L. Randall Wray | September 22, 2011

(Cross posted from EconoMonitor)

Back in fall of 2008 I wrote a piece examining what was then the biggest bubble in human history: http://www.levyinstitute.org/pubs/ppb_96.pdf.

Say what? You thought that was tulip bulb mania? Or, maybe the NASDAQ hi-tech hysteria?

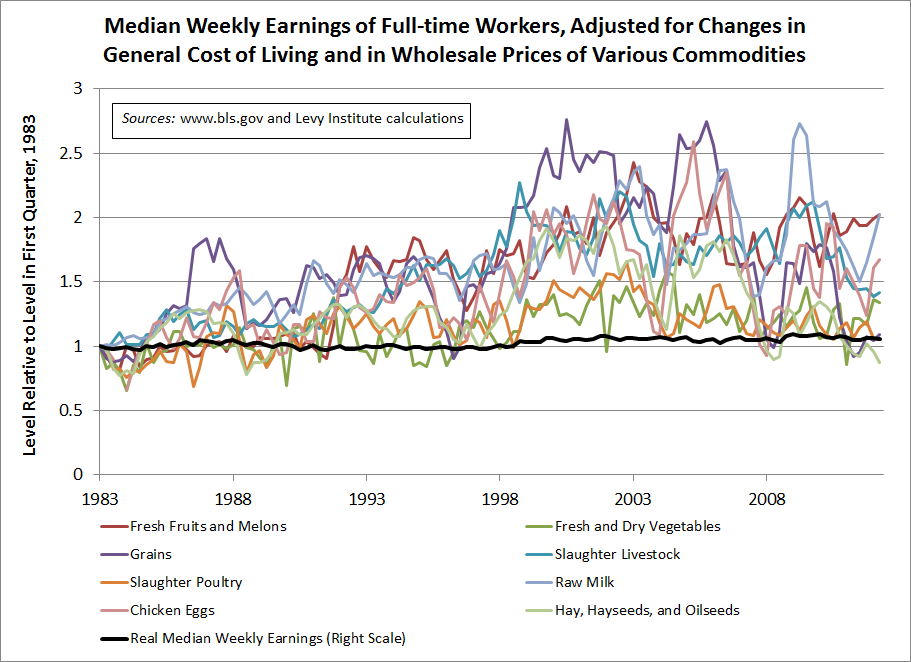

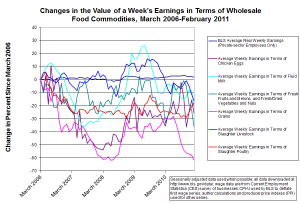

No, folks, those were child’s play. From 2004 to 2008 we experienced the biggest commodities bubble the world had ever seen. If you looked to the top 25 traded commodities, you found prices had doubled over the period. For the top 8, the price inflation was much more spectacular. As I wrote:

According to an analysis by market strategist Frank Veneroso, over the course of the 20th century, there were only 13 instances in which the price of a single commodity rose by 500 percent or more. For example, the price of sugar rose 641 percent in 1920, and in the same year, the price of cotton rose 538 percent. In 1947, there was a commodities boom across three commodities: pork bellies (1,053 percent), soybean oil (797 percent), and soybeans (558 percent). During the Hunt brothers episode, in 1980, silver prices were driven up by 3,813 percent. Now, if we look at the current commodities boom, there are already eight commodities whose price rise had reached 500 percent or more by the end of June: heating oil (1,313 percent), nickel (1,273 percent), crude oil (1,205 percent), lead (870 percent), copper (606 percent), zinc (616 percent), tin (510 percent), and wheat (500 percent). Many other agricultural, energy, and metals commodities have also had large price hikes, albeit below that threshold (for the 25 commodities typically included in the indexes, the average price rise since 2003 has been 203 percent). There is no evidence of any other commodities price boom to match the current one in terms of scope.

Now here’s the amazing thing about that bubble. The staff of Senator Joe Lieberman and Representative Bart Stupak wanted to know whether the bubble was just due to “supply and demand”. Relying on the expertise of Frank Veneroso and Mike Masters (two experts on the commodities market), I was able to conclude beyond any doubt that it was a speculative bubble driven by a “buy and hold” strategy adopted by managers of pension funds. Hearings were held in Congress, with guys like Mike Masters testifying as well as representatives from the airlines and other industries.

The pension funds panicked, realizing that their members would hold them responsible for exploding prices of gasoline at the pump. Pension funds withdrew one-third of their funds and oil prices fell from about $150 per barrel to $50. If you want to read the detailed analysis, go to my paper cited above—it has to do with commodities indexes, strategies pushed by your favorite blood sucking vampire squid (Goldman Sachs), and futures contracts. It gets wonky. To make a long story short, the bubble ended in fall of 2008.

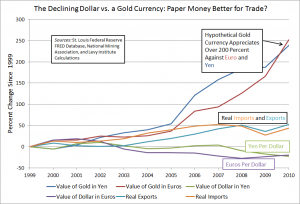

But then the crisis wiped out real estate markets and the economy. Managed money needed another bubble. They whipped up irrational fears of hyperinflation that supposedly would be caused by Helicopter Ben’s QE1, QE2, and the newly announced QE3. Better run to good “inflation hedges” like gold and other commodities. That did the trick. The commodities speculative bubble resumed.

And boy, oh boy, what a boom. continue reading…

ShareThis

ShareThis