IMF Provides Cover for Europe’s Dysfunctional Currency Union

The Council on Foreign Relations’ Brad W. Setser has produced a couple of interesting blogposts on Germany’s fiscal policies of late. The first one, titled “Germany Cannot Quit Fiscal Consolidation,” was published at the end of August. On September 18th, the second one appeared, titled “The Global Cost of the Eurozone’s 2012 Fiscal Coordination Failure.”

The latter is more limited in scope and draws heavily on a recent report by the Banque de France. Setser elaborates on the rather obvious point that the eurozone’s attempt at fiscal austerity in the years 2011–13, when the currency union experienced the second leg of its double-dip recession, was counterproductively harsh:

The consolidation observed between 2011 and 2013, based on the overall change in the primary structural balance of general government, is now estimated by the European Commission at almost 2.9% of potential GDP…the fiscal effort was 1.5 percentage points of GDP in 2012. (Banque de France 2017)

Corroborating the Banque de France’s analysis, Setser points out correctly that there was no sound economic case for Germany to embark on austerity just at the time when it also demanded this form of self-sacrifice, in the name of the “credibility” of the euro regime, from its euro partners. If anything, Germany should have continued with at least mildly expansionary fiscal policy to keep the eurozone’s recovery on track and enable its internal rebalancing. Setser chides the Banque de France for not mentioning that France, too, could have somewhat lessened and delayed its own fiscal tightening to support the regional growth momentum at a critical time.

It is certainly very interesting that the Banque the France today finds the courage to present an argument that implies a severe critique of Germany’s fiscal folly. Perhaps it felt inspired by the fresh spirit of the republic’s new president. Perhaps open debate will also help official Europe to finally catch up with the realities of truly enormous collateral damages caused by its flawed policy doctrines of “growth-friendly” austerity and structural reform. As it stands, the eurozone is at high risk to repeat past mistakes as soon as its current stream of good luck runs out.

The more recent blogpost also echoes Setser’s main concern analyzed in the earlier blogpost of late August: global rebalancing.

No doubt Germany did itself a disservice by turning towards austerity in 2010– the German economy’s recovery stalled in 2011–13. Germany thereby also did great harm to Europe’s currency union – pushing the eurozone back into recession, suffering high unemployment and massive permanent income losses in due course. But by doing so, Germany’s fiscal folly also had the result of turning the eurozone into a huge burden for the world economy. Worst of all, there are no signs that Germany may be changing course: over the last few years, Germany has run up even more sizeable budget surpluses.

Setser is not mincing words on the global relevance of the matter:

That means that German fiscal policy won’t be supporting either internal rebalancing in the eurozone (a fall in Germany’s surplus that helps support a rise in the surpluses or fall in the deficits of Germany’s eurozone trade partners) or global rebalancing. … It makes it less likely that the eurozone’s growth will spill over to the world through a reduction in the eurozone’s current account surplus. And it would be nice if Europe would now, during its recovery, repay the rest of the world for the negative demand and trade spillovers that went along with the second dip in the eurozone’s double dip recession.

With the eurozone refusing to “pay back” any received demand stimulus from abroad, Setser moves on to investigate whether more constructive efforts to rebalance global demand may be forthcoming elsewhere in the world economy. He turns to various IMF Article IV consultations as well as the Fund’s latest “External Balance Assessment” exercise for that purpose, only to emerge with the less than cheerful result that

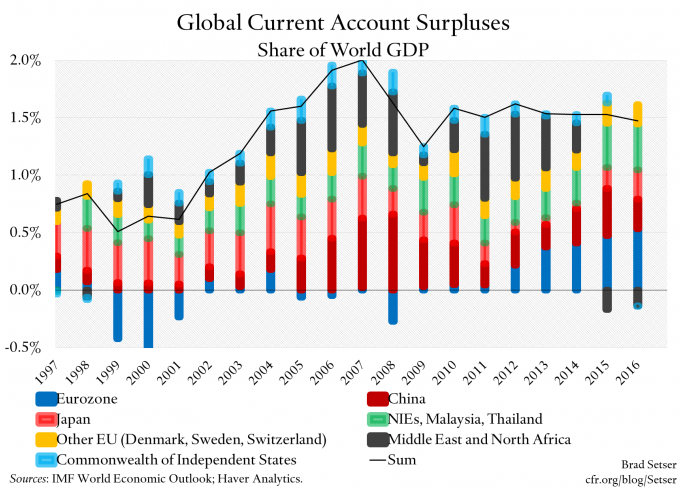

at the end of the day, the IMF is only calling for a pause in fiscal consolidation: Its long-term fiscal recommendation for China, Japan, and the eurozone is still for a consolidation that would raise national savings and thereby would be expected to raise the current account surpluses of all three. … China, Japan, and the eurozone combined are over a third of world GDP, and collectively have a current account surplus of about 1 percent of world GDP [see Setser’s chart below]. A fiscal consolidation in all three that would raise their national savings (or in China’s case reduce public investment) creates a pretty big headwind to global rebalancing. … [Hence it is to be feared] that rebalancing could come through policies that in aggregate slow global demand growth, and introduce a deflationary bias to the global economy.

Indeed. Despite publishing some enlightened research papers on the matter in recent years (see here, for instance), institutionally, the IMF appears to have a similarly hard time kicking its austerity obsession as Germany. Like brothers in mind: Always too keen to push for more austerity, never too worried about how very damaging that might turn out to be. This peculiarly distorted mindset, undisturbed by mounting evidence to the contrary, may also explain why the IMF is providing unwelcome political cover for Europe’s dysfunctional currency union by seemingly purely technical means, in the following sense.

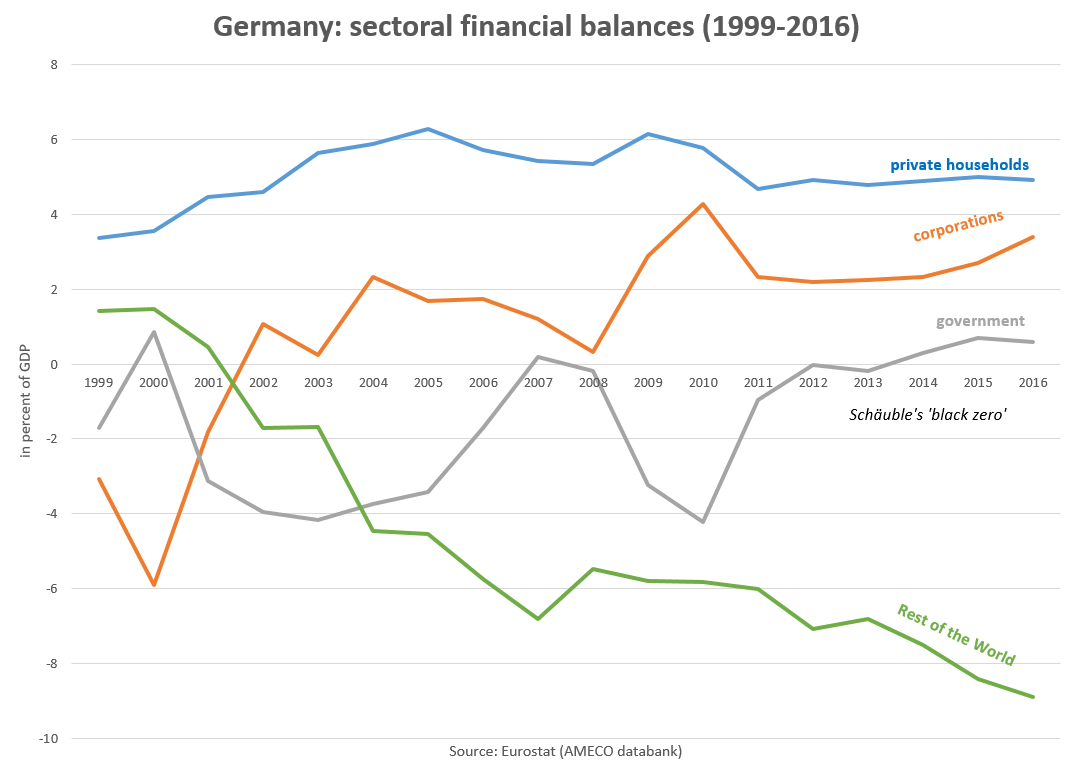

It should be obvious by now to any observer who is not in deliberate denial of the facts that Germany only manages to celebrate its supposedly virtuous fiscal conservatism by running up gigantic current account surpluses. The sectoral financial balances of all three of Germany’s domestic sectors show notorious surpluses. Germany’s corporate sector is highly profitable but refuses to invest accordingly. Not even negative interest rates entice Germany’s household sector to spend sufficiently, as the distribution of income and wealth is becoming ever more unequal thanks to wonderfully “liberating” reforms and official wage repression. The government prefers to run down Germany’s public infrastructure stock because the country’s fiscal lunatics believe that that may be the best way to prepare for the future and bolster the economic possibilities for our grandchildren. But the “German model” can only work if the rest of the world overspends and overborrows sufficiently. The German model has wrecked the eurozone to begin with. Germany and its euro satellites are now out for bigger prey – the world economy.

Back in 1999, Germany amended its constitution, essentially requiring the government to run (structurally) balanced budgets until eternity (the so-called “debt brake”). As there can never be too much stability and thrift, finance minister Wolfgang Schäuble finds both comfort and widespread praise as an overachiever. Pretty much the same is expected today from all euro members, as the so-called “Stability and Growth Pact” and “Fiscal Compact” call for just that.

Little surprise the sectoral financial balances of the eurozone as a whole have come to resemble the German model quite closely: The household and corporate sectors are both in surplus, the improvement in the government sector’s balance mirrors developments on the external front. Following its German rulebook, the eurozone practices its fiscal virtues on the back of the global economy – officially sanctioned by the IMF, an international institution that is supposedly concerned about global rebalancing.

For the IMF’s latest External Balance Assessment shows a current account “norm” for the eurozone of 3.1 percent of GDP, just slightly below its actual value for 2016 of the trivial amount of some 400 billion U.S. dollars. In other words, as far as global imbalances are concerned, the eurozone does not have any homework to do; the eurozone is somehow not even part of the problem or imbalance in the world economy at all. Surely the eurozone authorities will be much relieved to hear this verdict: the German model just got its official okay by the global community’s master watchdog.

In an endnote, Setser makes some very interesting observations concerning the eurozone’s current account surplus “norm”:

Thanks to a set of debatable technical adjustments that have been made to the IMF’s model (raising the contribution of aging to the current account surplus above the basic estimate that emerges from the underlying model), the IMF now believes that the current account “norm” for the eurozone is a surplus of three percent of GDP—more or less what we have now. Before those adjustments, the current account norm for the eurozone was lower—around one percent of the eurozone’s GDP in the 2014 model, around 2 percent in the 2015 model. These technical adjustments make it easier for the IMF to propose further fiscal consolidation in the eurozone, as the fiscal consolidation doesn’t open up a big current account gap.

Put differently, a minor “technicality” was used to let the eurozone off the hook. Prior to the global crisis, when concerns about global imbalance were running high and the IMF first concerned itself with the matter in the form of “multilateral consultations” as a new tool of multilateral surveillance, the eurozone authorities were keen to excuse themselves as being no party to global imbalances, since the eurozone’s current account was roughly in balance over the 2000s. As we now know, the eurozone’s internal imbalances were quite effective enough in turning Europe’s stability union into a mess and massive drag on global growth.

Not only did the IMF get involved financially in the eurozone’s internal crises, which is odd enough. Externally, the IMF now also sanctions that the eurozone continues to “solve” its internal challenges – that is, life in a dysfunctional currency union – on the back of the global community. For the eurozone authorities may now, once again, choose to excuse themselves as a party in global imbalances, since a perpetual three-percent-of-GDP current account surplus was declared to represent “balance,” at least in their case. It must be nice to have a good friend in Washington, D.C.

I am just a little concerned here that the IMF may not be doing itself a big favor by providing official cover to Europe’s dysfunctional currency union. Clearly the Trump administration has formed a less favorable view on the matter of Germany’s notorious current account imbalance; with Germany unquestionably pulling the strings in the eurozone too, and with important global ramifications as discussed here. And the U.S. Congress might well go along with getting more active about notorious surplus countries (or regions).

Moreover, China and other emerging market economies may be excused for feeling shortchanged in exercises undertaken in the name of global stability if the IMF’s European members continue to get special treatment, even if that happens through convenient “technicalities.” Their natural response would be to question the IMF’s impartiality and credibility – providing fresh impetus for flourishing alternative arrangements.

It turns out minor technicalities can be quite political.

ShareThis

ShareThis

Another excellent post on the German surplus’ agree with all. But note that the technical adjustment related to aging is considered by the IMF to be a valid correction, and not only for DE but also for JP. Thus, important to address this issue analytically, as well as politically