Stimulus funds, pens, and socks: where do they go?

All to the same place? You might be excused for thinking so after perusing Tyler Cowen’s post Why didn’t the stimulus create more jobs?, but you would be wrong. First let’s look at Cowen’s post for some obvious red flags. About the number of people hired using stimulus funds who were already employed, Cowen says:

You can tell a story about how hiring the already employed opened up other jobs for the unemployed, but it’s just that — a story. I don’t think it is what happened in most cases, rather firms ended up getting by with fewer workers.

OK, so the substance of this is he doesn’t like one story, he prefers another. I quite understand why, Cowen being who he is. I happen to like the other story, myself. However, one might want actual proof rather than preferences (dear as they are to neo-classical economists).

A second point requires reading the two studies Cowen refers to. Cowen says that “There are lots of relevant details in the paper but here is one punchline: ‘hiring people from unemployment was more the exception than the rule in our interviews.'” Interesting choice. Especially given that the first bullet point in their summary of results is: “ARRA funds led to worker hiring and retention.” And that is the point after all. The question of whether the ARRA funds went to directly hire unemployed workers or not is mostly beside the point.

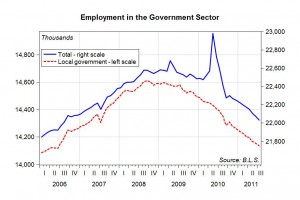

The question that matters in job terms is: how many more people were employed because of the ARRA spending than would have been without it? It’s a question we can’t know the answer to, because we will never know what would’ve happened without the stimulus. The insinuation in Cowen’s post is that for a variety of reasons the stimulus wasn’t that stimulative. The proof offered is that Cowen doesn’t think workers hired away from other jobs were replaced, or that (from the paper itself, now) wages were mandated to be too high: “38.2 percent [of “organizations required to pay prevailing wages”] thought that they could have hired workers at wages below the Davis-Bacon prevailing wage.” The latter point misses the point of stimulus: its multiplier effect (where have I seen that phrase before?). The number of jobs directly created or saved by the stimulus isn’t the whole story. Those workers, having non-zero rather than zero money in their pockets, will spend more, saving or creating other jobs, and so on.

A final “damning” conclusion from the paper: “[h]iring isn’t the same as net job creation.” Indeed. But net job creation is never actually dealt with in the paper, let alone net job creation/saving relative to no stimulus. For an estimate of job creation under the first three years of the stimulus, you could look at this paper (self-serving, isn’t it?).

I sometimes wonder whether folks who think stimulus spending has little to no effect (or a negative effect!) on employment think the money is just piled up on the White House lawn for President Obama to (gleefully, I’m assuming in this fantasy) toss a lit match onto.

ShareThis

ShareThis