Public Citizen on the Repo Ruse

Whether or not you already know what a “repo” is, Public Citizen’s new report on repurchase agreements, which played a part in the recent financial crisis (as well as the collapse of MF Global), is well worth reading. Here’s their introduction:

In the run-up to the 2008 financial crisis, banks depended increasingly on an unreliable method of funding their activities, called “repurchase agreements,” or repos. Repos may look like relatively safe borrowing agreements, but they can quickly create widespread instability in the financial system. The dangers of repos stem from a legal fiction: despite being the functional equivalent of secured loans, repo agreements are legally defined as sales. Dressing up repo loans as sales can lead to sloppy lending practices, followed by sudden decisions by lenders to end their risky lending agreements and market panics. Repos also permit financial institutions to cover up shortcomings on their balance sheets. The problems in the repo market were exposed as the 2008 financial crisis unfolded, yet the risks posed by repos remain largely unaddressed. Without reform, the financial system will remain susceptible to the sudden and severe shocks that repos can cause.

Micah Hauptman and Taylor Lincoln have also written a blog post that runs down some of the basics.

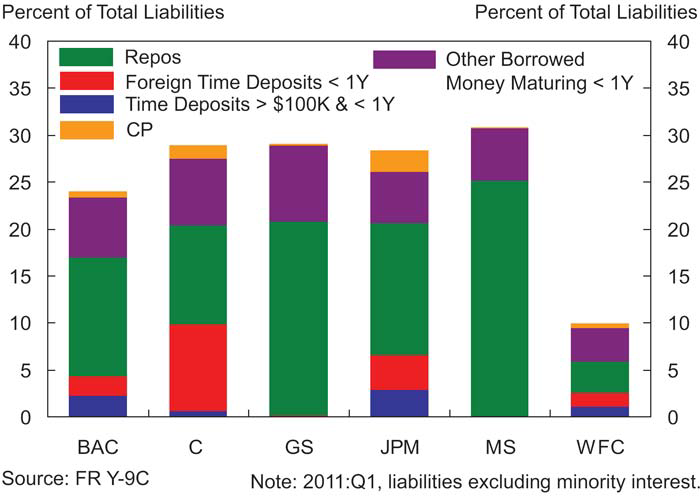

In their report, Public Citizen uses data from the Financial Stability Oversight Council (FSOC) that displays how heavily repos are (still) being used among the top six bank holding companies. This figure shows the percentage of the liabilities held by the biggest banks that are deemed “less stable” by FSOC. As you can see, repos (in green) represent the largest chunk:

Source: Financial Stability Oversight Council Annual Report (2011)

Source: Financial Stability Oversight Council Annual Report (2011)

The Public Citizen report also includes a brief history of the regulatory changes that enabled repos to play a role in the financial crisis. In a normal bankruptcy, a stay is issued which prevents lenders from automatically seizing and selling off collateral. Although a repurchase agreement effectively functions like a loan, they’re sometimes booked as sales; in part to avoid this stay requirement (giving lenders, or “buyers” of the collateral, a sense of being more protected in case of default. As the report notes, treating repos as sales also allows borrowers to make their balance sheets look better—something Lehman took advantage of to mask $50 billion worth of debt). A 1982 court ruling held that repos should be treated like secured loans—meaning that in case the borrower (the “seller” of the security) goes broke, the lender cannot immediately seize and sell the collateral. Protests from the financial industry and then-Fed Chairman Paul Volcker (due to the Fed’s use of repos in monetary policy fine-tuning) led Congress to pass a law in 1984 that exempted repos from automatic stays if the security used in the repurchase agreement was “low-risk collateral” (US Treasuries, federal agency securities, and CDs). Then in 2005, again in response to a serious lobbying effort, Congress passed a law (the unfortunately named Bankruptcy Abuse Prevention and Consumer Protection Act) that exempted, most notably, mortgage-related securities; thus setting the stage.

As Micah Hauptman, author of the report, points out, Dodd-Frank may actually encourage greater use of repos, due to their exclusion from the Volcker Rule prohibitions on proprietary trading (see Hauptman’s account of the way in which MF Global used repos to engage in proprietary trading).

According to Levy Institute Senior Scholar Jan Kregel, repos should simply be reclassified as loans and regulated as such; a reclassification he maintains is already within the authority of existing regulatory agencies or the FSOC. Kregel argues that repos have been a persistent source of instability, even when they were limited to “safe” assets like government securities (see his recent report “Using Minsky to Simplify Financial Regulation“).

ShareThis

ShareThis