An Incomplete Defense of UK Austerity

Kenneth Rogoff placed an editorial in Wednesday’s Financial Times defending the Cameron government’s austerity policies as a kind of insurance against the possibility of investor flight from UK government debt.

He concedes that the specific form of austerity that was implemented in the UK was ill-advised — public investments in infrastructure, he says, can be stimulative and pay for themselves. Nevertheless, he argues that in retrospect austerity in general was wise because we couldn’t have known for sure that the markets wouldn’t have panicked and ceased purchasing UK debt if the government had run higher deficits.

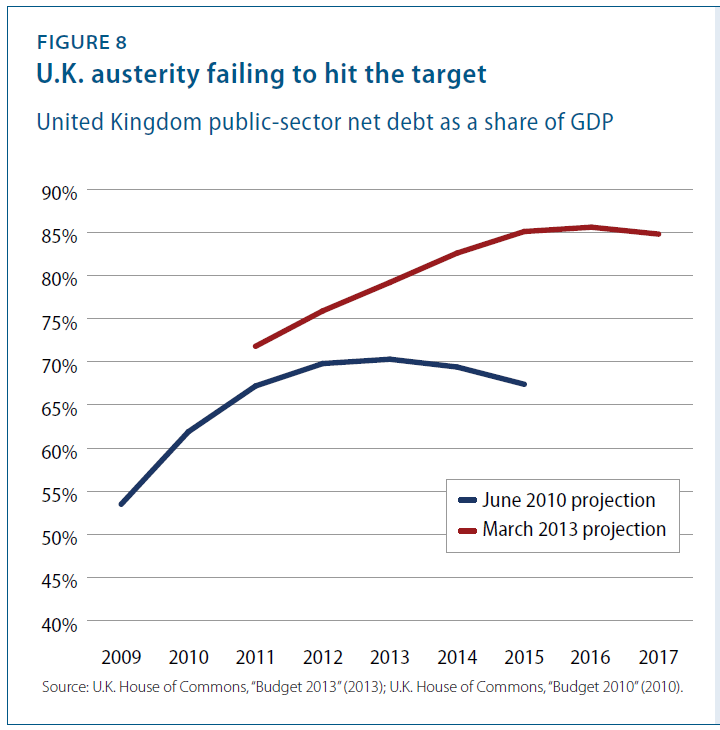

Now, one thing we might want to recall is that the UK’s austerity policies have not been hugely successful at shrinking the debt-to-GDP ratio.

What we’re looking at here is the “fiscal trap” phenomenon Greg Hannsgen and Dimitri Papadimitriou have written about. Austerity can be a pretty inefficient policy — assuming one’s goal is the reduction of debt ratios. (As Paul De Grauwe and Yuemei Ji recently found, this is clearly the case on the eurozone periphery: “more intense austerity programmes coincide with increasing government debt ratios.”)

But even if UK austerity were more successful at shrinking public debt ratios, we would want a better sense of the probabilities and downsides involved in Rogoff’s “you never know,” market panic scenario. Just how valuable is this insurance? Because we know pretty well what the costs of austerity are (a point Rogoff appears to concede) — high unemployment, heightened insecurity, and all the attendant deterioration in well-being.

What are the benefits? If we succeeded in reducing the UK’s public debt ratio by, say, 5, 10, or 20 percentage points, how significantly would that reduce the risk of market panic for a country that controls its own currency, according to this insurance theory?

More importantly, how disastrous would Rogoff’s market panic be if it came about? His story is that a collapse of the eurozone could have led financial markets to stop buying UK gilts, which would require immediate and harsh austerity (because the government would have to balance its budget absent the ability to borrow). But as Simon Wren-Lewis (no MMTer) points out, the UK already has an “insurance” policy against this kind of market revolt — namely, it issues its own currency:

… [the monetary authority] will buy any government debt that cannot be sold to the financial markets. Rogoff says that, if the markets suddenly forsook UK government debt “UK leaders would have been forced to close massive budget deficits almost overnight.” With your own central bank this is not the case – you can print money instead.

So we should really be comparing the costs of austerity to the costs of printing money in the event that markets turn on the UK (if we generously grant the premise that reducing public debt ratios in the near term would have any significant impact on diminishing the probability of such an event). Absent an explanation as to why printing money under such circumstances would be far worse than the damage already done by budget cuts, it’s hard to see why austerity is an insurance policy worth the hefty price.

ShareThis

ShareThis