Endogenous Financial Fragility in Brazil: Does Brazil’s National Development Bank Reduce External Fragility?

by Felipe Rezende

Introduction

The creation of new sources of financing and funding are at the center of discussions to promote real capital development in Brazil. It has been suggested that access to capital markets and long-term investors are a possible solution to the dilemma faced by Brazil’s increasing financing requirements (such as infrastructure investment and mortgage lending needs) and the limited access to long-term funding in the country. Policy initiatives were implemented aimed at the development of long-term financing to lengthen the maturity of fixed income instruments (Rezende 2015a). Though average maturity has lengthened over the past 10 years and credit has soared, banks’ credit portfolios still concentrate on short maturities (with the exception of the state-owned banks including Caixa Economica Federal [CEF] and the Brazilian Development Bank [BNDES]).

While there was widespread agreement that public banks, and BNDES in particular, played an important stabilizing role to deal with the consequences of the 2007-2008 global financial crisis, there is, however, less agreement on BNDES’ current role (de Bolle). BNDES has been subject to a range of criticisms, such as crowding out private sector bank lending, and it is said to be hampering the development of the local capital market (Rezende 2015). It is commonly believed that “development banks and other institutions in Latin America tend to replace markets rather than address collective action failures that lead to market incompleteness.” (de Bolle 2015). In particular, critics of Brazil’s national development bank have argued that large companies can borrow from private international capital markets and the bank extends credit to companies that have access to domestic capital markets.

Much of the policy discussion has been misplaced. Though the conventional belief assumes that capital markets are efficient and produce an optimal allocation of capital, this view is not supported by evidence. Free and competitive international capital markets have repeatedly failed to produce an optimal allocation of capital and privatized free-market banking systems have failed to assess risks properly thus misallocating resources (Kregel 1998, Wray 2011). Moreover, access to international capital markets has been based on the false premise of lack of domestic savings. As I have argued elsewhere (Rezende 2015) rather than justifying the existence of public banks —and BNDES in particular, based on market failures (Garcia 2011) — an effective answer to this question requires a theory of financial instability.

Learning from Past Financial Crises

In Minsky’s framework, endogenous processes lead to changes in cash flow commitments and balance sheet structures of economic units, which translates into declining margins of safety causing a shift in their financial profiles from hedge, to speculative and Ponzi positions. In this regard, Brazil’s public banks have countered financial instability dampening the effects of procyclical behavior of private sector bank lending during the past financial crisis (Barbosa 2010; Rezende 2015). There is also another impact that has received less attention, that is, lending in domestic currency avoids currency mismatch in funding domestic investment. In fact, among the lessons we can draw from Brazil’s 1980’s debt crisis and the Asian Crisis in 1997 (Kregel, 1998a, 1998b, 1998c, 2004) is to reduce foreign currency exposure. Because domestic firms borrowed in foreign currency they became exposed to increases in foreign interest rates and domestic currency depreciation relative to the borrowed currency. For instance,

A rapid increase in external financing (much of which was not used for import substitution at all), such as the one that occurred in the 1970s, places a heavy burden on a country’s balance of payments that can only be financed by increased foreign borrowing. This appears to have been the case in Latin America in the 1970s as increased borrowing was used to meet increasing debt service in a sort of Ponzi scheme. The process remained sustainable until the October 1979 Volcker surprise in U.S. monetary policy that increased the interest payments on foreign borrowing and caused an appreciation of the dollar that increased the domestic burden of dollar denominated loans and, at a stroke, drove most countries to insolvency…

the policy [external financing] became untenable in the face of the insolvency created by the large external claims and the failure to recognize this insolvency through default. The reforms that were introduced in a number of highly indebted economies in Latin America at the end of the 1980s were thus promoted by the industrial countries to avoid default that would have rendered the developed country lending banks insolvent given that their exposure to Latin America was a multiple of their capital. After attempts to generate external surpluses sufficient to meet external obligations and avoid default led to a sharp decline in growth and placed political stability in jeopardy, the Brady Plan sought a combination of debt relief and the creation of conditions that would allow the indebted countries to return to international capital markets to borrow the funds needed to meet the remaining debt service. (Kregel 2008: 8-9)

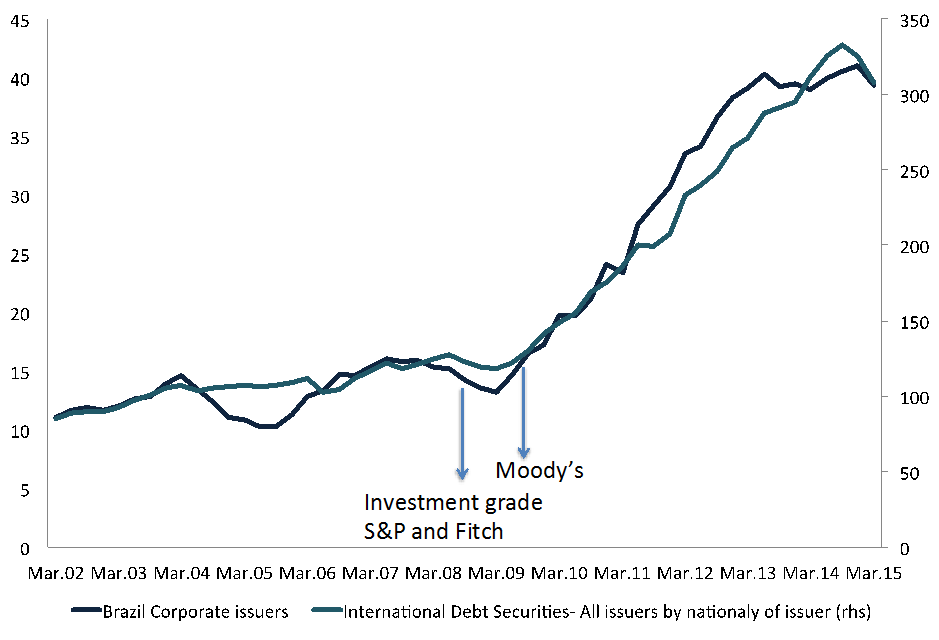

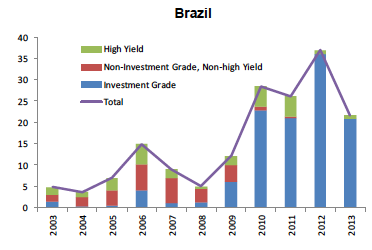

Financing domestic development through external financial flows has led to increased fragility and persistent financial crisis in which debt denominated in foreign currency created currency mismatch that combined with rising U.S. interest rates and exchange rate depreciation increased the debt service and the burden of foreign currency loans. These put the country in a “Ponzi” position, which resulted in a Minsky-Fisher type debt-deflation process. These countries were also subject to reversals of capital flows and decline in domestic activity. Moreover, even in the absence of such factors there is no reason to believe that access to international capital markets will necessarily be accompanied by an increase in investment in fixed capital assets to allow for the real development of the economy if the liabilities issued by the private sector in capital markets are not being used for the acquisition of productive assets. For instance, following Brazil’s upgrade to investment grade status by Standard & Poor’s and Fitch in 2008, low interest rates in global financial centers since the aftermath of the 2007-2008 global financial crisis have pulled Brazilian non financial companies to tap international markets (figure 1 and 2). During this period, Brazilian corporate issuers have sharply increased their external borrowing through foreign subsidiaries (see for instance Bastos et al. 2015; Avdjiev et al., 2014), in which investment-grade corporate bonds witnessed strong issuance (figure 2). Moreover, low or negative bond risk premium in advanced economies have pushed investors’ demand for higher-yielding assets (Shin 2013; Turner 2014).

Figure 1. Brazil: International debt securities outstanding (in billions of US dollars)

Source: BIS securities statistics table 12A and 12D

Figure 2. Non-financial companies debt issuance by issuer’s rating grade (US$ billion)

Source: Bastos et al 2015

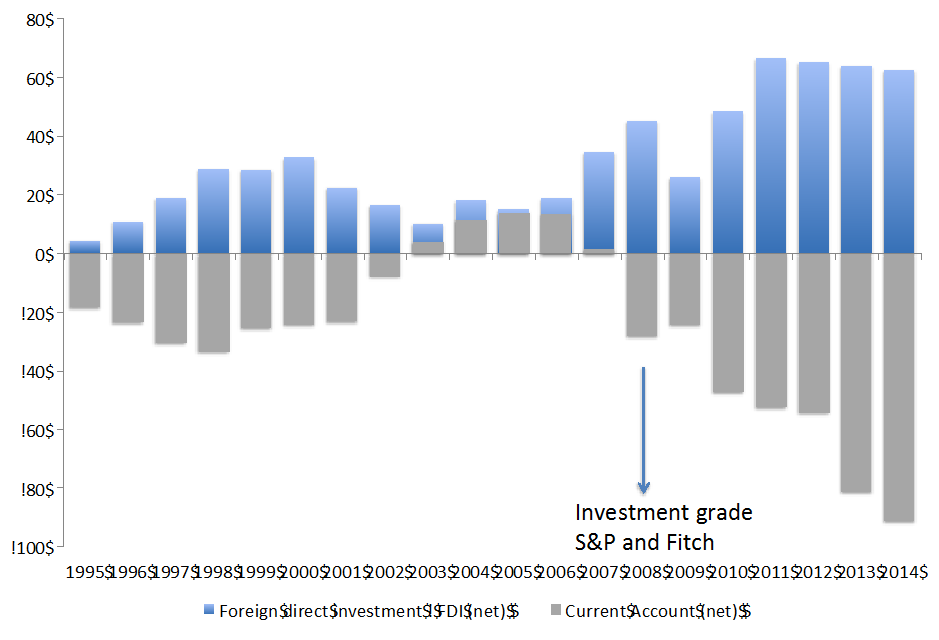

Corporate bond issuance through foreign subsidiaries boosted intercompany loans and foreign direct investment. This point has been recognized in a recent International Monetary Fund (IMF) report, which has pointed out that “intercompany loans accounted for some 60 percent of total FDI in 2014. Interestingly, about 60 percent of total intercompany loans is made up of loans to Brazilian foreign investors extended by their own subsidiaries. A likely cause for such loans is the large offshore debt security issuance by foreign incorporated subsidiaries of Brazilian parent companies…The striking correlation between offshore issuance by non-financial corporations and intercompany loans to Brazilian foreign investors suggests that the majority of offshore issuance indeed returns to Brazil in the form of FDI (an inflow of intercompany loans resulting from such offshore issuance can be regarded as carrying a risk profile more similar to portfolio debt than other types of FDI inflows).” (IMF 2015, 48)

Contrary to the conventional belief that FDI is the least risky form of foreign borrowing, FDI flows carries significant risks and creates structural instability into the system, it “is not an unconditional gift; it is financing provided against the expectation of profit earnings and the eventual repatriation or relocation of the investment” (Kregel 1996, 58). FDI flows are a source of financial fragility and have the potential to turn into Ponzi schemes causing an endogenous deterioration of the current account balance and disruptions in the foreign exchange market thus threatening exchange rate and macroeconomic stability. Interestingly, even though non-financial companies sharply increased dollar denominated bond issuance abroad since 2008, a recent study by the (IMF) has shown “that stepped up bond issuance was mostly aimed at re-financing rather than funding investment projects, as firms extended the average duration of their debt while securing lower fixed-rates, reducing roll-over and interest rate risks. The shift towards safer maturity structures has come at the expense of a leveraging-up in foreign-currency-denominated financial debt” (Bastos et al 2015).

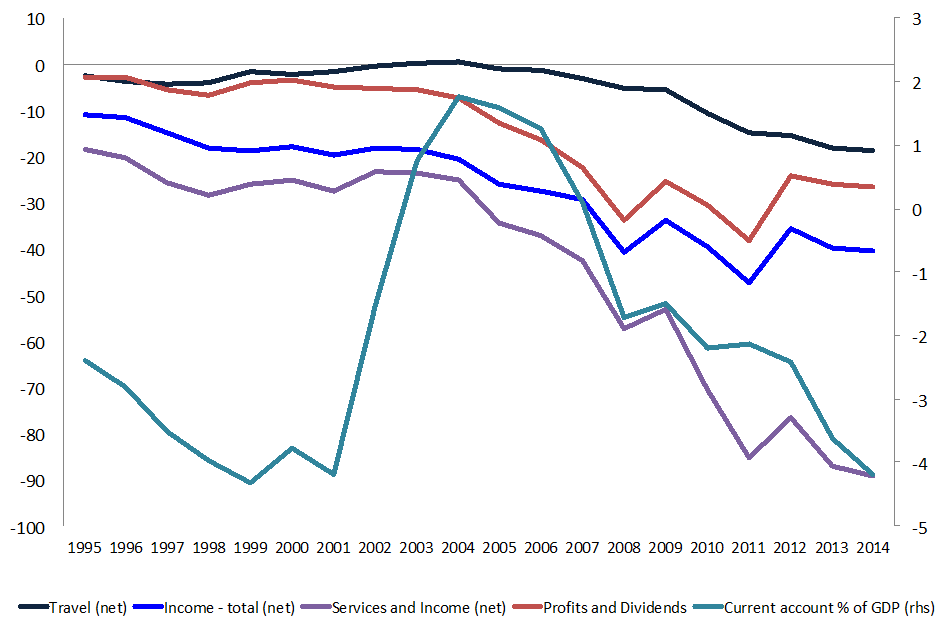

It has already been suggested that Minsky’s analysis of financial fragility can be applied to developing countries that rely on international financial markets (Kregel 2004, p. 7). Because foreign direct investment inflows[1] create future commitments in the form of debt service causing deterioration in the current account balance, increasing capital flows have contributed to foreign imbalances increasing the deficit on the services balance thus rising current account deficits. Not surprisingly, the reliance on external financing has created a deficit on the factor services balance of the current account (figure 3 and 4).

Figure 3. Foreign Direct Investment and Current Account (US$ billion)

Source: BCB

Figure 4. Factor services account balance (US$ billion) and current account balance

Source: BCB

FDI growth has been linked to increasing remittances of profits and dividends and debt service on intercompany loans, which are draining profits out of the domestic economy. The factor services account balance has shown deterioration, as the accumulation of current account deficits (figure 4) require rising net capital inflows thus being equivalent to a Ponzi investment scheme (see for instance, Kregel 1996, 2004). A reversal of international factors such as negative real short-term interest rates interest rates in advanced economies and investor’s risk appetite for emerging market assets will create a potentially disruptive force in emerging market economies.

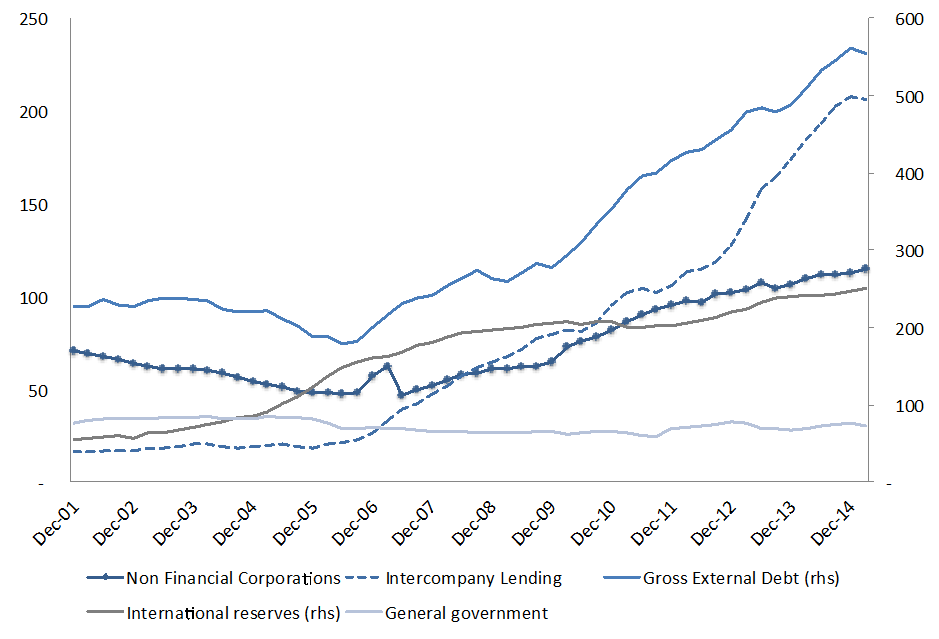

While the accumulation of international reserves by emerging economies has received much attention as a strategy of self insurance (figure 5) against balance of payment crisis (Carvalho 2010), the role played by public banks, and BNDES in particular financing capital goods thus reducing firms’ reliance on foreign capital, has been overlooked. Brazil is a net foreign creditor (excluding intercompany lending) and its export earnings have covered a significant portion of its debt servicing needs over the past five years. Even though Brazil’s accumulation of reserves provides another cushion of safety to stabilize external financing, this margin of safety has been declining due to increasing external obligations, in particular by nonfinancial companies (figure 5).

Figure 5. Brazil’s external debt and international reserves (US$ billion)

Source: Central Bank of Brazil

The IMF report noted that “The National Development Bank of Brazil (BNDES) provided substantial funding to Brazilian companies through loans and equity injections after the global crisis. This is likely to have contributed to lower bond issuance amongst Brazilians [Non-Financial Companies] NFCs than it would otherwise have been the case.” (Bastos et al 2015, ft, 6).

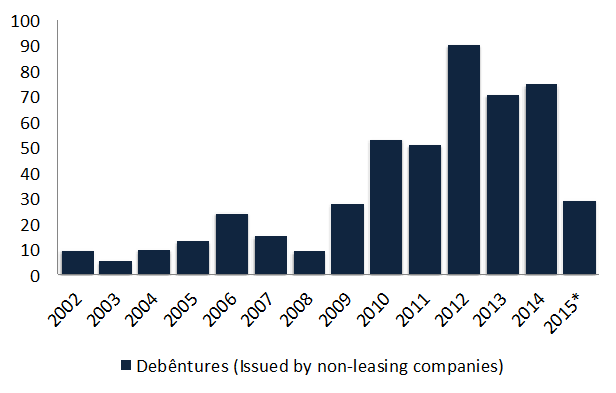

Moreover, though it has been argued that the development of a long-term capital market might provide a solution to Brazil’s funding requirements to support productive investment, it is interesting to note that the development of the corporate bond market (figure 6) has not been associated with rising investment in capital assets (figure 7).

Figure 6. Debêntures Issued by non-leasing companies (R$ billion)

Source: Anbima, *July 2015

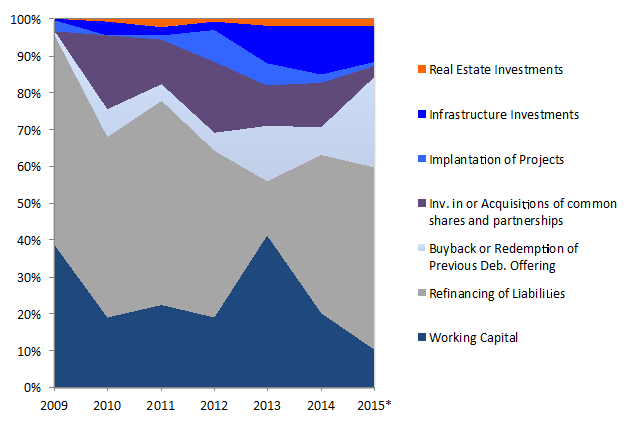

In spite of Brazil’s local debt capital markets growth over the past years, debênture issuance has been concentrated on the short end of the yield curve. More importantly, according to Anbima (Brazilian Association of Financial and Capital Market Entities), as of 2014, 43 percent the proceeds of debênture issuance to went to pay off existing debt (such as bank loans), 20 percent for working capital, 12 percent for acquisitions of common shares and partnerships, 2 percent in project implementation, 8 percent was used for redemption or repurchase of previous issuance, 13 percent in infrastructure investment, and 2 percent was allocated in real estate assets (figure 7).

Figure 7. Debêntures Allocation of Proceeds

Source: Anbima, Capital market bulletin

That is, there is no reason to believe that funds allocated through private capital markets will be directed to finance investment in capital goods. Moreover, though the conventional wisdom believe that BNDES hampers the development of the local capital market, I have argued elsewhere (Rezende 2015a) that Brazil’s central bank reliance on the interest rate as the policy tool and its decision to let longer-rates to be determined by markets have created volatility and instability in the bond market. The study shows that high interest rate level and volatility have hampered the development of the longer end of the yield curve and reduced liquidity in Brazil’s fixed income market. In this regard, recent initiatives to foster the development of Brazil’s private fixed income market pay little attention to the total return provided by corporate fixed income instruments. Hyperactive interest rate manipulations by Brazil’s central bank have increased volatility and the bond risk premium required to compensate investors for duration exposure (Rezende 2015a). As the total yield on a corporate bond must include a credit spread over a riskless sovereign bond, the yield required to induce investors to hold corporate instruments with longer durations would cause the project being financed to be unprofitable.

From the issuer’s perspective, not surprisingly, debenture issuance has been concentrated on the short end of the yield curve to minimize the interest rate risk component thus reducing the overall yield. That is, from the issuer’s perspective, debêntures have lower funding costs compared to traditional bank loans, but its yield is still expensive to fund productive capital assets. Thus, it is not surprising that the proceeds of debêntures issuance have been used primarily to repay expensive outstanding debt obligations. From the buyers’ side, risk adjusted corporate bonds total returns have not been satisfactory to attract institutional investors, that is, the excess return of corporate bond funds index over duration-matched government securities shows that corporate bonds have either underperformed or performed poorly government securities (Rezende 2015a). Banks have attempted to circumvent the burden of bank regulation and have purchased most of the debenture issued. For instance, as of 2013, banks’ holding of debêntures was roughly equal to 79 percent of the total outstanding. They have taken advantage of regulatory arbitrage holding corporate bonds rather than holding corporate loans on their books.

Without a reduction of the benchmark Selic rate towards zero, the overall costs (including the credit premium) of debêntures issued by corporations would be too high, which would require a higher expected return on capital assets. At such high rates, fewer investment projects would be profitable. In this regard, not only BNDES play an important role in promoting economic development through financing domestic capital accumulation but it reinforces a system of intervention to stabilize and unstable economy (Rezende 2015) and complements policies to move from reliance on excessive external financing for development countering the persistence of negative net financial flows thus contributing to greater financial stability.

In its current form, the National Economic and Social Development Bank (BNDES) is the main source of long-term funding in the country. It provides financing for capital development of inherently risky activities such as investment in expensive and long-lived assets. Its existence conforms to Minsky’s call for designing a financial structure that dampens fragility and instability, and provides funding to support the capital development of the economy. Regulations must be dynamic to remain effective (Kregel 2014). One method of enhancing Brazil’s macroprudential policy toolkit is to limit borrowing in foreign currency taking into account its external debt servicing needs under different scenarios, taking into account firms’ exports earnings capacity and the reserve accumulation to maintain the country in a hedge financing profile. This could be accomplished by “limiting borrowing to the amount that generates debt service equal to average net export earnings less a cushion of safety represented by two standard deviations.” (Kregel 2004, p. 7).

Brazil’s investment needs notwithstanding, requires an active role played by BNDES and other public financial institutions, although with a different set of organizational capabilities to foster public-private partnerships and develop a capital market complementary to BNDES that supports productive investments. Brazil’s National Development Bank, in cooperation with other innovation-related institutions, can play a bigger role to support technological development and innovation policies and support domestic demand strategies.

[1] Note that “There has been a long-standing difference between nationality-based and residency-based foreign bond placements in Brazil. However, the difference between the two measures has widened substantially after 2009, which coincided with the post-global crisis environment of ample liquidity. The growing wedge between residency and nationality criteria since 2010 has coincided with stepped up efforts from the Brazilian government to mitigate currency appreciation pressures through capital control measures (figure A5). In particular, between early 2011 and early 2012, the government progressively increased the maturity of the debt issued abroad subject to foreign exchange taxation. Because foreign subsidiaries are non-residents from a balance of payments perspective, they would not be subject to the tax unless the proceeds were repatriated. Interestingly, issuance through Cayman Islands has increased after the tax tightening, and reduced after the tax loosening between 2010 and 2012. In addition, FDI intercompany loans (one possible repatriation channel of the proceeds from foreign issuance) have increased after tax loosening as well, while portfolio and FDI-equity stabilized.” (Bastos et al 2015, p. 15)

References

Avdjiev, S., M. K.F Chui, and H. S. Shin. 2014. “Non-Financial Corporations from Emerging Market Economies and Capital Flows,” BIS Quarterly Review, December 2014.

Bastos, F.R., H. Kamil, and B. Sutton. 2015. “Corporate Financing Trends and Balance Sheet Risks in Latin America: Taking Stock of “The Bon(d)anza”, IMF Working Paper, WP/15/10.

Barbosa, N. (2010). “Latin America: Counter-Cyclical Policy in Brazil: 2008–09,” Journal of Globalization and Development, 1(1): 1–11.

De Bolle, M. 2015. “Do Public Banks in Brazil Hurt Productivity?”, RealTime Economic Issues Watch, March 1st, available at http://blogs.piie.com/realtime/?p=4985

Carvalho, F.C. 2010. “Accumulation of International Reserves as a Defense Strategy” in Asia” in Time for a Visible Hand: Lessons from the 2008 World Financial Crisis, in Griffith-Jones, S, Ocampo, J.A. and Stiglitz, J., eds. New York: Oxford University Press.

Garcia, M. 2011. “What Is the BNDES For?” Retrieved from http://www.economonitor.com/blog/2011/07/what-is-the-bndes-for/#_ftn1

International Monetary Fund (IMF). 2015. “Brazil: 2014 Article IV Consultation,” IMF Country Report No. 15/121. Washington, D.C.

Kregel, J. A. “Some Risks and Implications of Financial Globalisation for National Policy Autonomy,” UNCTAD Review 1996,” Geneva, March 1997, pp. 55-62.

_______. 1998. Derivatives and Global Capital Flows: Applications to Asia,” Cambridge Journal of Economics,” Oxford University Press, vol. 22(6), pages 677-92, November.

_______. 1998a. “East Asia Is Not Mexico: The Difference Between Balance of Payments Crises and Debt Deflations,” Levy Economics Institute Working Paper No. 235. Available at SSRN: http://ssrn.com/abstract=100788

_______. 1998b. “Yes, ‘It’ Did Happen Again: A Minsky Crisis Happened in Asia,” Economics Working Paper Archive wp_234, Levy Economics Institute.

_______. 2004. “External Financing For Development And International Financial Instability,” G-24 Discussion Papers 32, United Nations Conference on Trade and Development.

_______. 2008. “The discrete charm of the Washington consensus,” Journal of Post Keynesian Economics, vol. 30(4), pages 541-560, July.

_______. 2014. “Minsky and dynamic macroprudential regulation,” PSL Quarterly Review, vol. 67(269), pages 217-238.

Minsky, H.P. 1986. Stabilizing an Unstable Economy. New Heaven: Yale University Press.

Musacchio, A, and Lazzarini, S. (2014) “Assessing Brazil’s BNDES,” FT.com, Jun 06.

Rezende, Felipe. 2015. “Why Does Brazil’s Banking Sector Need Public Banks? What Should BNDES Do?” (January 2, 2015). Levy Economics Institute of Bard College Working Paper No. 825. Available at SSRN: http://ssrn.com/abstract=2544722

_______. 2015a. “Developing Long Term Funding in Brazil,” Project Report, the Multidisciplinary Institute for Development Strategies (MINDS).

Safatle, C. 2015. “Setor privado articula frente de apoio a Levy,” Valor Econômico – 04/09/2015.

Shin, H. S. 2013. “The second phase of global liquidity and its impact on emerging economies,” Keynote address at the Asia Economic Policy Conference, Federal Reserve Bank of San Francisco. November.

UNCTAD (TDR 2013). Trade and Development Report, 2013. Adjusting to the Changing Dynamics of the World Economy, United Nations publication, Sales No. E .13.II .D.3, New York and Geneva.

Wray, L. R. 2011. “The Financial Crisis Viewed from the Perspective of the ‘Social Costs’ Theory,” Levy Economics Institute, Working Papers Series. Available at SSRN: http://ssrn.com/abstract=1800226

Felipe Rezende

Department of Economics

Hobart and William Smith Colleges

Geneva, NY 14456

[email protected]

Research Fellow,

Multidisciplinary Institute for

Development and Strategies (MINDS)

www.minds.org.br

This article was prepared for the project “Financial Governance, Banking, and Financial Instability in Brazil: Analysis and Policy Recommendations,” funded by the Ford Foundation, FORD grant no. Grant 1110-1279-0, administered through the Multidisciplinary Institute for Development Strategies (MINDS). Principal investigator: Felipe Rezende (Hobart and William Smith Colleges and MINDS). The author thanks FORD and MINDS for support of this research.

ShareThis

ShareThis