Indecent exposure

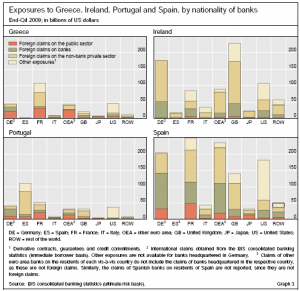

The Bank for International Settlements has released its quarterly review (hat tip EconBrowser). In it, you will find an interesting graph on page 19 (or page 23 including cover pages), titled “Exposures to Greece, Ireland, Portugal, and Spain by nationality of banks”. It’s reproduced here on the left (click on it for a larger view).

The Bank for International Settlements has released its quarterly review (hat tip EconBrowser). In it, you will find an interesting graph on page 19 (or page 23 including cover pages), titled “Exposures to Greece, Ireland, Portugal, and Spain by nationality of banks”. It’s reproduced here on the left (click on it for a larger view).

I am puzzled by the relatively small size of public sector debt compared to the quite significant contribution of private sector debt in the countries discussed. Is fiscal austerity really going to be a solution?

I wonder how in the world cautious German and smart French banks ended up with so much exposure to private debt in Spain. Of course, ingenious American banks are disproportionately exposed to financial products rather than straightforward debt. It seems financial reforms of different kinds are required in different places.

ShareThis

ShareThis