The GOP Lost the Election but Is Winning Fiscal Policy

Congressional Republicans may or may not suffer politically from the government shutdown and upcoming debt ceiling fight, but in terms of policy they have already secured a significant and lopsided victory in the battle over the budget, whether they realize it or not.

Repeal of the Affordable Care Act seems pretty unlikely (not just because the President is wildly unlikely to repeal his signature legislation in return for something his opponents also claim to want — raising the debt limit — but also because he seems determined to learn from his 2011 mistake and is unlikely to grant any concessions in return for not defaulting on financial commitments). Still, below all the shutdown/debt limit/ACA drama, the discretionary budget number that Senate Democrats are offering to Republicans (the “clean” continuing resolution) represents a near-complete capitulation to GOP demands.

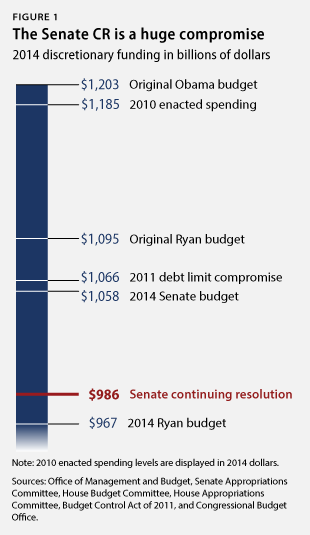

Despite having lost the popular vote for the Presidency, Senate, and House, Republicans were not only able to extract major concessions on discretionary spending, but to exceed even their original demands, as Dylan Matthews observes: “So we’ve been cutting spending at a faster pace than Paul Ryan wanted to when Republicans took over Congress.” This figure by Michael Linden and Harry Stein illustrates the situation (they call this a “compromise,” but I’m not sure that’s the best choice of labels):

What this means is that, even if we avoid a debt limit crisis and a lengthy shutdown — both of which would weigh on the already sluggish economic recovery — tight fiscal policy will continue to limit economic growth. And that’s the best case scenario. (Those who are trying to game out the political consequences of these various showdowns and governing crises should take this into account — the GOP will ultimately benefit from a sluggish economy, even if in the short run the public ends up blaming them for the shutdown.)

The Levy Institute will soon be releasing its newest strategic analysis for the United States (the late Wynne Godley, whose work at the Levy Institute inspires the model used in these economic forecasts, was recently featured in the New York Times). The past couple of analyses have underscored the difficult bind the US economy has been placed in as a result of Congress’s devotion to budget austerity. Aggregate demand has to come from somewhere; if it isn’t from abroad (exports), it will have to come from domestic sources. If government spending increases are not forthcoming — and we’ve every reason to believe they’re not — then the only way to reach even the modest growth numbers projected by many (including the Congressional Budget Office) is through a big rise in household and business indebtedness. In other words, if we continue to run discretionary budgets that out-Paul-Ryan Paul Ryan, we’ll either be stuck with insufficient growth or a dangerous ballooning of private leverage (absent any new developments in the foreign sector).

ShareThis

ShareThis