pressure to reduce spending on essential government functions? How harmful would inflation in the 3–4 percent range be, given the costs of trying to avoid it? Whatever your answers are, these questions need to become a more routine part of the deficit debate, for the sake of better public understanding of the choices being made on our behalf.

ShareThis

ShareThis