On Financial Transaction Taxes and Nonsense-Powered Economic Headwinds

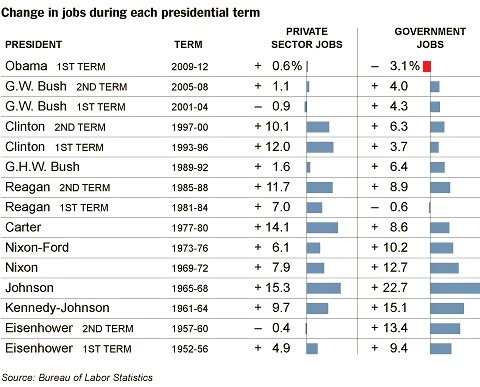

Randall Wray joined Suzi Weissman on her “Beneath the Surface” radio show on Friday. They began the interview with a discussion of the policy blunders that are creating headwinds for the US economy, including the expiration of the payroll tax cut, the decline of real per capita government spending, and, as Wray put it, “the government sucking jobs right out of the economy.” He’s not referring here to the walking corpse of the theory that regulatory uncertainty is to blame for the slow recovery, but to the fact that government is holding back job growth far more directly: by laying off workers at an unprecedented rate. For context, look at this chart put together by Floyd Norris (highlighted):

They also addressed this Marketplace segment on the “death of inflation,” ongoing threats from the financial system, and some ideas for financial reform that are currently being tossed around. On the latter, Wray argued that the idea of a financial transactions tax (being considered by a number of EU countries) is a second-best or partial solution. Instead of sin taxes and other such “economists’ solutions,” as he described them, Wray recommended coming at the problem more directly: by outlawing certain speculative activities and going after practices like high-frequency trading. They closed with a discussion of the prospects of another financial crisis emerging.

Listen to the interview here.

ShareThis

ShareThis