QE vs the Recovery Act: How Does Our Approach to Stimulus Affect Inequality?

Annie Lowrey recently renewed the ongoing discussion over whether the Federal Reserve’s attempts at reviving the economy through quantitative easing (QE) are exacerbating inequality. The abbreviated version of the argument is that QE operates mainly through boosting asset prices, leading to gains in stocks and housing that largely benefit those at the top. If that’s the case (Lowrey quotes Josh Bivens suggesting that one would also have to weigh any potential reductions in the unemployment rate from the Fed’s easing), it’s bad news for those who care about inequality, because for the next three years, monetary stimulus is the only game in town (it will be interesting to see whether Republicans continue to be skeptical of fiscal stimulus if they win the White House in 2016).

Turning to fiscal policy, Ajit Zacharias, Tom Masterson, and Kijong Kim did a preliminary estimate (pdf) of the likely distributional impacts of the American Recovery and Reinvestment Act (ARRA). They found that the Recovery Act would have a positive impact on employment (largely “palliative,” given the rapid rate of job loss at the time) and little overall effect on inequality. A fiscal stimulus skewed more toward expenditure and less dominated by tax cuts than the Recovery Act could have a greater positive impact for low-income households and individuals.

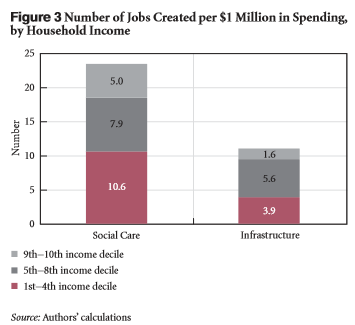

This is particularly the case if those expenditures come in the form of direct job creation — and even more so if we also consider projects in areas beyond infrastructure and green energy. Along with Rania Antonopoulos, Zacharias, Masterson, and Kim studied (pdf) the potential benefits of a direct job creation program in the social care sector (early childhood education and home-based care). They found that such a program would not only have a greater employment impact when compared to investment in infrastructure, but would also be particularly beneficial for households at the bottom of the income distribution.

ShareThis

ShareThis