Greg Hannsgen | September 23, 2010

Hyman P. Minsky, the renowned financial economist, macroeconomist, and Levy Institute distinguished scholar, was born 91 years ago today. A short bio of Minsky, along with links to many of his publications, can be found here. Minsky’s papers are collected at the Minsky Archive, which is housed at the institute. In April, we will be holding our 20th Annual Hyman P. Minsky Conference in New York City. I hope you enjoy these links to information about an economist who was and is very important to this institute.

Comments

Greg Hannsgen | September 8, 2010

Last week, my colleague Tom Masterson commented on an op-ed piece by Robert Barro, which argued that much of the U.S. unemployment problem―perhaps 2.7 percentage points of the June unemployment rate of 9.5 percent―could be attributed to the availability of extended unemployment insurance benefits.

According to Barro’s argument, huge numbers of people are out of work by their own choice. In fact, data released yesterday from the Job Openings and Labor Turnover Survey (JOLTS) suggest that something very different is going on. Some economic theories about unemployment are based on the notion that workers use more of their time for leisure activities or full-time job search at times when their wages or salaries are relatively low. An example would be an ice-cream vendor who takes time off on cool or rainy days because sales are expected to be weak at such times. Along these lines, Barro has recently argued that Congressional extensions of benefit eligibility have made paid work less desirable for recipients whose checks might have been discontinued in the absence of new legislation.

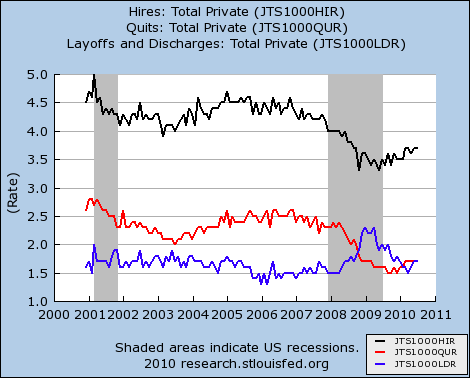

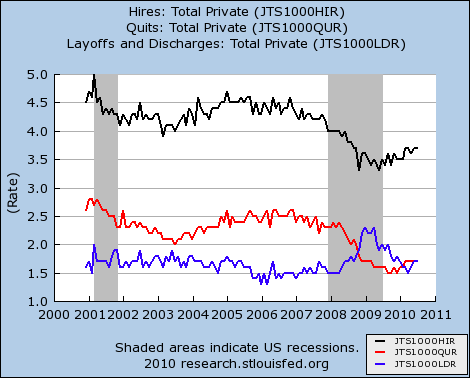

The figure above shows seasonally adjusted JOLTS data on the private sector for December 2000 through July 2010. This monthly survey, conducted by the Bureau of Labor Statistics, covers approximately 16,000 nonagricultural businesses. The black line shows that the estimated “hire rate” in the private sector was 3.7 percent in July. In other words, there were approximately 3.7 new hires in private industry for each 100 current employees in that part of the economy. This compares to 4.6 as recently as late 2006.

The other data series shown in the figure may shed more light on the validity of the leisure/job search explanation for high unemployment. The blue line shows the rate of “layoffs and discharges,” a category that includes all reported involuntary separations that were initiated by the employer. This figure peaked last spring at about 2.3 percent of the private-sector workforce and had fallen to a more typical level of 1.7 percent by July. The 2.3 percent figure, reached twice in early 2009, is the highest layoff and discharge rate for the period shown on the graph. Indeed, the graph shows a prolonged period beginning in late 2008 during which the rate of involuntary separations was well above the historical norm.

Finally, the “quit rate,” shown in red, is the percentage of workers who resign in the survey month, in this case July. For the private sector, this statistic fell from 2.3 percent at the start of the recession in 2007 to 1.7 percent in July. Hence, there has been only a modest increase in this rate since it bottomed out late last year at 1.5 percent. Recent low readings stand in stark contrast to an average observation of 2.4 percent for the period spanning December 2000 to November 2007. Such low quit rates strongly suggest that fewer rather than more workers than usual have been finding new jobs or resigning to take time off for job search, vacations, or home-based activities. The new statistics depict a job market in which many employees are losing their jobs or at least believe that it will be very difficult to find new jobs if they leave their current ones.

Comments

Thomas Masterson | September 7, 2010

The Free Exchange blog calls President Obama’s proposed $50 billion infrastructure stimulus “A New Hope.” Our research begs to differ. We find that spending $50 billion on infrastructure would create little more than half a million new jobs. That’s not an inconsiderable number, but it’s a drop in the bucket compared to the 14.9 million who were unemployed in August (according to the last employment situation report).

There are strong arguments to made in favor of infrastructure spending. But if the administration were to spend the same amount on social care (child care, home health care, etc.), the employment gain would be more than twice as great, reaching nearly 1.2 million.Those would be lower paying jobs, but they would go to individuals further down the economic ladder–the people, in other words, most in need of help and most likely to provide further stimulus by promptly spending their earnings.

Perhaps the president’s latest proposal is merely a political trap Obama is setting for the Republicans, giving them yet another opportunity to ostentatiously oppose something popular. If so, good luck. But after the weaker-than-needed stimulus package last year, which is now running out of gas in terms of boosting employment, this proposal won’t provide much additional job growth. Half measures, as the saying goes, avail us naught. And this proposal is much less than half of what is needed.

Comments

Daniel Akst | September 3, 2010

Levy Senior Scholar L. Randall Wray explains the foresight of Hyman Minsky in this video.

Comments

Dimitri Papadimitriou | September 1, 2010

Suggestions a few months back by Germany’s chancellor that countries running consistently high deficits be expelled from the Euro zone evidently haven’t fallen on deaf ears. Even though almost everyone thinks of expulsion as a remote possibility, the notion does get factored into the thinking of bankers and investors in a way that may ultimately become a self-fulfilling prophesy. Fears of sovereign-debt debt default are not about to go away anytime soon.

But there is an alternative for dealing with public debt that may help achieve a more perfect union. The European Central Bank should create a large sum of money—say, a trillion Euros—and distribute it across the Euro zone on a per capita basis. Each country could use this emergency relief as it sees fit. Greece might purchase some of its outstanding public debt; others might spend it on fiscal stimulus.

If you think this idea will force every European household to purchase a wheelbarrow with which to transport its soon-to-be-worthless currency, consider the case of Japan. With a 227 percent sovereign debt to GDP ratio, Japan is the world’s most indebted nation. But close to half of this debt is held by the country’s central bank, and interest payments on this half are returned to the Japanese government, making it in effect interest-free. Basically, the central bank printed the money to acquire this debt. To inflation hawks, the creation of trillions of yen to finance government deficits raises the terrifying specter of runaway inflation. Yet prices in Japan over the last two decades have risen by a mere 6 percent—not annually, but for the entire period. The only problem with the yen, meanwhile, is that it’s too strong.

The ECB should do the same thing. It holds sovereign bonds, and it should refund the interest payments on this debt to the issuing countries just as the Japanese central bank has done. The Federal Reserve does the same thing when it returns all net earnings from its securities holdings to the U.S. Treasury.

Modern money economists would argue that over the longer term for the Euro zone countries it may be necessary to put in place a permanent fiscal arrangement through which the central authorities distribute funds to be used by member nations. Ideally this should be in the hands of the equivalent to a national treasury responsible to an elected body of representatives—in this case, the European Parliament. This would parallel the U.S. Treasury’s relationship with the American states. Perhaps an amount equal to 10 percent of Euro zone GDP would be distributed each year on a per capita basis to member nations. This would relieve pressure to adopt austerity and reduce the need to keep borrowing from financial markets. To be sure, the European Parliament has long engaged in transfers to its poorer nations—but its total budget has been below 1 percent of GDP, which is clearly too small to allow economies to operate near full employment even in the best of times. In a deep recession, even 10% of GDP might not be enough, in which case the EU can provide more funding.

A second option for over-indebted Euro zone states that has been put forward is to include a covenant in their debt instruments stating that in the event of default the bearer can use those securities to pay taxes. This would make it obvious to investors that these new securities are as good as cash, and would allow countries to finance deficits at low interest rates. This option may suffer from a “moral hazard” problem—it could lead governments to continue with business as usual, spending too much and generating inflation. And it does not resolve the fundamental problem with the euro—the absence of a supra-national fiscal authority that can generate an alternative to the “beggar thy neighbor” export-led growth strategy that the current arrangement promotes.

Comments

ShareThis

ShareThis