Preliminary Program for the 25th Minsky Conference

The preliminary program has been posted for the 25th Annual Hyman Minsky Conference, being held April 12-13 here at Blithewood on the Bard College campus.

The deadline for registration is April 1st.

Tuesday, April 12

| 8:30−9:00 a.m. | Registration |

| 9:00−9:15 a.m. | Welcome and Introduction Dimitri B. Papadimitriou, President, Levy Institute |

| 9:15−10:30 a.m. | Session 1. GLOBAL FRAGILITY AND EMERGING MARKETS OUTLOOK MODERATOR: Theo Francis, Special Writer, The Wall Street Journal SPEAKER: Jan Kregel, Senior Scholar, Levy Institute; Professor, Tallinn University of Technology Fernando J. Cardim de Carvalho, Senior Scholar, Levy Institute; Emeritus Professor of Economics, Federal University of Rio de Janeiro |

| 10:30 a.m. − 12:30 p.m. | Session 2. COMMODITIES AND DERIVATIVES REGULATION MODERATOR: Izabella Kaminska, Journalist, Financial Times SPEAKERS: Michael Greenberger, Professor, School of Law, and Director, Center for Health and Homeland Security, The University of Maryland Robert A. Johnson, President, Institute for New Economic Thinking; Senior Fellow and Director, Franklin and Eleanor Roosevelt Institute Michael Masters, Founder and Chairman of the Board, Better Markets |

| 12:30−2:15 p.m. | Lunch SPEAKER: Robert J. Barbera, Codirector, Center for Financial Economics, The Johns Hopkins University “Six Degrees of Separation: Why the Fed’s Strategy of Precautionary Unemployment Is Nutty” |

| 2:15−4:45 p.m. | Session 3. IS THE CURRENT CREDIT STRUCTURE CONDUCIVE TO FINANCIALLY STABLE RECOVERY? MODERATOR: TBD SPEAKERS: Henry Kaufman, President, Henry Kaufman & Company, Inc. Richard Berner, Director, Office of Financial Research, US Department of the Treasury Martin L. Leibowitz, Managing Director, Morgan Stanley Albert M. Wojnilower, Economic Consultant, Craig Drill Capital |

| 4:45−6:45 p.m. | Session 4. MINSKY, INEQUALITY, AND THE MONETARY/FISCAL POLICY OUTLOOK MODERATOR: TBD SPEAKERS: Viral V. Acharya, C. V. Starr Professor of Economics, New York University Stern School of Business Scott Fullwiler, Professor of Economics and James A. Leach Chair in Banking and Monetary Economics, Wartburg College Stephanie A. Kelton, Research Associate, Levy Institute; Chief Economist, US Senate Budget Committee; Professor, University of Missouri—Kansas City |

| 6:45−7:15 p.m. | Reception |

| 7:15 p.m. | Dinner |

Wednesday, April 13

| 9:00−11:30 a.m. | Session 5. US ECONOMIC OUTLOOK FORECAST MODERATOR: Eduardo Porter, Columnist, The New York Times SPEAKERS: Lakshman Achuthan, Cofounder and Chief Operations Officer, Economic Cycle Research Institute Bruce C. N. Greenwald, Robert Heilbrunn Professor of Finance and Asset Management, Columbia University Michalis Nikiforos, Research Scholar, Levy Institute Frank Veneroso, President, Veneroso Associates, LLC |

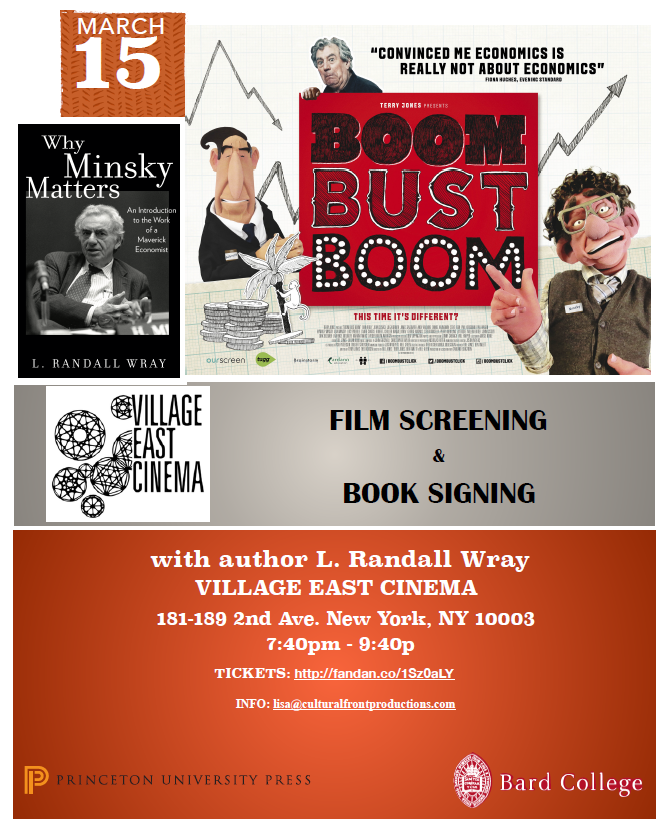

| 11:30 a.m. − 1:30 p.m. | Session 6. BANK REGULATION, TOO BIG TO FAIL, AND LIQUIDITY MODERATOR: Peter Eavis, Reporter, The New York Times SPEAKERS: Edward Kane, Professor of Finance, Boston College Walker F. Todd, Trustee, American Institute for Economic Research L. Randall Wray, Senior Scholar, Levy Institute; Professor of Economics, Bard College |

| 1:30−3:15 p.m. | Lunch SPEAKER: Barney Frank, Former US Representative (D-MA, 4) |

| 3:15−5:15 p.m. | Session 7. EUROPEAN PERFORMANCE AND REGULATORY OUTLOOK MODERATOR: TBD SPEAKERS: Emilios Avgouleas, Chair, International Banking Law and Finance, School of Law, University of Edinburgh Mario Tonveronachi, Professor of the Economics of Financial Systems, University of Siena Loukas Tsoukalis, Pierre Keller Visiting Professor, Harvard University |

| 5:15−7:00 p.m. | SPEAKER: Vítor Constâncio, Vice President, European Central Bank “A Challenging International Economic Environment for Central Banks” |

ShareThis

ShareThis