The Role of the Fed in the Sustainability of the Long-term Budget

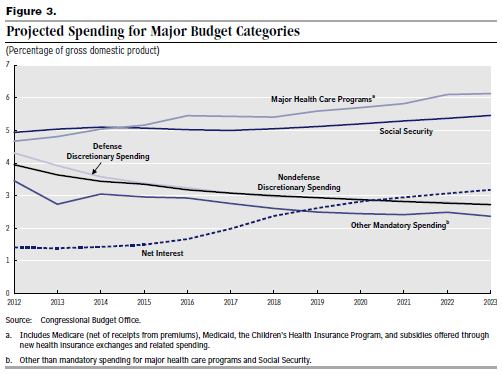

As noted, the Congressional Budget Office says that the federal deficit will shrink to 2.1 percent of GDP in two years and then start to grow again after 2015. The most important factor contributing to the widening budget deficit over the next 10 years, according to the CBO, is not Social Security, or even Medicare, but a predicted rise in interest payments on the debt, as you can see here:

The net interest projection is based on assumptions about what policy decisions the Federal Reserve will make in the future; in this case, the Fed is assumed to raise interest rates substantially. The deficit tops out at 3.5 percent of GDP in 2023 in the latest CBO forecast (which is just above the 40-year average of 3.1 percent of GDP), but it continues to climb outside of the 10-year window, and this is what has many people concerned.

Although much of the discussion of the long-term budget has been focused on “entitlements” and healthcare costs in particular, rising interest payments also play a key role in the CBO’s long-term forecast. In fact, James Galbraith has argued that they play the key role in terms of arguments about the “sustainability” of the debt:

The CBO’s assumption, which is that the United States must offer a real interest rate on the public debt higher than the real growth rate, by itself creates an unsustainability that is not otherwise there. … Changing that one assumption completely alters the long-term dynamic of the public debt. By the terms of the CBO’s own model, a low interest rate erases the notion that the US debt-to-GDP ratio is on an “unsustainable path.” The prudent policy conclusion is: keep the projected interest rate down. Otherwise, stay cool.

The key to whether the debt ratio will grow unbounded in the future has to do with whether the rate of interest on public debt will be greater than the rate of economic growth. Those who subscribe to the functional finance or Modern Money Theory (MMT) view of public deficits and debt emphasize that interest rates are a policy variable (that rates are under the control of the Federal Reserve, rather than being wholly at the mercy of “markets”). If that’s the case, keeping the interest rate low enough allows for a permanent primary deficit to be sustainable over the long term, even if the debt-to-GDP ratio ultimately stabilizes at a level higher than some may be comfortable with. (Although justifying such discomfort obliges one to explain what it is about the debt-to-GDP ratio per se that poses a problem. Scott Fullwiler gets into these issues in more detail here.)

As Galbraith has pointed out, the interest rate increases assumed by the CBO’s long-term forecast wouldn’t just be ill-considered policy, they are also “belied by history.” Over the postwar period in the United States, it is the exception rather than the rule for the rate of interest on the public debt to be above the rate of growth (with the exception being the period from the ’80s to the late ’90s).

ShareThis

ShareThis

the marginal cost of capital (Keynes) rule would not recommend having the cost of capital be higher than the growth of the economy…central banks can prevent that unless politics and “Randilogy” rule the day.

In the long run it’s all about:

1. Growth rate

2. Interest rate

3. Inflation rate

Government debt is largely *endogenous*.

Ditto household debt:

http://www.asymptosis.com/swimming-in-the-stream-how-economic-forces-force-household-indebtedness.html