Jörg Bibow | May 2, 2013

In economics, there is a remarkable “stickiness” in bad ideas and confusions. In fact, some bad ideas and confusions never seem to go away. For instance, last summer Martin Feldstein bravely suggested that euro weakening would help solve the euro crisis and rescue Europe (WSJ: “A weaker euro could rescue Europe”). Similarly, in a Bruegel Institute Policy Brief also published last summer and titled “Intra-euro rebalancing is inevitable but insufficient,” Zsolt Darvas argued that euro weakening was badly needed to restore competitiveness of euro crisis countries whose perceived inability to rebalance their external positions was a major root of the euro crisis. More recently, these two issues, euro external competitiveness and intra-euro competitiveness imbalances, were also bundled together in a piece by David Keohane titled “Why strength could be the single currency’s undoing” (FT.com 17 April 2013). Mr. Keohane seemed to identify a “euro paradox,” or even two paradoxes actually. One apparent paradox is that policy measures by the euro authorities that boost confidence in the euro run the risk of doing damage to it by undermining its long-term existence through enticing euro strength, which would postpone an export-led recovery. The other seeming paradox is that the single currency cannot exist at different levels for different countries and that it will therefore always be expensive for some and cheap for others.

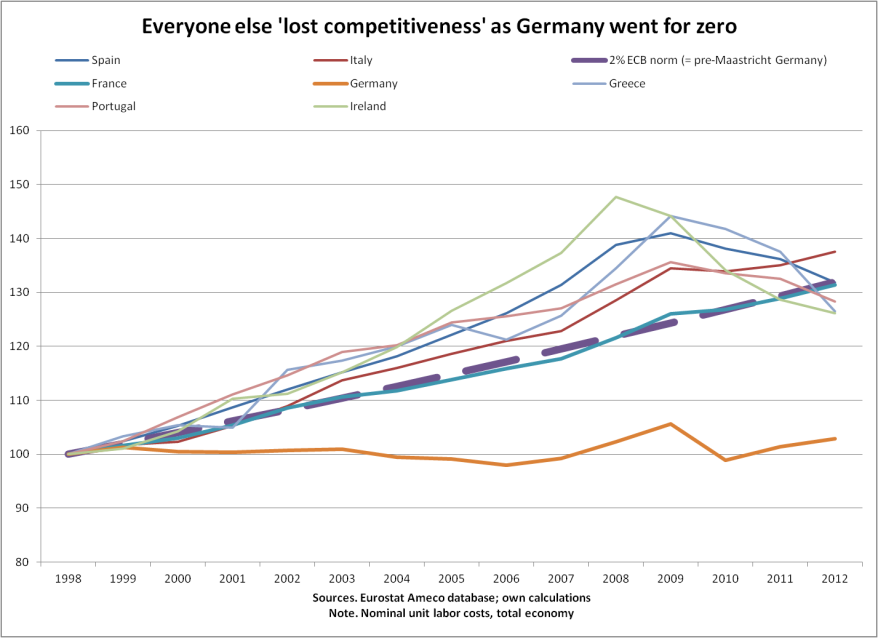

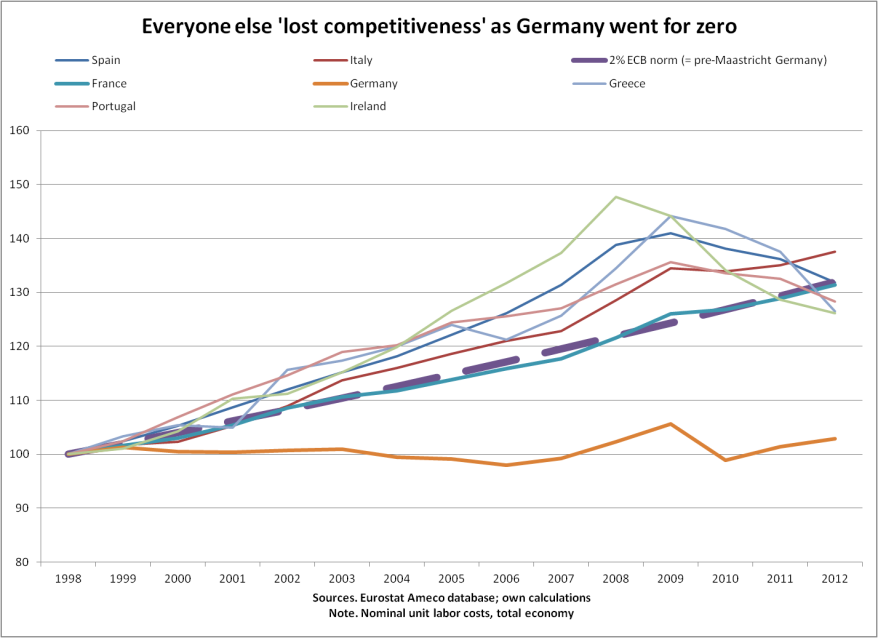

Unfortunately, euro weakness as the supposed solution to the euro crisis is a thoroughly misguided piece of advice. The idea about the euro being expensive for some but cheap for others at its current level is nothing else but the external mirror image to the fact that competitiveness positions inside Europe’s currency union are utterly unbalanced – which led to corresponding intra-area current account imbalances and debt overhangs. While this is a correct diagnosis of intra-euro imbalances, implying a need for rebalancing, it must be stressed that there was absolutely nothing inevitable about this outcome. It was just that, contrary to the requirements of a currency union, Euroland simply failed to keep unit-labor cost trends within the union aligned with the commonly agreed two-percent inflation norm. In particular, as Germany stabilized its nominal unit labor cost trend at zero under the euro, the country turned űber-competitive in due course as a result. This resulted in the buildup of excessive current account surpluses – with corresponding German exposure to debts issued by its euro partner countries and exuberantly gobbled up by German banks and investors.

Perversely rewarded by the markets, Germany is imposing competitive austerity on its uncompetitive partners as the cure-all that is supposed to restore stability as well as growth. Quite predictably, the result of allegedly “growth-friendly” continent-wide austerity is catastrophic. Domestic demand in the eurozone has been shrinking for over a year now, at an annual rate of around 2 percent. The decline in GDP has been contained to less than one percent only due to a very sizable positive growth contribution from net exports. continue reading…

Comments

L. Randall Wray |

In recent days both Brad DeLong and Paul Krugman have written good pieces arguing against the austerity marketed by deficit hyperventilators. We can thank Thomas Herndon’s muckraking that pushed the topic front and center, showing that there is no empirical evidence in support of the austerian’s claim that big government debts slow growth.

Here’s Krugman’s argument. To briefly summarize, historical experience has demonstrated that the “growth through austerity” argument is false. Further, the monetarists have also got it wrong: monetary policy won’t get us out of this recession trap; what we really need is a good dose of fiscal policy. Given that we are in a “liquidity trap,” we can safely expand government spending without worrying about the usual downside to deficits. And in a liquidity trap, there is really no difference between Modern Money Theory and the conventional ISLM analysis. It is only once we return to a more “normal” situation that budget deficits would “matter” in the sense that they’d cause problems.

DeLong amplifies the argument here. Once we’re out of the liquidity trap, then sustained budget deficits will push up interest rates and crowd out private spending (especially investment). This is basic ISLM stuff. For those who have not taken intermediate macro, it is enough to know that in current conditions increasing budget deficits will not raise interest rates because the private sector welcomes all the liquid and safe government debt it can get. Further, flooding the economy through Quantitative Easing will not cause inflation because, again, everyone wants liquidity and would rather hold it than spend it. In more normal times, budget deficits and money helicopters would cause inflation and rising interest rates. And that would be bad.

Note, both of them raise additional good arguments against the R&R results and against austerity more generally. I am focusing in on the one point about the liquidity trap for the purposes of this blog simply because it seems to be the sticking point that prevents them from fully embracing MMT. From the perspective of Krugman and DeLong, MMT is fine for the liquidity trap, but wrong for the normal situation—when deficits will matter. continue reading…

Comments

Michael Stephens | May 1, 2013

When top managers at our largest financial firms claim to have been oblivious of dangerous financial practices carried out under their watch, the most serious implications for regulatory reform don’t actually follow from scenarios in which these managers are lying. It’s a bigger deal, in terms of how far we need to go in changing the way we regulate the banking system, if they’re telling the truth.

Bad apples, after all, can be replaced. But what if the ignorance is real; if managers really don’t know what’s going on in the units below them due to the sheer complexity of the financial institutions they’re running? This might be thought of as a convenient excuse; a universal “get out of jail free” card. But if true, it has more far-reaching, radical implications than most Bankers Behaving Badly scenarios, because it points to a problem that touches on the very structure of the financial system and its key institutions.

This, says Jan Kregel, is part of the the deeper lesson of JP Morgan Chase’s “London whale” fiasco. In a new policy brief, Kregel reviews the recent Senate Permanent Subcommittee on Investigations report on JP Morgan Chase’s difficulties and draws out the lessons for financial reform:

The most probable explanation of the misinformation concerning the “London whale” affair is a massive failure of managerial direction and control that was not the result of deliberate deception, but rather the natural response of individuals who were being paid handsomely to take responsibility but simply did not know what was going on because the size and complexity of the organization made that impossible—again, evidence of an institution that was too big to manage effectively and, a fortiori, too big to regulate.

And as Kregel emphasizes, although it’s not size per se that is problem, but rather the complexity of the institution, there’s often an intimate connection between them: “While complexity is clearly a bigger threat to financial stability than large size, it is usually, but not only, large size that induces complexity.” continue reading…

Comments

Jörg Bibow |

France and Germany held largely contradicting hopes and aspirations for Europe’s common currency. To France the key issue in establishing a European monetary union was to end monetary dependence, both from the vagaries of the U.S. dollar and from regional deutschmark hegemony, and to establish a global reserve currency that could actually stand up to the dollar as part of a new international monetary order. By contrast, the main German concern was to forestall the threat of deutschmark strength as undermining German competitiveness within Europe. Reserve currency status and currency overvaluation stand in conflict with Germany’s export-led growth model.

In light of the euro crisis both nations are bound to reassess the euro’s viability. No doubt France has seen all its hopes for the euro disappointed. France is facing the prospect of a lost generation today, a prospect shared with other debtor nations in the union, and a prospect that undermines the Franco-German axis and may soon turn it into the ultimate euro battleground.

… Continue reading in English / Spanish

(see this working paper for more background)

Comments

ShareThis

ShareThis