Greece: More Competitive, Closer to Collapse

One of the theories that motivates the policies the troika (EC/IMF/ECB) is imposing on Greece is that reducing Greek wages will make Greek exports more attractive, helping to contribute, so the theory goes, to growth in GDP and employment.

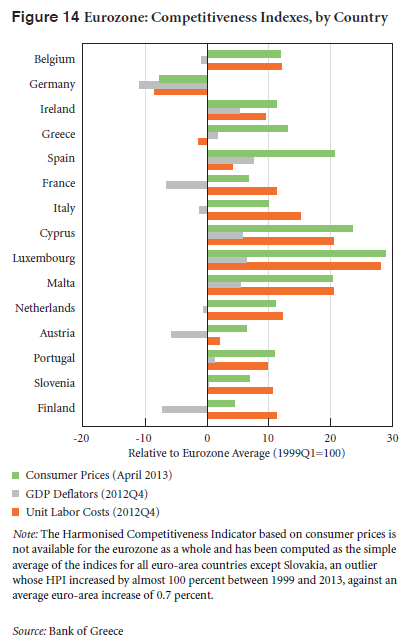

And in an interview that appeared yesterday at Truthout, Dimitri Papadimitriou points out that Greek competitiveness, at least in terms of relative unit labor costs, has indeed increased, more so than in any other eurozone country save Germany. But despite the fact that exports have also risen some, Greece is still stuck — and likely hasn’t even seen the worst of its social and economic deterioration.

This graph from the Levy Institute’s recent stock-flow analysis (pdf) of the Greek economy illustrates the point (N.B. in this figure, an increase in value, i.e., moving to the right, implies a decrease in competitiveness). Although relative unit labor costs (in orange) have declined in Greece, Papadimitriou points out in the interview that “the declining fortunes do not affect consumer prices [in green] that are continuously rising, pushing more and more people into deeper poverty”:

Papadimitriou goes on to lay out an alternative negotiating strategy for Greece, based on exploiting what he calls a “division in the house of troika.” If this strategy fails, the options become more “unthinkable”:

[T]he division between the IMF and the European Commission can turn out to be advantageous to the strategy that Syriza has advocated: suspension of interest payments until growth emerges and then resumption of interest payments linked to GDP growth. Furthermore, this will need to be supplemented with a higher allocation of structural funds with no matching contribution for a number of years. (More than 40 billion euros have been paid toward interest that can be refunded). This can be made possible only if the present government’s pronouncements of achieving a primary budget balance are realized. If this is not achievable — most likely it is not — then the options are more or less of the unthinkable sort.

This includes the introduction of a parallel national non-convertible currency, including government tax-based bonds traded and used for payment of taxes at par. The parallel currency can start with government consumption expenditures including the instituting of a carefully designed and monitored guaranteed public service employment program as advocated by the late Hyman Minsky.

The experience of such jobs programs is encouraging. Design, monitoring and evaluation of the program would be under the aegis of a central state authority with many regional branches along the lines of the successfully designed Americorps structure in the US. The parallel currency will eventually replace the euro for all internal transactions, but more importantly, as mentioned, it will not be convertible to the euro — avoiding speculative attacks. Even though this may sound like a radical idea, it has been suggested by many conservative and progressive economists alike.

Read the entire interview here.

ShareThis

ShareThis