Greg Hannsgen | August 30, 2012

Whatever the outcome of efforts to resolve severe economic difficulties in Europe and elsewhere, it is becoming increasingly clear that the next big economic crisis may not hinge on interest rates at all. One reason is that the world’s central banks, many of them following something like a Robinsonian “cheap money policy,” have managed to keep interest rates reasonably low in many countries. For example, it seems clear that yields on Spanish and Italian bonds are under control for now, after statements last month by Mario Draghi, the president of the ECB, that he was “ready to do whatever it takes,” to keep interest rates down. As made clear in this interesting and enlightening 2003 book edited by Bell and Nell (Stephanie Bell Kelton and Edward Nell), the theoretical argument for the Eurozone was badly flawed from the beginning. (Indeed, many in the world of heterodox economics saw these flaws from the beginning.) But, returning in this post to a key theme in Joan Robinson’s writings on the interest rate, I will offer some of the thoughts of John Maynard Keynes himself, who wrote in 1945 that:

The monetary authorities can have any rate of interest they like.… They can make both the short and long-term [rate] whatever they like, or rather whatever they feel to be right. … Historically the authorities have always determined the rate at their own sweet will and have been influenced almost entirely by balance of trade reasons [Collected Writings*, xxvii, 390–92, quoted from L.–P. Rochon, Credit, Money and Production, page 163 (publisher book link)].

Here in the United States, the Fed has shown its ability as a liquidity provider to keep interest rates on relatively safe investments very low across the maturity spectrum, despite spending much more than it received in tax payments in calendar years 2009–2011, and presumably the current year. Keynes’s statement, much like the quote from Robinson mentioned above and the one in this earlier post, foretells this outcome.

Hence, recent US experience supports the view that calls for cuts in government spending and/or tax increases cannot be justified by fears that high deficits cause high interest rates at the national or global level.

* Note: The complete set of Keynes’s works is out of print in hardback and will be reissued as a 30-volume set of paperbacks later this fall, according the Cambridge University Press website. – G.H., September 3

Comments

Greg Hannsgen | July 26, 2012

The cliff approaches, and politicians and pundits in Washington are pondering how to deal with it. For those who have forgotten, recent nontechnical summaries of the legislative issues and amounts of money at stake can be found here , here, and in this old post. But essentially, the term “fiscal cliff” refers to a massive group of tax increases and spending cuts due to take effect on or around January 1 of next year. President Obama and some Congressional Democrats are seeking to take a stand for distributional fairness and deficit reduction at the same time by pushing for a renewal of the Bush tax cuts, but only for those with incomes less than perhaps $250,000 for a couple. On the other hand, some long-time fiscal conservatives are seeking to cushion the blow by delaying the impact of the spending cuts and tax increases and by seeking a less indiscriminate choice of program cuts. They emphasize that in any case, draconian measures must in their view be taken eventually and committed to now.

From the point of view of Keynesian macroeconomics, what the fiscal conservatives fail to understand is that the economy requires even more fiscal ease than they have been willing to contemplate so far; otherwise, like Spain and many other European nations (see the FT and the WSJ on the European austerity debate), this country will experience such weak economic performance that even the goal of reducing the deficit will be elusive—let alone feeding the hungry, keeping states and localities from going broke, maintaining an adequate defense, or funding scientific research.

The automatic spending cuts (known also as sequesters) due to take effect soon are designed to hit almost every discretionary defense and nondefense spending item—to the tune of 10- to 15-percent cuts in what the federal government spends each day on average on these items. continue reading…

Comments

Michael Stephens | May 3, 2012

Levy Institute Senior Scholar James Galbraith was interviewed by the Washington Post‘s Brad Plumer about his new book Inequality and Instability: A Study of the World Economy Just Before the Great Crisis. Galbraith explains that the rises in inequality we’ve witnessed globally since the 1980s can be traced to changes in finance and the macroeconomy (“when something’s happening at the same time around the world, in different countries that are widely separated, that’s a macro issue”):

Between the end of World War II and 1980, economic growth in the United States is mostly an equalizing force, and job creation isn’t dependent on rising economic inequality. But after 1980, economic booms and rising inequality go hand in hand. So what’s going on? In 1980, we really went through a fundamental transformation. We stopped being a wage-led economy with a growing public sector that was providing new services. Programs like Medicare and Medicaid were major drivers of growth in the 1970s.

Instead, we became a credit-driven economy. What the evidence in the U.S. shows is that the rise in inequality is associated with credit booms, which are often periods of great prosperity. We had one in the late 1990s with information technology and one in the 2000s with housing, before everything fell apart. But this is also a sign of instability — the crash that follows is very ugly business. If we’re going to go forward with growth on a more sustainable basis, then controlling inequality and controlling instability are the same issue. One is an expression of the other.

Read the interview here.

The Real News Network also featured a three-part interview with Galbraith (videos assembled here).

Comments

Greg Hannsgen |

If there is a pundit on the topic of the Federal Reserve, surely William Greider is one. (Recall his famous book, Secrets of the Temple.) This recent piece from Greider in the progressive magazine the Nation offers some helpful historical perspective on the role of the nation’s central bank in recent years.

Comments

Greg Hannsgen | January 24, 2012

Paul Krugman—orthodox economist? Heterodox economist? Pragmatic economist? New Keynesian economist? Michael Stephens recently commented on an article in the Economist that discussed MMT, as well as two other non-mainstream schools of macroeconomic thought. The article contrasted the three relatively unfamiliar and unorthodox approaches with “[m]ainstream figures such as Paul Krugman and Greg Mankiw[, who] have commanded large online audiences for years.”

As Michael points out,

If you step back, what’s slightly unsatisfactory about [describing Krugman simply as a mainstream economist] is that Krugman is, right now, more in tune with the policy preferences of two-thirds of these “doctrines on the edge of economics” than he is with the reigning fiscal or monetary policy stance of the US government.

But as Michael well knows, Krugman is hardly alone among neoclassical scholars in most of his policy views. Micheal’s point is true of quite a few mainstream economists right now—they are far more flexible on the policy issues that dominate the agenda today than they are on many other economic issues. This excerpt from a recent essay written by Marc Lavoie may help to illuminate the very significant differences of opinion that distinguish such forward-thinking neoclassicals from numerous heterodox economists around the world:

Paul Krugman (2009) has also made quite a stir by continue reading…

Comments

Greg Hannsgen | January 4, 2012

In my last post, I reviewed an enjoyable book about some post-Keynesian economic economic thought and thinkers. To round things out a bit more, I thought I might offer a list of a few more often-overlooked but classical themes from economists who may be obscure to some blog readers or perhaps simply forgotten. Many of the points made in this post involve ways that economies change and develop, a topic that often brings “historical time” into the picture. (This list is by no means exhaustive or even carefully chosen.)

•virtuous circles in economic growth: it’s often thought that the economy reverts to a steady and mediocre long-term growth trend following an especially good or bad economic year. Unfortunately, this may not be happening now (see Figure 1 in this Levy Institute one-pager). One theme of the Smithian growth theories pioneered for our era by Nicholas Kaldor and other economists profiled in A. P. Thirlwall’s excellent book The Nature of Economic Growth (2002; paperback 2003) is that a year or two of strong economic growth won’t necessarily increase the chances of a lean year in the future. continue reading…

Comments

Greg Hannsgen | January 2, 2012

In 2009, the Institute released some careful research on the micro-level effects of the recovery act (one example is at this link). That work helps to answer questions about how the benefits of specific stimulus packages will be spread out among different individuals, and households, and demographic groups in the United States.

Increasingly, these and other distributional issues loom large in U.S. debates about economic policy. For example, some influential economists contend that a distribution of income that is increasingly slanted toward “the 1 percent” has been a contributing factor to the dangerous upward trend in U.S. household debt that began decades before the recent financial crisis. The regressive tax policies called for by many candidates ahead of tomorrow’s big Iowa Republican presidential caucuses also bring to mind these serious problems (see this New York Times link for a description of the Republican candidates’ somewhat varied positions on fiscal issues).

An important school of thought that emphasized distributional issues in macroeconomics was the so-called “Cambridge school,” whose name connotes its association with Cambridge University in England and Cambridge progenitors such as John Maynard Keynes. This year, Piero Garegnani, who was closely linked in many ways with this school of thought, passed away (an interesting professional obituary is here). It was interesting to see this eminent Italian economist speak in a small, uncrowded room, at the big annual economists’ conference in Chicago, about five years ago. Decades earlier, Garegnani was a protagonist in the “capital controversy” between the Cambridge school and a number of well-known orthodox economists, most of them based in Cambridge, Massachusetts, here in the United States.

Geoffrey Harcourt was another important figure in this debate. During the Institute’s holiday break last week, I eagerly read The Structure of Post-Keynesian Economics: The Core Contributions of the Pioneers, Harcourt’s sympathetic 2006 account of the work of the Cambridge school and some of its closest post-Keynesian intellectual relatives. The book moves quickly in its 157+ pages through many of the main ideas developed by these post-Keynesian schools. The points are made with words, simple algebra, and diagrams. The book contains some interesting tidbits and observations that only an insider such as Harcourt could muster.

Among the themes of the book continue reading…

Comments

Michael Stephens | November 10, 2011

Here is another flattering mention of Wynne Godley‘s prescient writings on the euro, this time from John Cassidy’s blog at the New Yorker. (Cassidy sat in on the Keynes side of this week’s “Keynes vs. Hayek” debate.)

Many of Godley’s publications at the Levy Institute (“haven for heterodox thought,” as Cassidy calls it), including his early observations about the exponential growth in private debt that marked the Greenspan economy, can be found here.

Gennaro Zezza, together with Marc Lavoie, is also putting together a new book featuring Wynne Godley’s writings (The Stock-Flow Consistent Approach: Selected Writings of Wynne Godley). It will be released in early 2012:

This book is the intellectual legacy of Wynne Godley, the famous British economist who was the head of the Department of Applied Economics at the University of Cambridge for nearly 20 years, after having been deputy director of the Economic section at the UK Treasury. These selected writings are useful not only as a summary of the evolution of Godley’s analysis, but also equip economists with new tools for the achievement of sustainable economic growth. Professor Godley’s work always originated from puzzles in the real world economy, rather than from curiosities in economic models, and his work has retained its practicality; the stock-flow models have proved to be effective in predicting recent recessions. These essays present Godley’s challenge to accepted wisdom in the field of macroeconomic modelling, which, in his opinion, did not reflect the economics that he had learned by working on practical matters for the Treasury in the 1960s. Godley developed post-Keynesian traditions and created models which fully integrate theory with the financial system and real demand and output.

Comments

Greg Hannsgen | September 2, 2011

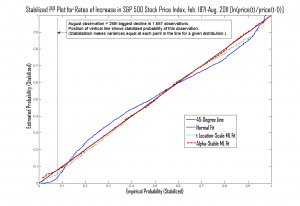

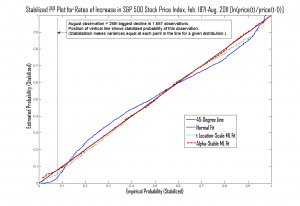

According to wsj.com, the S&P 500 stock price index stood at 1,218.89 at the close of the trading day on Wednesday afternoon, after a month that saw much turmoil in the financial markets. Combining monthly data from the website for Robert Shiller’s book Irrational Exuberance with the average unadjusted closing value for August (closes from Yahoo! Finance), last month’s percentage drop of –10.6 percent was the 26th largest in the 1,687-month period from February 1871 to August 2011. Shiller’s dataset includes some very large drops, including –26.5 percent for November 1929, the worst in the sample.

Some basic theories in finance rest upon the assumption that returns and/or changes in prices can be modeled as random draws from a normal distribution, the familiar bell-shaped curve used by statisticians. The late scientist and mathematician Benoît Mandelbrot showed that many financial data series had so many large increases and decreases that they could not be modeled in this way. (For a posthumous appreciation of Mandelbrot’s work, see science writer James Gleick’s article in the New York Times Magazine.) Mandelbrot hypothesized that many data sets could instead be modeled with the “heavy-tailed” distributions referred to as alpha-stable or stable-Paretian. These distributions allow for many “outliers,” or extreme observations. continue reading…

Comments

Michael Stephens | August 31, 2011

From an intriguing interview with David Graeber, author of Debt: The First 5,000 Years, regarding the history of money and debt:

Yes there’s a standard story we’re all taught… It really deserves no other introduction: according to this theory all transactions were by barter. “Tell you what, I’ll give you twenty chickens for that cow.” Or three arrow-heads for that beaver pelt or what-have-you. This created inconveniences, because maybe your neighbor doesn’t need chickens right now, so you have to invent money.

…

Think about what they’re saying here – basically: that a bunch of Neolithic farmers in a village somewhere, or Native Americans or whatever, will be engaging in transactions only through the spot trade. So, if your neighbor doesn’t have what you want right now, no big deal. Obviously what would really happen, and this is what anthropologists observe when neighbors do engage in something like exchange with each other, if you want your neighbor’s cow, you’d say, “wow, nice cow” and he’d say “you like it? Take it!” – and now you owe him one.

…

So really, rather than the standard story – first there’s barter, then money, then finally credit comes out of that – if anything its precisely the other way around. Credit and debt comes first, then coinage emerges thousands of years later and then, when you do find “I’ll give you twenty chickens for that cow” type of barter systems, it’s usually when there used to be cash markets, but for some reason – as in Russia, for example, in 1998 – the currency collapses or disappears.

Comments

ShareThis

ShareThis