Heterodoxy and the Mainstream(s)

Over the break an article appeared in The Economist spotlighting three “schools of macroeconomic thought”: Scott Sumner’s market monetarism, Austrian free banking, and neo-chartalism (MMT). In addition to noting the role of the blogosphere in refining and promoting these heterodoxies, the article elects to use Paul Krugman as a stand-in for the “mainstream” opponent.

If you step back, what’s slightly unsatisfactory about this choice is that Krugman is, right now, more in tune with the policy preferences of two-thirds of these “doctrines on the edge of economics” than he is with the reigning fiscal or monetary policy stance of the US government. Krugman has written extensively about the fact that our current debt and deficit levels present no serious current economic problem. (The dispute between Krugman and MMTers stems from disagreements about the long-term debt.) And as The Economist points out, Krugman is fine with nominal GDP targeting.

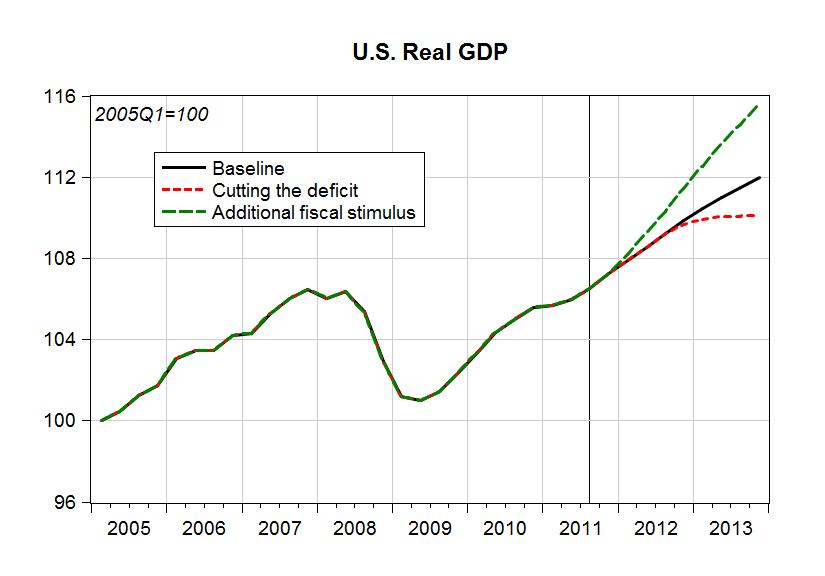

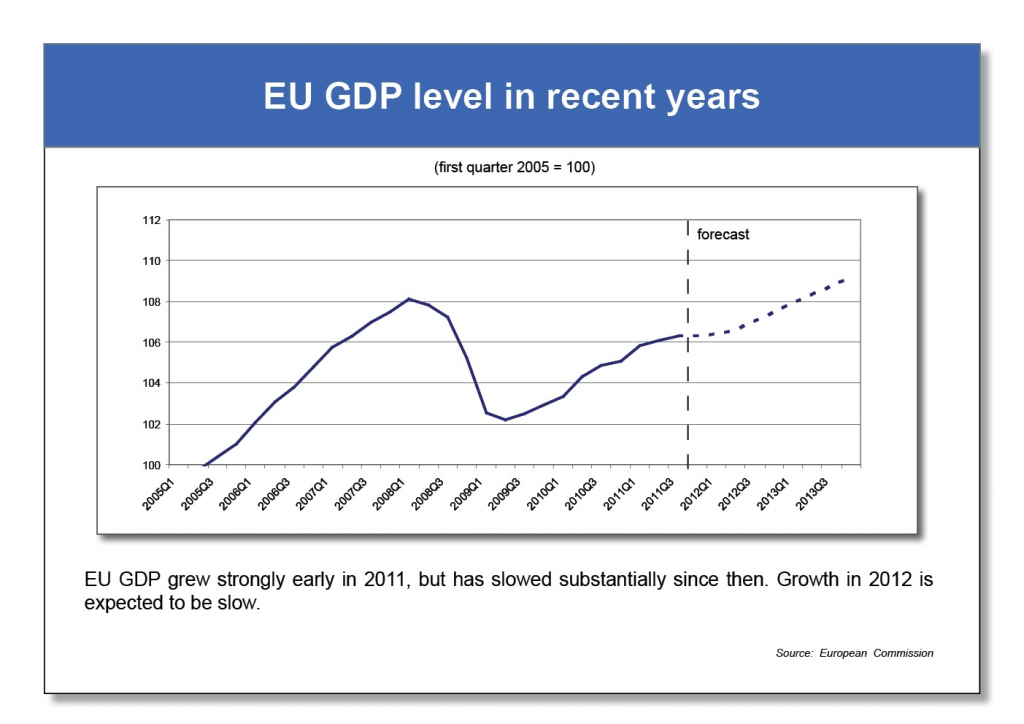

Figuring out where to draw the boundaries of “the mainstream” in the economics profession is one thing, but when it comes to the range of politically acceptable policy options (a different kind of mainstream, admittedly) Krugman stands shivering in the cold side-by-side with a lot of heterodox thinkers. With respect to both policy outcomes and policy rhetoric, our institutions seem to pay a great deal more attention to deficits, debt, and inflation than they do to unemployment and the threat of deflation (though one might argue that, at least with respect to fiscal stimulus, this has more to do with the fact that in the US political system the “opposition” party has the ability to see the government fail. Resistance to fiscal stimulus may all but disappear from Congress in the event of a Romney presidency. Explaining the preferences of the FOMC is a more complicated affair.) The mainstream policy space since 2010 excludes neo-chartalism, market monetarism, and Paul Krugman.

A handful of the Levy Institute’s working papers and policy briefs related to the neo-chartalist approach can be read here: “Money,” “Deficit Hysteria Redux?“, “Money and Taxes,” “Modern Money.”

ShareThis

ShareThis