Internal Devaluation in Greece

In a recent speech at the Levy Institute conference on “The Eurozone Crisis, Greece, and the Experience of Austerity” held in Athens, Mr. Yves Mersch, a member of the Executive Board and General Council at the ECB, made it clear that the success of the troika plan for the Greek economy requires the current account balance to improve as the public deficit is reduced. In his own words,

To facilitate an export-led recovery, this trend [decreasing competitiveness] has to be corrected and there is no way this can be achieved in the short run other than by adjusting prices and costs. I know the difficulties that such adjustment creates and the criticisms that are leveled against it. But we are in a monetary union and this is how adjustment works. Sharing a currency brings considerable microeconomic benefits but it requires that relative prices can adjust to offset shocks.

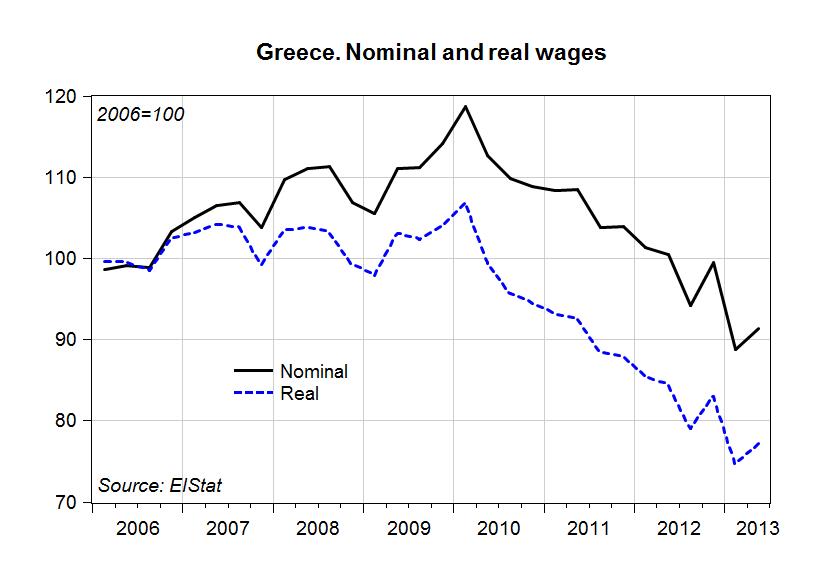

The troika requests for a reduction in costs have been met by Greeks, as our first chart shows.

Indeed, nominal wages(1) have fallen by 23 percent from their peak in the first quarter of 2010, and real wages(2) have fallen by 27.8 percent over the same period.

While it is true that prices started to fall later than wages, and therefore the improvement in competitiveness has been limited, its impact on exports is doubtful.

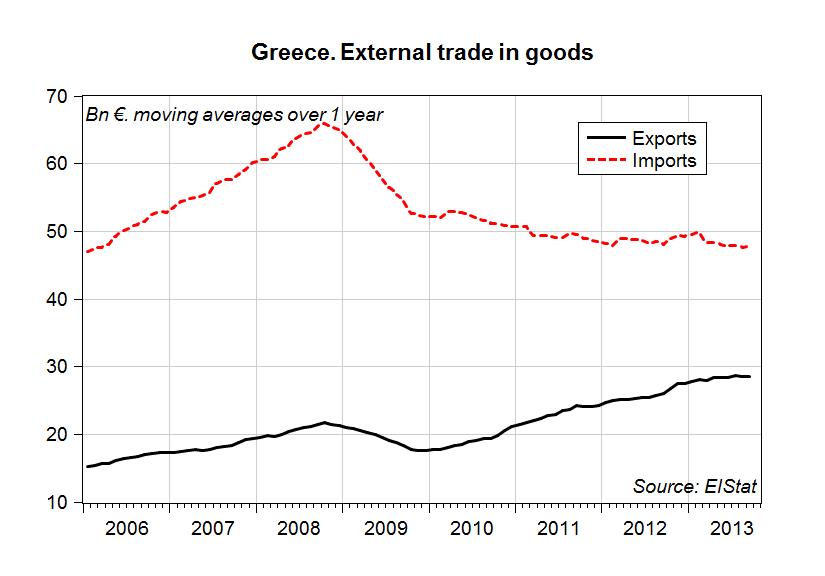

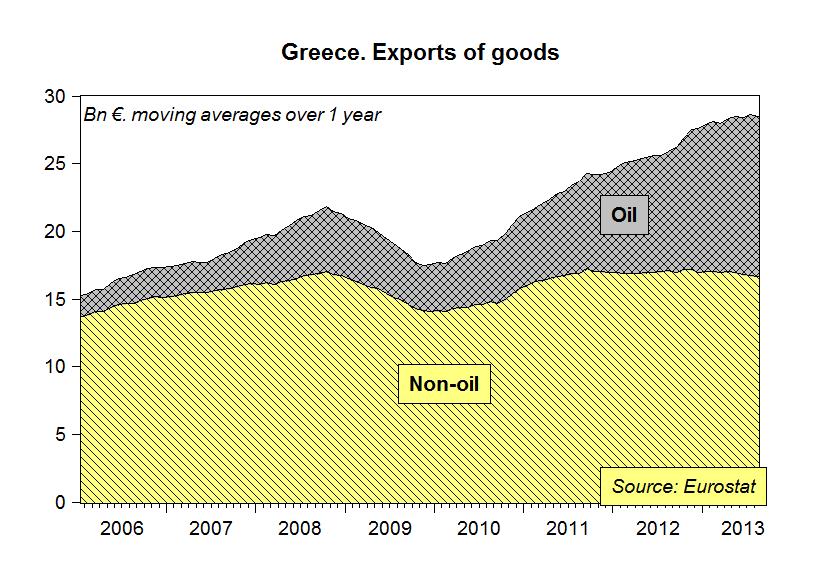

The chart above shows that nominal exports of goods have somewhat improved, but if we decompose exports of goods using the Eurostat database by SITC categories, we learn that most – if not all – of the increase in exports of goods is related to oil products(3). Indeed, recent news indicates a fall in non-oil exports.

Summing up, internal devaluation has so far had negligible effects on Greek exports, while the fall in the purchasing power of wages has added to the fall in domestic demand generated by fiscal austerity, and thereby contributed to the unprecedented crisis in Greece.

Our July projections have so far been on track, and we predict that even if prices keep falling, as advocated by the troika plan, the response of the current account will be too slow to compensate for fiscal austerity. Strategies to increase employment and income are urgently needed.

Notes:

(1) The wage index is taken from the Hellenic Statistical Authority (ElStat).

(2) Real wages are obtained by deflating the wage index by the Overall CPI published by ElStat, seasonally adjusted in Eviews and converted to quarterly frequency.

(3) We use the SITC category “Mineral fuels, lubricants and related materials” for our measure of oil-related exports.

ShareThis

ShareThis