21st Annual Hyman P. Minsky Conference: Debt, Deficits, and Financial Instability

The annual Minsky conference, co-sponsored by the Levy Institute and the Ford Foundation, was held this past week in NYC. The audio transcripts of all the presentations (including one by yours truly) are online here. (I will also add my powerpoint below so you can look at it while listening to the audio.)

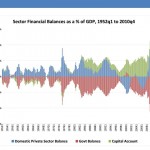

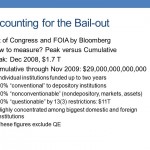

My presentation quickly summarized results of a project I am directing that examines democratic governance and accountability of the Federal Reserve, focusing on its response to the global financial crisis. You can read our first report here.

I won’t go into that today. I just wanted to very quickly summarize two quite interesting statements made by others over the course of the conference.

First, Joe Stiglitz had a great analogy about derivatives. Recall that part of the reason for the creation and explosion of derivatives was to spread risk. For example, mortgage-backed securities were supposed to make the global financial system safer by spreading US real estate risks all over the world. He then compared that to, say, a deadly flu virus. Would you want to spread the virus all over the world, or quarantine it? Remember Warren Buffet’s statement that all these new financial products are “weapons of mass destruction”–like the 1914 flu virus. And, indeed, just as Stiglitz said, spreading those deadly weapons all over the world ensured that when problems hit, the whole world financial system was infected.

The other observation was by Frank Partnoy, and also addressed the innovations in the financial sector. He said that these innovations mostly exploit information asymmetries in order to:

a) dupe customers (think Goldman Sachs and John Paulson constructing synthetic CDOs sure to blow up, and betting against Goldman’s customers who bought them); and

b) engage in regulatory arbitrage (evade rules, laws, supervisors, etc; ie, move trash into SIVs to evade capital requirements).

So here’s the question: why on earth do we let protected financial institutions—that have Uncle Sam standing behind them to clean up the mess they make—engage in such activities. As was pointed out by someone (I’ve forgotten who—but you can listen to the transcripts), financial innovations are very different from innovations in the “real” sector: they almost never have social benefits that exceed the social costs.

Anyway, go to the links above, and enjoy. It was a very good conference. The slides from my talk are below.

ShareThis

ShareThis

[…] 21st Annual Hyman P. Minsky Conference: Debt, Deficits, and Financial Instability « Multiplier Effe…. […]

[…] 21st Annual Hyman P. Minsky Conference: Debt, Deficits, and Financial Instability « Multiplier Effe…. […]