GDP Revisions and Our Looming Policy Masochism

The economy grew at an unflattering 1.3% annual rate in the second quarter, while first quarter GDP growth has been revised downwards to a wretched 0.4%.

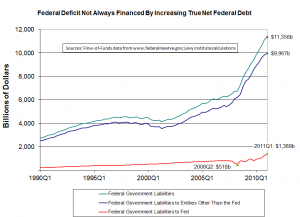

Against the backdrop of these abysmal numbers, the US government appears poised to do its best to make matters worse. Even if the debt limit negotiations generate an agreement, this is likely to entail a rather substantial anti-stimulus over the next couple of years. When combined with the expiration of the unemployment insurance extensions and of last year’s payroll tax cut, one can expect the US government to shortly be withdrawing somewhere on the order of a quarter of a trillion dollars from the economy.

The forecasting group Macroeconomic Advisers estimates that, as a result of the possible debt limit deals alone, GDP will be roughly 0.1 percentage points lower next year, and up to almost 0.5 points lower in 2013.

Again, it is useful to remind ourselves that this is purely self-inflicted. There is no requirement that budget savings be produced equal to the value of the rise in the debt ceiling—this is entirely a result of political strategy and political demands. And aside from the debt limit negotiations themselves, there is not much of a case to be made that reducing deficits in the near term in any way solves an emergent economic problem. Interest rates are low by historical standards and inflation remains in check. What’s more, key indicators show little evidence of expectations of increasing inflation down the road (for more on this, see the Levy Institute’s Public Policy Brief on the health of the recovery, containing useful numbers on measures of inflationary expectations).

Debt and deficits are not some moral stain on the nation; they are simply a matter of economic accounting. And as such, with regard to the idea of reducing debt and deficit levels we must always ask: what problem is this supposed to solve? In a recent working paper, Levy Institute Research Associate Mathew Forstater provides a helpful primer (pp. 6-13) on three different ways of understanding the potential economic issues surrounding government debt and deficits: from a “deficit hawk,” “deficit dove,” and “functional finance” approach.

MS

ShareThis

ShareThis