Many of the themes in fiscal policy, economic growth, and distribution that we have been working on here have been in the news lately. Scholars from many fields are weighing in. One common theme is dynamics and their importance:

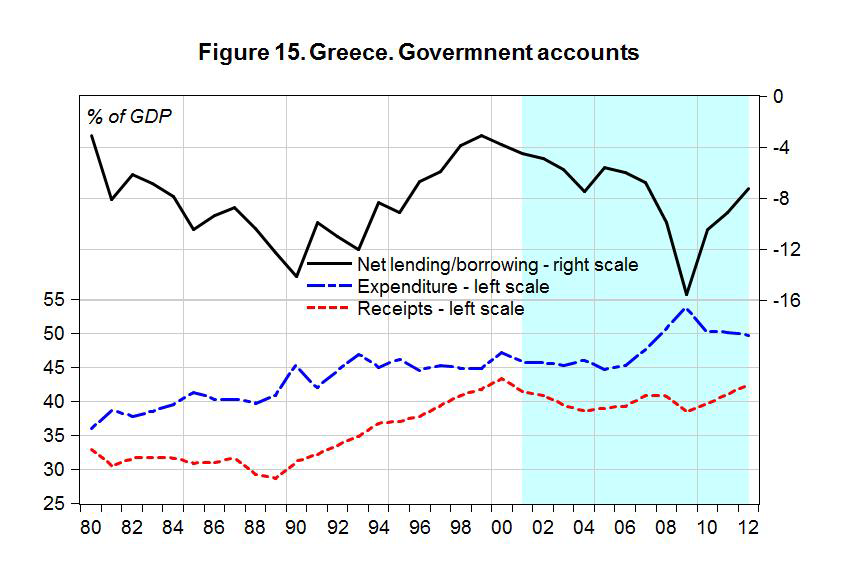

1) Evidence of a self-reinforcing fiscal trap in operation in Britain, forwarded by the NIESR, a British think tank: Dawn Holland and Jonathan Portes argue today in Vox that in the UK austerity has led to higher debt-to-GDP ratios, defying the predictions of orthodox macro models. For something from our Institute on the topic of fiscal traps, including the UK example, you might take a look at this public policy brief from Dimitri Papadimtriou and me, posted just last week.

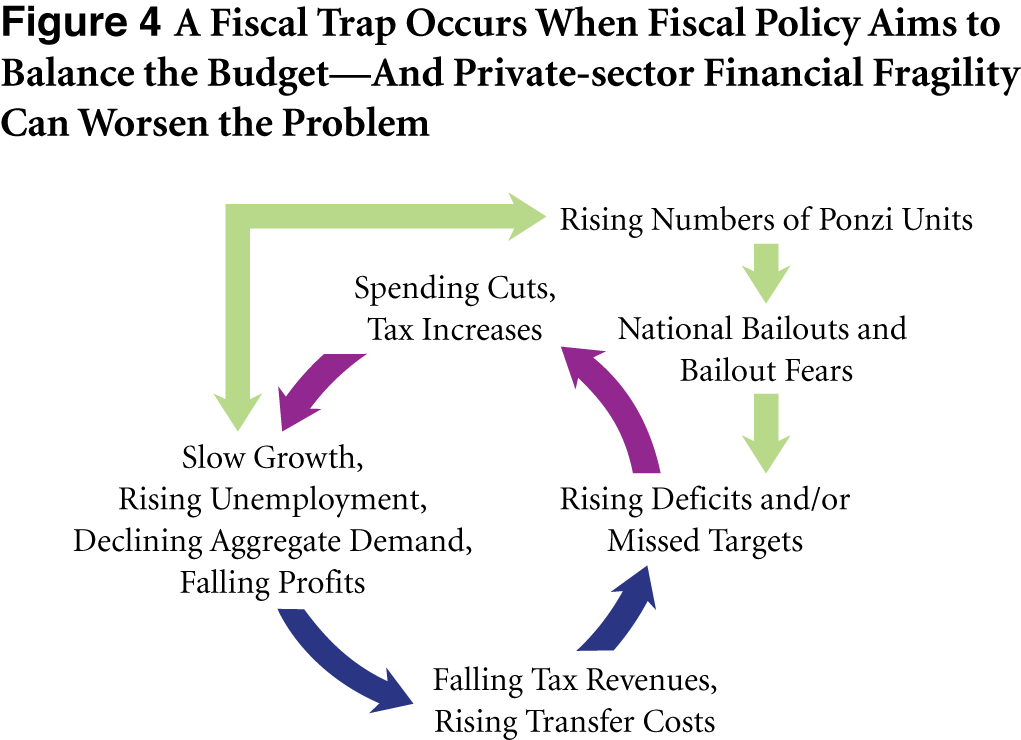

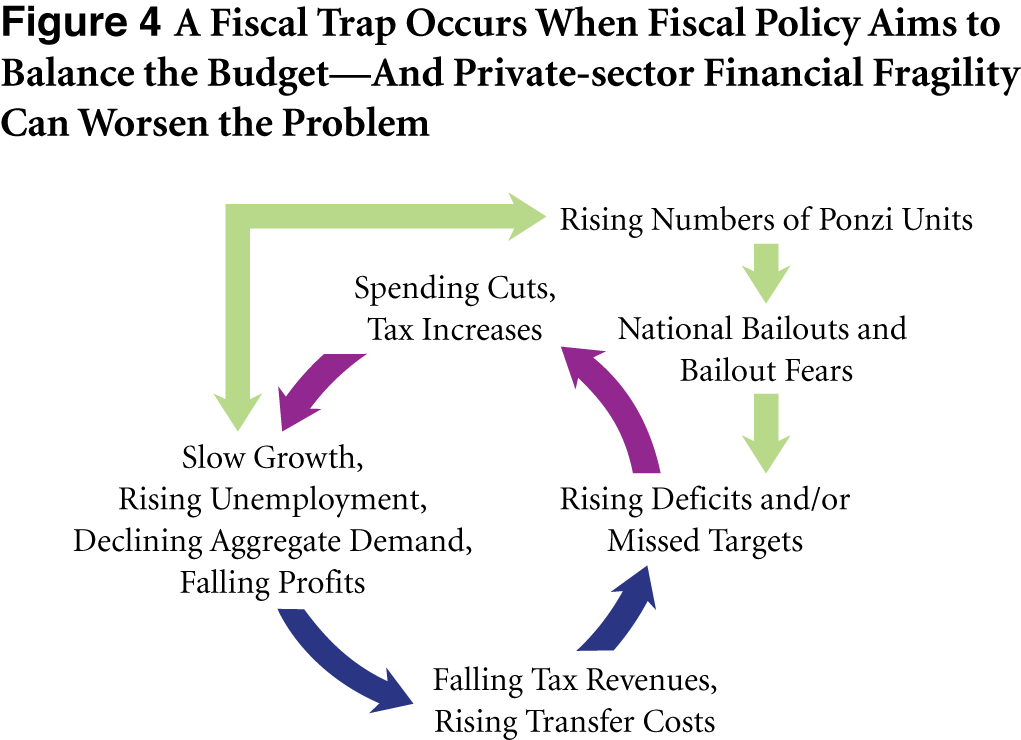

It is important to keep in mind, as the authors of the British study point out, that fiscal austerity is hardly the only cause of the economic crises now underway in much of the world. For example, they get at the problem of coordinating macro policies in a group of open economies. Above this paragraph is a diagram from our brief, illustrating, among other things, the role of Minskyan financial fragility in generating crises in many places in the world. This role is shown by the light green arrows in the diagram, which show how rising numbers of “Ponzi units,” (firms and households that need to borrow in order to make their interest payments) can play a role in a fiscal trap. Spending cuts or tax increases are sometimes “self-defeating” in this view because they undermine the tax base—the amount of activity subject to taxation. The mechanism involved is a Keynesian multiplier effect. Internationally, there are many examples of this problem these days.

2) More on models of economic growth and income distribution and their relationship to models from applied mathematics in letters to the editor of the Financial Times (here and here) and in a blog post from a mathematician: The FT letters discuss, among other things, the perhaps debatable role of unemployment in keeping real wages from rising. On the other hand, the blog post discusses various kinds of discontinuous dynamic behavior that fall under the rubric of catastrophe theory, mentioning a classic business-cycle model by Nicholas Kaldor and various sorts of straws that break camels’ backs. Author Steven Strogatz notes that “in some…cases (boiling water, optical patterns), the picture from catastrophe theory agrees rigorously with observation. But when applied to economics, sleep, ecology, or sociology, its more like the camel story—a stylized scenario that shouldn’t be taken for more than it is: a speculation, a hint of something deeper, a glimpse into the darkness.”

All of these ideas play a role in numerous macroeconomic models, including the one that I discussed in this post, which features CDF interactive graphics. New macro team hire Michalis Nikiforos has been working on many of these issues, too.

ShareThis

ShareThis