Minsky Meets Brazil (Part II)

by Felipe Rezende

This series will discuss at length the underlying forces behind Brazil’s current crisis. (See Part I here)

Part II

Building on Keynes’s investment theory of the cycle, Minsky’s work suggests that the structure of the economy becomes more fragile over a period of tranquility and prosperity. That is, endogenous processes breed financial and economic instability. While Minsky adopted Keynes’s “investment theory of the cycle,” he added a financial theory of investment, with a detailed exposition of the theory in his book John Maynard Keynes (1975), which put at the forefront the interrelation between investment decisions and the financial structure designed to allow economic units to take positions in assets by issuing debt. In this regard, debt accumulation is at the core of Minsky’s instability theory. His financial theory of investment incorporated Kalecki’s approach in which aggregate profits are created, mostly, by the autonomous components of demand (Minsky 1986, 1989). One can add to this analysis Godley’s three balances approach, which explores the interlinkages between the government sector, the private sector, and the external sector. This means that a surplus must be matched by an equal deficit and flows accumulate to stocks.

In this regard, Godley’s framework sheds light on the identification of financial fragility at the macro level, in which, to accumulate financial wealth, the private sector (firms and households) needs to spend less than its income. This can be accomplished through a combination of government budget deficits and current account surpluses. This framework is then incorporated into Minsky’s theory of the business cycle to analyze Brazil’s current crisis. In particular, Minsky’s framework not only sheds light on how to detect unsustainable financial practices, but the position adopted in this paper is that the current Brazilian crisis does fit with Minsky’s instability theory.

This article attempts to demonstrate the existence of endogenously generated instability in the Brazilian economy, which has created frequent and systemic financial crises. Brazil’s current crisis is not due to unsustainable policies; the country’s problem is systemic.

It aims to provide an alternative interpretation of the Brazilian crisis as a result of endogenous process, which created destabilizing forces, reducing margins of safety and increasing financial fragility. As Minsky put it “stability is destabilizing.” The success of traditional stabilization policies over substantial periods has created endemic financial fragility and rising external private indebtedness, causing the deterioration of current account and the fiscal balance. The pursuit of structural stabilization policies, in an attempt to produce a fiscal surplus, causes further deterioration of fiscal deficits and government debt followed by the collapse of economic activity. To break this cycle requires monetary sovereignty and domestic demand led development.

Minsky’s view of the capitalist system puts at the forefront of the conceptual framework the interconnectedness of balance sheets and cash flows and the creation of endogenous instability. In modern economies, private endogenous liquidity grows during booms and these IOUs represent future financial commitments that must be met as they fall due. This means that economic units have to generate enough cash flows over time to validate their debt commitments.

In this regard, Kregel (2014), building on Minsky, has suggested a framework that focuses on macroeconomic and microeconomic aspects to financial fragility and provision for liquidity so that economic units can meet their near-term obligations. At the macro level, Minsky- Kalecki- Levy’s profits equation and Godley’s sectoral balances approach provide an alternative approach to understanding what determines stability and provide insight into the dynamics of the adjustment process. Government spending can be seen as an injection of monetary instruments into the non-government sector, providing that which is necessary to pay taxes along with desired net savings of that currency. This is the so-called “vertical relationship” between the government and non-government sectors (Mosler and Forstater 1999; Wray 1998). At the micro level, Minsky’s categorization of debt units – hedge, speculative and Ponzi – along with his Financial Instability Hypothesis shed light on the endemic financial fragility, the relationship between stability and destabilizing forces underlying capitalist debt structures, and boom-bust cycles of market economies. In this framework, at the macro level, government deficits create cash and are needed to provide liquidity to indebted economic units, while at the micro level cash flows can be generated by operating, financing and investment activities.

For instance, business firms issue IOUs to finance the acquisition of capital assets and banks purchase firms’ liabilities by issuing their own IOUs (e.g., demand deposits). These IOUs represent future financial commitments that must be met as they fall due. For business firms, the use of productive capital and investment assets usually generates cash flows. For households, their main sources of cash inflows are wage and salaries from employment, investments such as rents, dividends, bonds, mutual funds, etc.).

Economic units can also sell assets to finance their operations. This requires an orderly and liquid secondary market in continuous balance between buyers and sellers to avoid that falling prices trigger a debt deflation process. This reduction in the value of assets relative to liability commitments results in insolvency of economic units.

Thus, in Minsky’s framework, declining margins of safety and rising risky positions are a normal outcome of capitalist market processes so the analysis of current and the estimation expected cash flows of an economic unit, financial instruments used to generate cash – and the balance sheet and cash flow interconnectedness among bank and non-bank financial institutions – are crucial for the identification of robust financial structures, potential Ponzi structures, and significant systemic risks (Minsky 1975: 152). In this environment, financial institutions are tempted to adopt leveraged-growth strategies to expand their balance sheets increasing interest, credit, and liquidity risks triggering internal dynamic changes that results in increasing fragility and instability in the economy.

It means that the detailed analysis of cash flows provides a better indication of financial fragility and instability. It shows how cash is generated and how reliable those sources of cash are under different economic scenarios, exposing whether flows of cash are due to income producing activities, flows from portfolio holdings, or flows from the sale of assets or the issuance of new liabilities (Minsky 1972: 147). It measures the sources and amounts of cash money into and out of financial institutions helping identifying sustainable, unsustainable practices, and Ponzi schemes.

Sectoral Financial Balances in the Brazilian Economy: Godley’s basic macroeconomic accounting identity

Following account identities and stock-flow consistency, we find that the surplus of the non-government sector equals the deficit of the government sector. Moreover, government deficit spending adds to the non-government sector’s net financial assets, where the nongovernment financial balance equals the domestic private sector financial balance plus the balance of the rest of the world, that is, flows accumulate to stocks changing net financial wealth.

It follows that if the non-government sector desires to run surpluses, the government sector must run a budget deficit. It is also useful to distinguish between currency issuer (the federal government) and currency users (that is, the nongovernment sector which is comprised of the domestic private sector and the external sector). If the government sector runs a deficit then the nongovernment sector accumulates net savings.

In this regard, Godley’s three-sector balance approach, grounded on accounting identity, shows the interaction between the government sector, the domestic private sector- households and firms-, and the foreign sector[1]. In the aggregate, if one sector runs a surplus at least one sector must run a deficit. The sum of all balances, that is the private sector, the government sector, and the foreign sector must equal to zero. We get:

Domestic Sector Balance + Government Sector Balance + External Sector Balance = 0.

By rearranging terms:

Domestic Sector Balance = – Government Sector Balance – External Sector Balance

Or:

Domestic Sector Balance = Government budget deficits + Current account balance

When the government sector deficit spends it creates private sector surplus, all else equal, while a government surplus destroys nongovernment sector’s net nominal wealth. In order for the private sector to continually run surpluses, then either the government or the foreign sector must run a deficit, that is from the identity we get the following:

Domestic Private Sector Surplus = Public Sector Deficit + Current Account Surplus

We can distinguish the beginning of the new millennium for Brazil’s economy between two periods: one characterized by the U.S. financial bubble that contributed to the creation of current account surpluses in emerging economies until the onset of the GFC and the other initiated in 2007 characterized by a persistent deterioration of Brazil’s current account deficits.

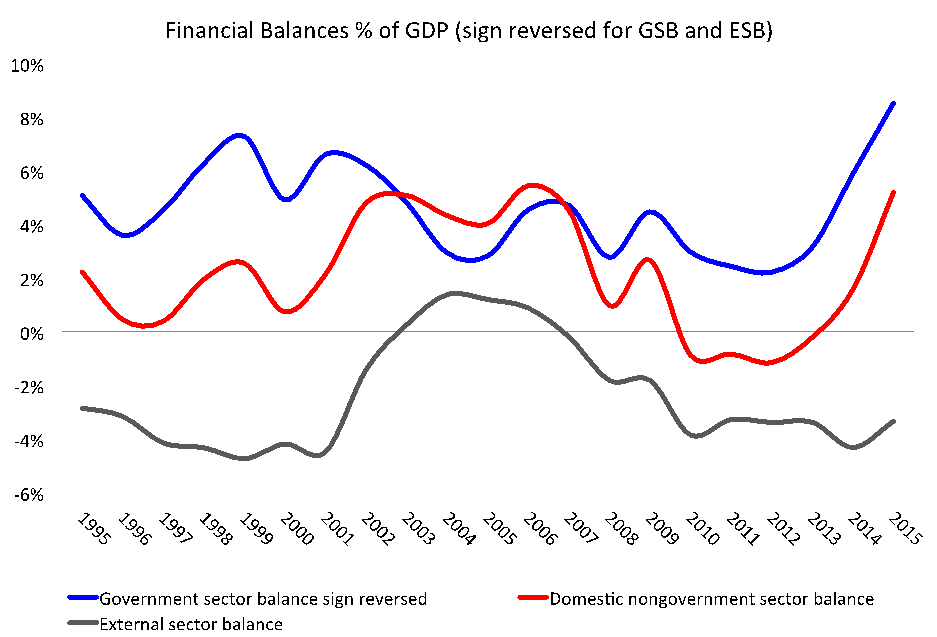

During the bubble phase, the domestic private sector ran an average surplus balance equal to 4.8% of GDP from 2002 to 2006 as a result of the combination of current account surpluses (average 0.5% of GDP) and government fiscal deficits (4.3% of GDP). It allowed the net acquisition of financial assets by the domestic private sector to exceed the net issuance of liabilities, which translated into rising net financial wealth in the private sector (figure 1). This period was marked by a significant expansion of real incomes, credit growth, domestic demand and GDP growth, and declining unemployment rates to historical low levels (see Arestis et al 2008).

Figure 1. Financial Balances % of GDP

Source: IBGE, CEI, author’s own elaboration

Following the rapid economic growth in the years preceding the 2007-2008 global financial crisis, there was a sharp increase in aggregate profits. That is, as the economy experienced an investment boom, profits increased along with investment, which influenced expectations and encouraged more investment.

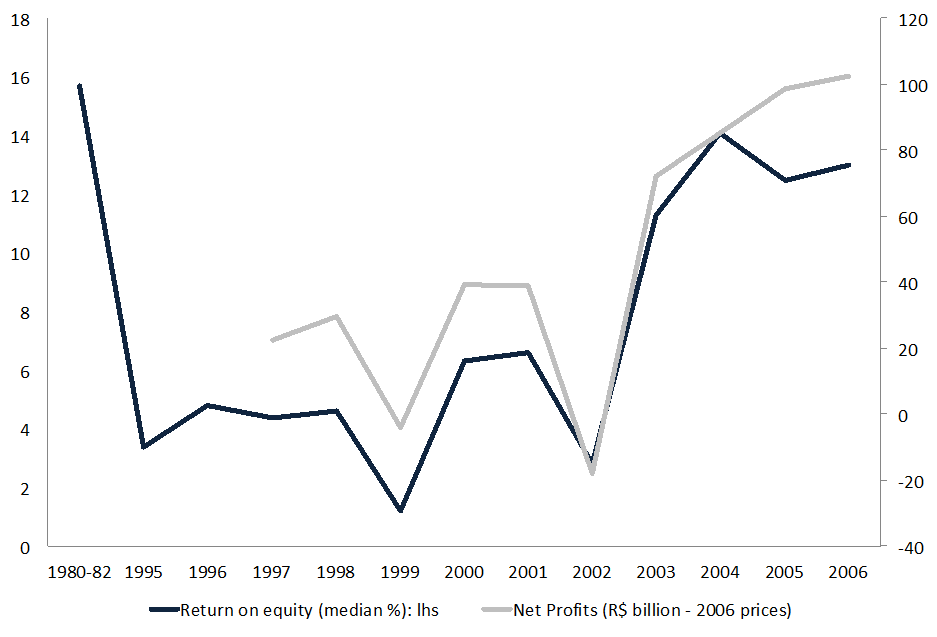

During this period net profits sharply increased (figure 2) and have been on an upward trend causing a wave of optimism about future sales and profits thus stimulating investment in new capital goods, that is, profits were the main driver of the surplus in the non-financial companies sector balance.

For instance, the median return on equity (ROE) for the 500 largest companies increased to 12.7%, on average, during the 2003-2006 period while profits jumped to R$ 90 billion. This increase in realized profits and growing profit expectations influenced investment decisions. It is worth noting that the median (ROE) for the 500 largest companies during 1995-2002 was equal to, on average, 4.3%. The ROE almost tripled compared to the 1995-2002 average.

Figure 2. Net profits and profitability

Source: Campelo Jr., 2007

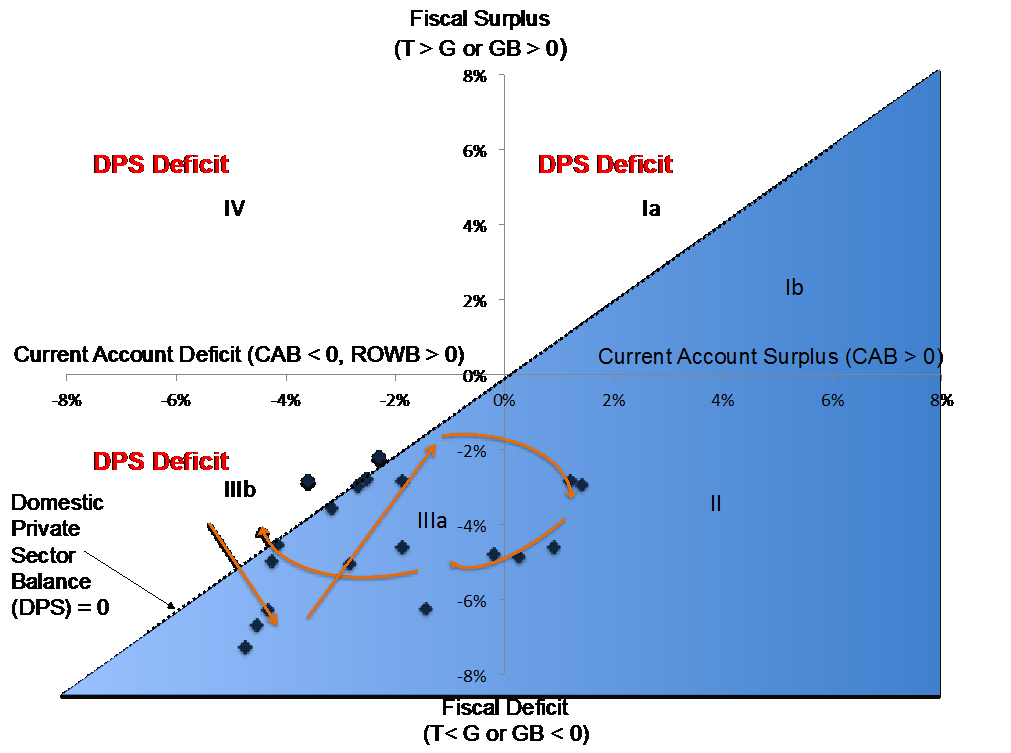

However, as discussed in the previous section, the conditions that prevailed prior to the 2007-2008 GFC, which benefited developing economies, were characterized as a bubble and the positive conditions[2] experienced by developing economies are unlikely to return (Kregel 2009, p.5). Given changes in the global trade structure, the bust in commodity prices, rising domestic private sector (foreign and domestic currency) debt, and declining budget deficits, from 2007 to 2013, the domestic private sector ran an average financial balance equal to 0.1% of GDP, the external sector an average deficit equal to 2.9% of GDP, and the government sector posted an average deficit equal to 3% of GDP. We can use the sectoral financial balances (figure 3) to analyze the following scenarios using a device suggested by Robert Parenteau (Kregel 2009).

Figure 3. Sectoral Financial Balances – % of GDP (1995-2013)

Source: IBGE, CEI, authors’ own elaboration

The bubble phase allowed the Brazilian economy to run unprecedented current account surpluses, which combined with government sector deficits meant that the domestic private sector balance was in a surplus position. This situation is depicted in quadrant II in the figure 9.

However, the financial instability created by the reliance of external finance – given by Domar’s condition (Kregel 1999, 2004) – generates negative net transfers, which removed profits and income from the private sector. After the global financial crisis there was a sharp reversal of the current account balance into a deficit, which reduced the domestic private sector balance’ the surplus (quadrant IIIa). This brings us to the second period, which has been characterized by a reversal of favorable conditions since the onset of the 2007-2008 GFC, that is, Brazil has been experiencing since 2007 deteriorating current account deficits increasing to 3.4% of GDP in 2013 from 0.2% in 2007. We are now on Quadrant IIIb on figure 3.

With the deterioration of current account deficits and the rigidity of the fiscal balance, that was equal to 3.2% in 2013, then this means that the private sector was running a deficit, which is depicted in quadrant IIIb. That is, the net issuance of liabilities exceeds the acquisition of financial assets by the domestic private sector so the private sector was dissaving. This is an unstable financial profile that Minsky characterized as Ponzi in which net debt outstanding grows. For this financing regime to remain viable requires rising asset prices and can persist as long as lenders are willing to refinance principal and interest payments.

However, a reversal of the conditions necessary to support Ponzi units leads to the sale of assets by economic units to raise cash to meet their outstanding commitments, which can trigger a Fisher-type debt deflation process. If the private sector’s desire to net save increases, then fiscal deficits increase to allow it to accumulate net financial assets. This requires a countercyclical movement of the federal budget to support cash flows and central bank intervention to stabilize the price of financial assets.

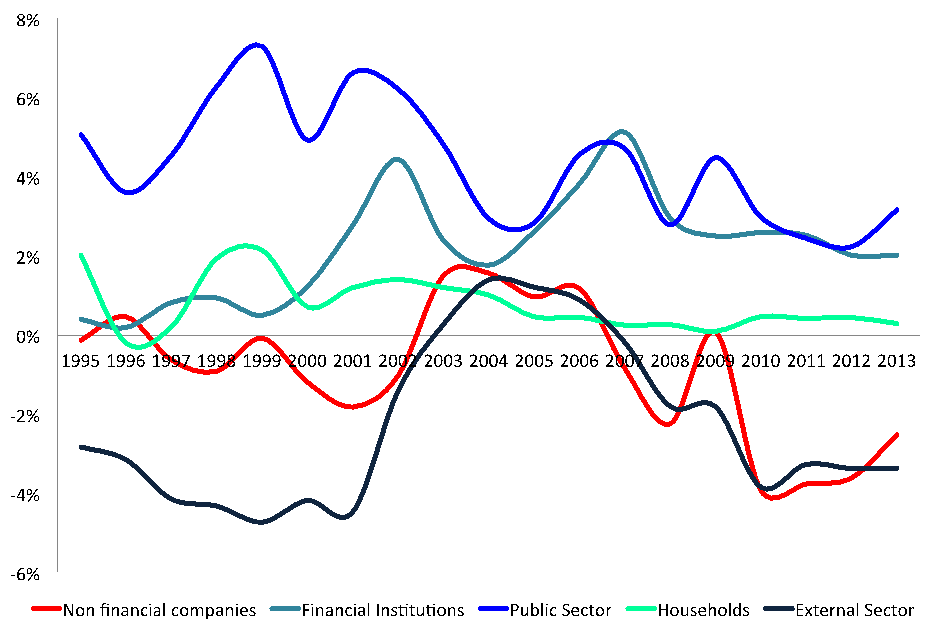

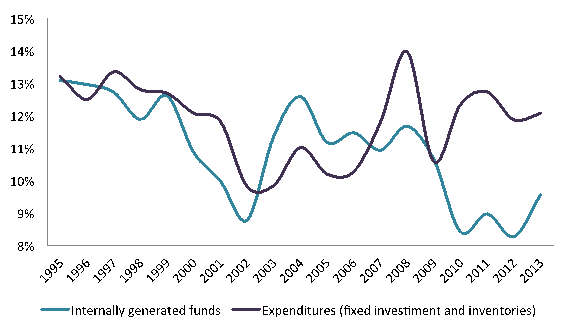

The disaggregation of the private sector among households and firms shows that, in 2007, the corporate sector turned into a deficit and since then, with the exception of 2009 when its balance was equal to 0.1% of GDP, its balance position deteriorated to a deficit equal to 2.5% of GDP in 2013 – that is, fixed investment and investment in inventories have exceeded internally generated funds generated by firms (figure 4).

Figure 4. Financial Balances by institutional sector as a percentage of GDP

Source: IBGE, CEI, authors’ own elaboration

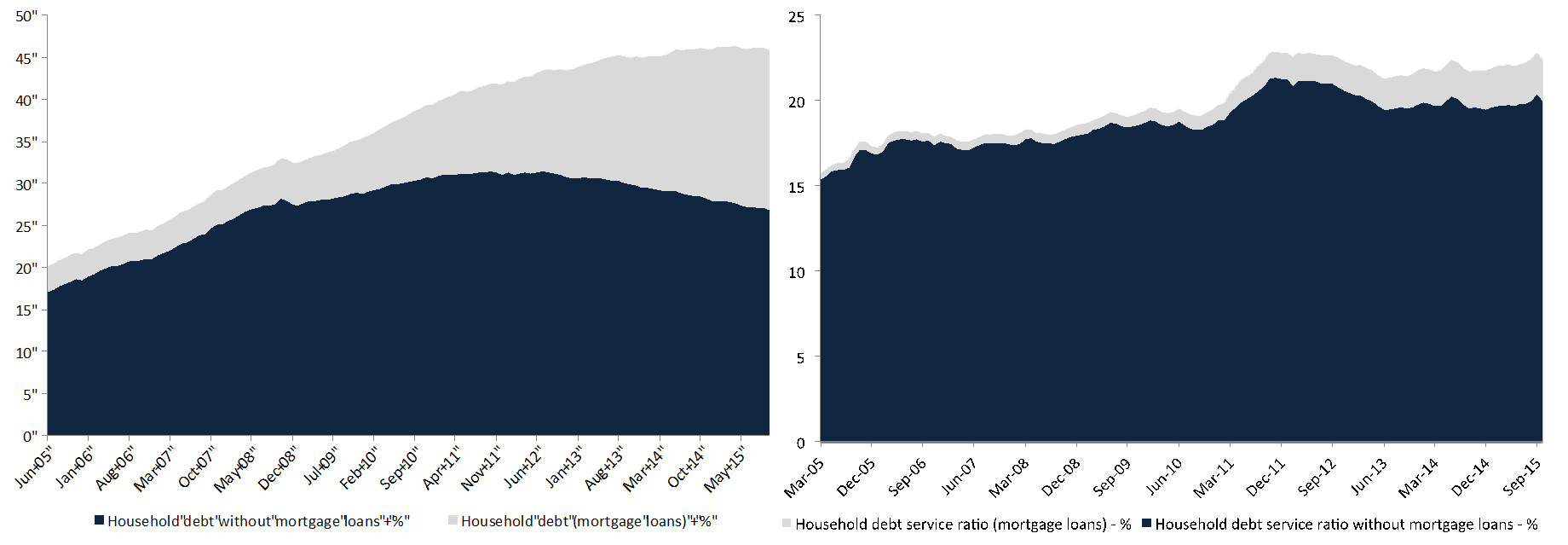

Though the household sector has accumulated record debt-to-income burdens (figure 5), to some extent this household debt was sustained by a small positive balance (figure 4) – i.e., the household sector generated a surplus, spending less than its income[3].

Figure 5. Household indebtedness and debt service ratios

Source: BCB

While the household sector has continually spent less than its income – households’ sector surpluses – in contrast, the corporate sector is a net debtor since 2007, receiving less income than it spends. The corporate sector balance declined from 1.2% of GDP in 2006 to -2.5% of GDP in 2013. These are significant amounts. This sharp reversal in the corporate sector balance in this period influenced the motor for the expansion of the Brazilian Economy, which was driven by unsustainable corporate sector deficit spending (figure 6).

Figure 6. Corporate sector balance as % of GDP

Source: IBGE, CEI, authors’ own elaboration

While there was a significant decline in internally generated funds available to corporations, its expenditures remained at a very high level exceeding internally generated funds, the use of borrowed funds increased, suggesting a change in firms’ investment behavior. That is, the non-financial sector balance deficit in recent years was the result of new fixed capital investment exceeding undistributed earnings. It is apparent that an increase new fixed capital investment is inversely correlated with the non-financial sector balance.

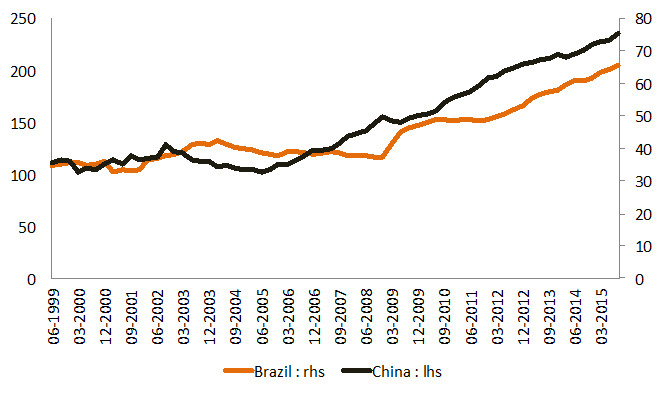

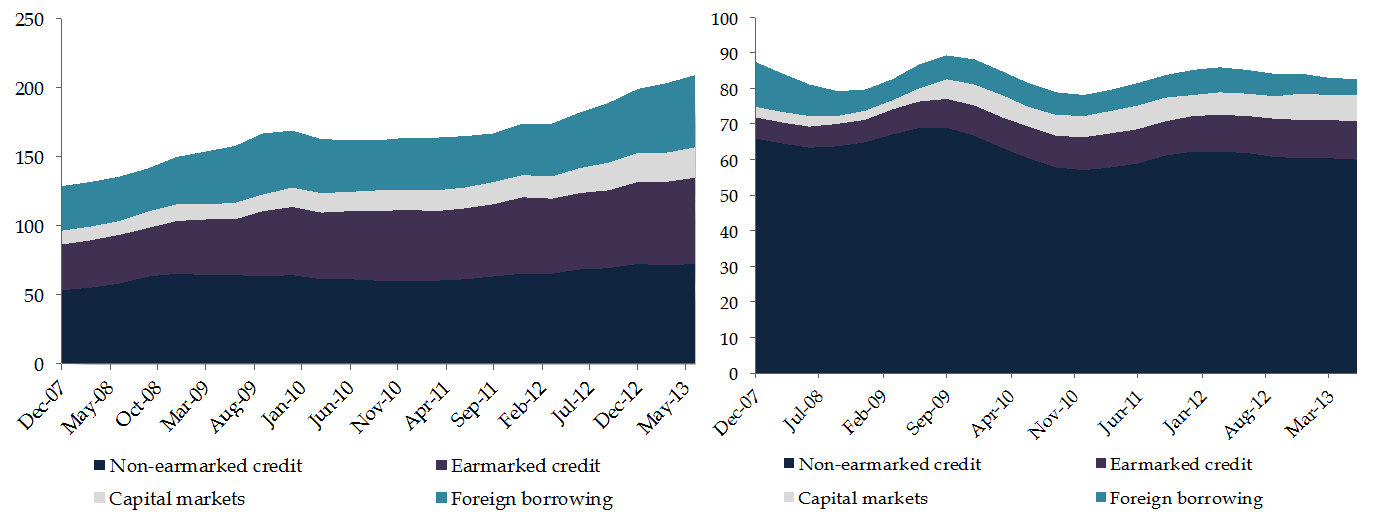

As this happens, the net flow of credit into the corporate sector increased and the level of debt to GDP was rising all the time (figure 7). Because since 2007 firms have been running large deficits (with the exception of 2009 due to a small decline in current account deficits and increase in the budget deficit position), its indebtedness sharply increased[4] (figure 12 and 13).

Figure 7. Non-financial private sector debt as % of GDP

Source: BIS, authors’ own elaboration

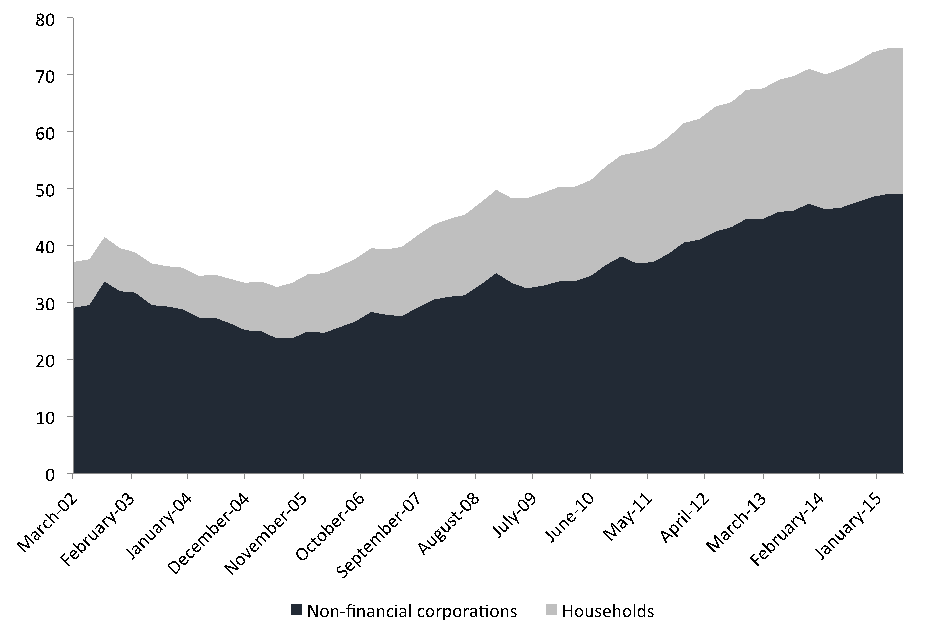

This means that while internally generated funds declined, the corporate sector was borrowing at an increasing pace (figure 7 and 8). Though the conventional analysis stress that non-financial corporations indebtedness should not be a cause of concern, since it is not high by international standards, and it showed an improvement in their debt profile, they overlook the impacts of rising debt levels firms’ debt servicing capacity.

Figure 8. Private sector debt as % of GDP

Source: BIS

For instance, non-financial companies indebtedness relative to gross operating surplus increased to 209% in June 2013 from 128% in 2007, while the debt service ratio slightly declined from 87.5% in 2007 to 82.75% in June 2013 (figure 9). As this happened, non-financial companies have lengthened their debt maturity and lowered the average interest rate paid by increasing their reliance on subsidized government credit (mostly due to loans extended by Brazil’s national development bank -BNDES) and foreign borrowing. In Brazil, earmarked rates are lower than market rates (bank loans and domestically issued bonds – figure 9).

Figure 9. Corporate indebtedness as share of gross operating surplus and debt service ratio[5]

Source: BCB, REF September 2013

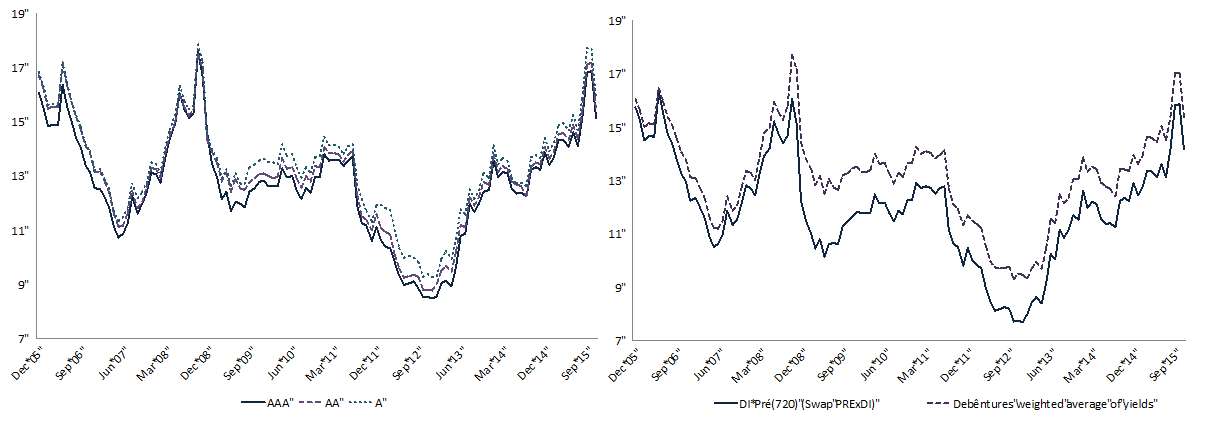

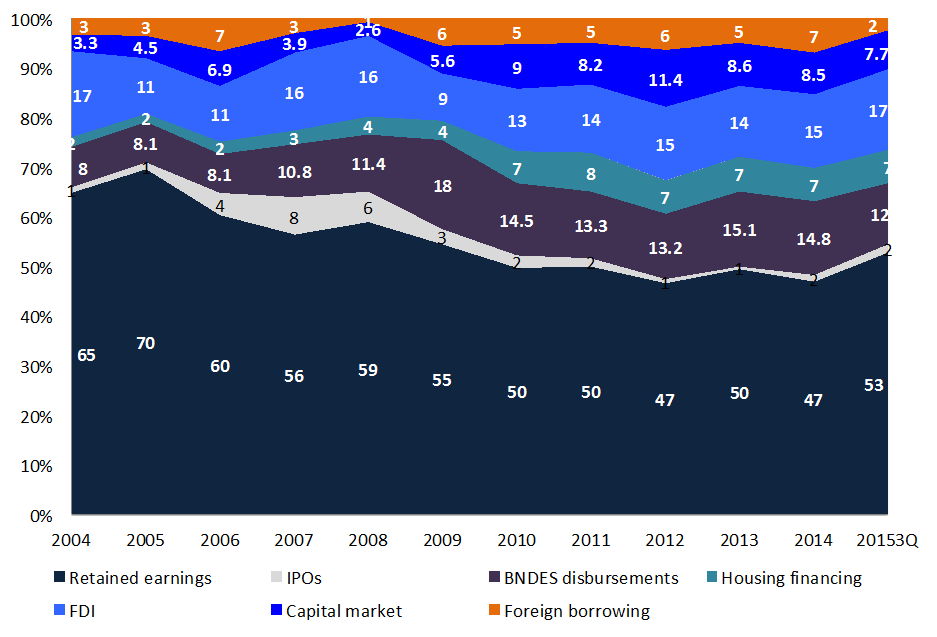

While non-financial companies’ debt has been increasing at unsustainable levels, debt-service ratios remained somewhat stable due to the reliance on BNDES borrowing and low cost foreign debt. Though Brazilian companies increased their reliance on local bond markets, the high level of local rates (figure 10) compared to low rates in international markets and BNDES’ lending rates have encouraged non-financial companies to borrow funds abroad and to take more BNDES debt (Bastos et al 2015).

Figure 10. Debentures nominal yield by rating and Swap Pré-DI- (2-YR) (% p.y)

Source: CEMEC 2015, author’s own elaboration

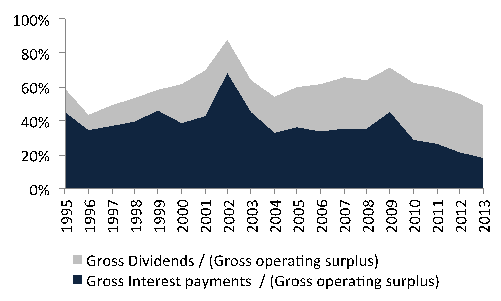

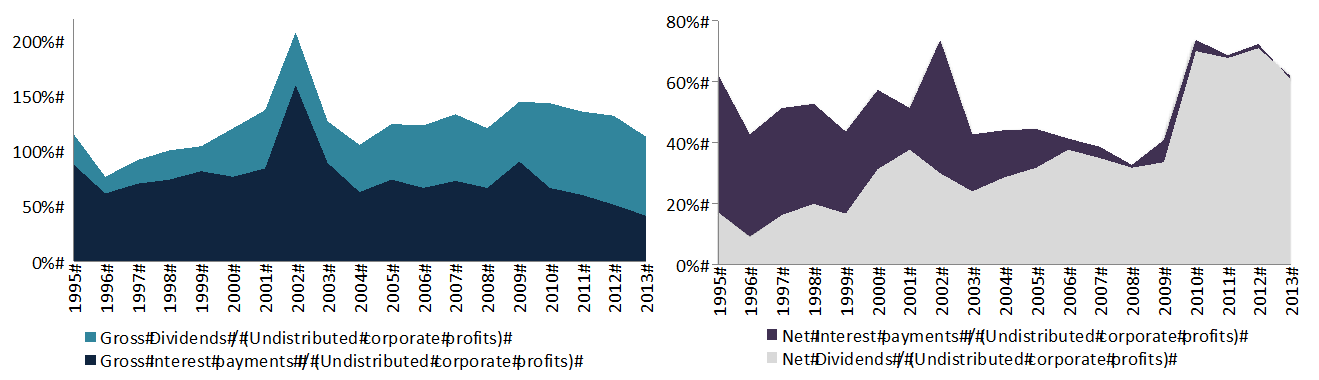

To sum up, the private sector’s deficit is entirely due to firms’ expenditures that greatly exceed their incomes. While lower borrowing costs attracted companies to increased their reliance on foreign borrowing and BNDES financing – contributing to lower their interest expenses– companies raised their dividends payments (figure 11 and 12). Though corporate earnings have been much lower than they have been in the past, income payments on assets, particularly through dividend payments, relative to gross operating surplus have sharply increased (figure 11).

Figure 11. Non-financial companies gross dividends and interest payments as a share of gross operating surplus

Source: IBGE, CEI, authors’ own elaboration

Dividends absorbed, on average, 68% of undistributed corporate profits earnings during 2010-2013 (figure 12). As this happens, and aggregate corporate profits declined, this translated into a sharp decline in retained earnings. This reduction in corporate funding affected firms’ investment in productive capabilities – with unsurprising results. Moreover, this increase in dividend payments to other sectors had a weak impact on the economy[6].

Figure 12. Non-financial companies gross dividends and interest payments as a share of undistributed corporate profits

Source: IBGE, CEI, author’s own elaboration

Relatively high aggregate dividend payments contributed to lower undistributed earnings to record lows in 2012. While low stock market values (figure 13) have contributed to lower wealth positions, companies increased dividends paid by to other sectors (figure 12).

Figure 13. Ibovespa in USD and BRL/USD exchange rate

Source: BCB

Though during the boom years, a large share of investment was financed by enterprise internally generated funds compared to the use of external funds. As the expansion got underway, firms were willing to increase the use of external funds to finance investment, which led to riskier financial profiles and declining cushions of safety.

With the deterioration of the current account balance removing profits, via the Minsky-Kalecki-Levy’s profit equation, financial positions moved to riskier financial profiles. The combination between declining internally-generated funds and rising local and foreign borrowings changed the composition of investment financing and deteriorated financial profiles. Just like in Minsky’s model, it is apparent the increase in the use of external funds (overindetedness) and the sharp decrease in the share of internally-generated funds in financing investment (figure 14).

Figure 14. Non financial companies and households investment financing % of total

Source: CEMEC 2016

In Part III, we’ll look at the factors underlying the decline in investment expenditures in the Brazilian economy.

References

Arestis, Philip, L. F. de Paula, and Fernando Ferrari-Filho. (2008). “Assessing the Economic Policies of President Lula da Silva in Brazil: Has Fear Defeated Hope?”, Centre for Brazilian Studies, University of Oxford, Working Paper Number CBS-81-07.

Avdjiev, S., M. Chui and H S Shin. 2014. “Non-financial corporations from emerging market economies and capital flows”, BIS Quarterly Review, December, pp 67–77.

Bastos, F.R., H. Kamil, and B. Sutton. 2015. “Corporate Financing Trends and Balance Sheet Risks in Latin America: Taking Stock of “The Bon(d)anza”, IMF Working Paper, WP/15/10.

Barbosa, N. 2008. “An Unusual Economic Arrangement: The Brazilian Economy During the First Lula Administration, 2003–2006,” International Journal of Politics, Culture and Society, 19(3/4): 193–215.

__________. 2010. “Latin America: Counter-Cyclical Policy in Brazil: 2008–09”, Journal of Globalization and Development, 1(1): 1–11.

Bresser-Pereira, L.C. 2015. “The macroeconomic tripod and the Workers’ Party administrations,” in (ed.) Lauro Mattei. Forthcoming.

Fraga, A. 2016. “Sobre a relação entre os regimes fiscal e monetário no Brasil,” IEPE/CdG, Texto para Discussão nº 35.

Ferrari-Filho, Fernando, André Moreira Cunha & Julimar da Silva Bichara (2014). “Brazilian countercyclical economic policies as a response to the Great Recession: a critical analysis and an alternative proposal to ensure macroeconomic stability,” Journal of Post Keynesian Economics, 36:3, 513-540

International Monetary Fund (IMF). 2014. World Economic Outlook (WEO). Legacies, Clouds, Uncertainties, October 2014

__________. 2015. World Economic Outlook: Adjusting to Lower Commodity Prices. Washington (October).

Kregel J.A. 2009. The global crisis and the implications for developing countries and the BRICs: Is the “B” really justified? Brazilian Journal of Political Economy 29(4), 341-56.

Minsky, Hyman P. 1965. “The Role of Employment Policy.” in M.S. Gordon (ed.) Poverty in America. San Francisco: Chandler Publishing Company.

__________. 1972. “Financial Instability Revisited: The Economics of Disaster.” In Board of Governors (ed.) Reappraisal of the Federal Reserve Discount Mechanism, vol. 3, 95-136. Washington, DC: Board of Governors.

__________. 1975. “Suggestions for a Cash Flow-oriented Bank Examination.” In Federal Reserve Bank of Chicago (ed.) Proceedings of a Conference on Bank Structure and Competition, 150-184. Chicago: Federal Reserve Bank of Chicago.

__________. 1975a. John Maynard Keynes. New York: Columbia University Press.

__________. 1982. Can it happen again? Armonk, NY: ME Sharpe.

__________.1986. Stabilizing an Unstable Economy, New Heaven: Yale University Press.

__________. 1989. “Profits, Deficits and Instability: A Policy Discussion” (1989). Hyman P. Minsky Archive. Paper 148. http://digitalcommons.bard.edu/hm_archive/148

__________. 1994. “Financial instability and the decline(?) of banking: public policy implications,” Proceedings, Federal Reserve Bank of Chicago, issue May, pages 55-68.

Rezende, F.C. 2015. “Why Does Brazil’s Banking Sector Need Public Banks? What Should BNDES Do?” The Levy Economics Institute, Working Paper No. 825.

[1] From national accounting identities, dross domestic product (Y) equals the sum of consumption expenditures (C) , investment (I), government purchases (G) and net exports (X – M) that is Y = C + I + G + (X – M). We know that S = I + G – T + CA, rearranging the terms we get: that S – I = G – T + CA where (S – I) the private sector balance equals the government balance plus the current account balance.

[2] Improved external accounts and a surge in capital inflows contributed to the appreciation of the exchange rate, which harmed the competiveness of domestic industries and its export capacity, and domestic asset prices contributing to a consumption boom.

[3] Even though the government has been trying to reduce indexing in the economy, they introduced a formula, through the enactment of law 12.382/11, to readjust the minimum wage in Brazil that depends on prior-year inflation plus the level of GDP growth from the last two years. To be sure, it allowed real incomes to go up by doing this, but it also reintroduced an inertial component to changes in the price level in Brazil.

[4] For the sake of comparison, non-financial private sector debt growth in Brazil increased at a rate similar to debt growth in China, which is already dealing with the consequences of an asset price bubble fueled by credit.

[5] It includes bank loans, bonds, and foreign borrowings

[6] Article 202 of law no. 6,404/76 – known as “The Brazilian corporate law”, requires the payment of mandatory dividends, which should be at least equal to 25.0% of a company’s net income. Note that the Provisional Measure 627/2013, enacted into law no. 12.973/2014 on May 14, 2014, among other things, mandated that “under the new law, dividends from profits generated between January 1, 2008, and December 31, 2013, that are greater than the amount calculated using the Tax Balance Sheet are not subject to tax. In the original version of PM 627, this rule was limited to dividends paid by November 12, 2013, if the company made an election to apply the new law from January 1, 2014. The new law removes this limitation.” (PWC 2014, p.2). This suggests that while corporate profits are subject to taxation, dividends based on earnings are tax exempt.

ShareThis

ShareThis