Not All Macro Models Failed to Predict the Crisis

Noah Smith has a post on the failure of macro theory to predict the crisis. He concedes that DSGE models did very badly on this score, but, he continues, “There are no other models out there that did forecast the crisis” and there is no better alternative.

The word “better” is important here because some “angry heterodox” people have pointed Smith to at least one alternative—Wynne Godley’s Seven Unsustainable Processes—that had in fact predicted the crisis. However, Smith rejects this as “basically just chartblogging” [emphasis added]. He writes that

Yeah, sure, if you put out hand-wavey reports saying “capitalism sux, there’s gonna be a crash!” every year or two, you’re eventually going to be able to say “see, I told you so”. But that’s no replacement for real modeling.[sic]

First of all, there is nothing wrong with chartblogging. In fact, Noah Smith is a chartblogger—an excellent one.

Having said that, is Godley’s argument just hand-wavey-capitalism-sux-chartblogging or is there something more to it (perhaps even some real modeling)?

To begin with, Godley’s argument in the Seven Unsustainable Processes (which is a policy paper) is based on his theoretical work. Godley was one of the major proponents of what is today called Stock-Flow Consistent methodology. Some of his books and his writings (with real models and everything) are here, here, and here.

(The other major proponent of this methodology was James Tobin. His lecture when he was awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was a manifesto of this methodology.)

Based on this theoretical work, in the 1990s Godley built a more policy-oriented macroeconomic model at the Levy Economics Institute. The simulations in the Seven Unsustainable Processes were produced with this model (and are thus far from chartblogging).

To understand the argument of the Seven Unsustainable Processes we need to keep two things in mind. First of all, the analysis is Keynesian, so it is aggregate demand that drives output, employment, and growth. These Keynesian results do not stem from imposing rigidities on an otherwise supply-side neoclassical model.

A second important piece of the analysis is a simple macroeconomic identity that comes straight from the National Accounts:

(Private Expenditure – Income) + (Government Expenditure – Income) = Current Account Deficit

In other words, the sum of the private sector and government sector deficit is always equal to the current account deficit. Accounting consistency requires that the flows expressed in the three balances accumulate into related stocks. For example, if the private sector is running a deficit, that will (ceteris paribus) tend to decrease its net worth and increase its debt and debt-to-income ratio.

The examination of these financial balances in relation to income (or GDP) is important because it gives clues about (i) central structural characteristics of an economy, (ii) which component of demand is driving growth, and finally (iii) what net assets/income ratio for each sector is implied from the current situation.

Having said this, we can now go to the crisis and the question of whether Godley actually predicted it or not.

To fully appreciate Godley’s argument we need to put it into its historical context. 1999, when the Seven Unsustainable Processes came out, was the peak of the optimism that the so-called “New” (unregulated) Economy was able to generate and sustain economic growth and prosperity. The US economy had been expanding for nearly eight years (the longest recovery in the postwar history of the US economy), the budget was in surplus, and inflation and unemployment had both fallen substantially.

The Council of Economic Advisers forecast was that GDP would grow by 2.5 percent between then and the year 2005, and the CBO was projecting a rise in the budget surplus through the next 10 years. These were the projections of the DSGE models of the time. The optimism of these projections was shared, as we know, by most economists and policy makers.

Godley himself was not so impressed. He wrote that the apt question to ask is “whether the present stance of […] policy is structurally appropriate looking to the medium- and long-term future.”

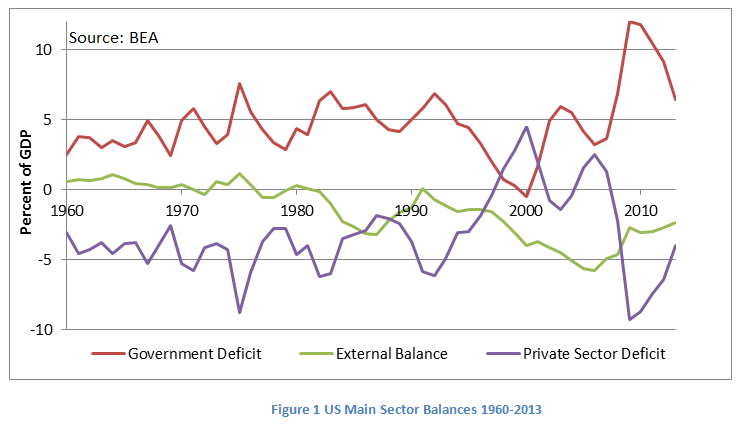

To understand his skepticism we need to have a look at the three balances of the US economy since 1960 (Figure 1). What we see here is that in the first decades of this period the US economy had a current account balance fluctuating around zero and the government was running a deficit which was mirrored by a surplus of the private sector (fluctuating around 5% of GDP).

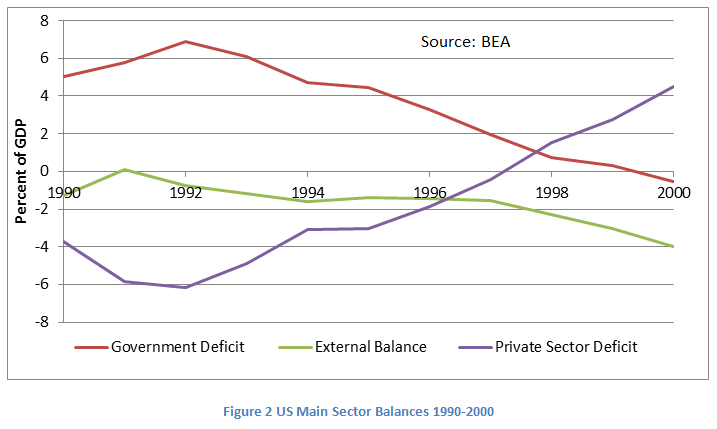

This situation changes in the mid-‘80s and especially in the ‘90s (see Figure 2). During this period there is a very sharp fiscal consolidation. The government deficit decreases from close to -7% at the beginning of the decade to a small surplus by the end of it. At the same time, the external balance deteriorates, and from 0% at the beginning of the decade reaches -4% by the end of it. Naturally, during the same period the balance of the private sector goes from a positive 6% at the beginning of the decade to a -4% deficit by the end of it. This is the first time in US post-war history that the private sector is running a deficit.

Based on this, the gist of Godley’s argument is simple. If an economy faces “sluggish net export demand” and at the same time there is a restrictive fiscal policy (remember the CBO projections that the surpluses would increase over the following ten years), economic growth becomes “dependent on rising private borrowing.”

Growth could come about only as a result of a spectacular rise in private expenditure relative to income [and thus an increase in the debt-to-income ratio of the private sector].

In other words, what Godley is saying is that a prerequisite for the projections of the DSGE models of the CBO and the CEA to materialize is that—to use the Minskyan terminology—the private sector abandons its traditional hedge position and adopts a speculative and then Ponzi position. This process was and still is clearly unsustainable.

(By the way, Minsky was another economist who predicted the crisis. I am not sure if his work qualifies as real macroeconomic modeling for Smith.)

This kind of unsustainability makes the US economy extremely fragile because:

If spending were to stop rising relative to income without there being either a fiscal relaxation or a sharp recovery in net exports, the impetus that has driven the expansion so far would evaporate and output would not grow fast enough to stop unemployment from rising. If, as seems likely, private expenditure at some stage reverts to its normal relationship with income, there will be, given present fiscal plans, a severe and unusually protracted recession with a large rise in unemployment.

It was exactly this kind of rapid decrease in private expenditure that led to the crisis of 2001 and the Great Recession in 2007, and is still behind the weak recovery of the US economy.

Finally, Godley writes that

It should be added that, because its momentum has become so dependent on rising private borrowing, the real economy of the United States is at the mercy of the stock market to an unusual extent. A crash would probably have a much larger effect on output and employment now than in the past.

Does this ring any bells to anyone?

To conclude, I think that a careful reading of Godley shows that not only did he predict the crisis but he also described the process (mainly the build-up of private debt) that led to it. In that sense, he was much more than an angry “heterodox” person who predicted ten out of the last two recessions, as Smith wants to depict him. Finally, his policy conclusions are based on a very solid theoretical base (with “real” models). Therefore, (to say the least) it is unfair to call his papers chartblogging.

One final comment related to the original theme of Smith’s post and the posts by David Andolfatto and Mark Thoma. There are alternatives to the dominant DSGE approach to macroeconomic theory and policy. The kind of Keynesian Stock-Flow consistent approach proposed by Wynne Godley is one of them—and in fact a better one.

There are several reasons for that. First of all, this approach does not assume full employment equilibrium in the short run or that the economy will converge towards such an equilibrium in the medium/long run. Arguably, this is the most important contribution of Keynes to macroeconomic theory. He demonstrated that the general state (hence the General Theory) of the capitalist economy is not one of full employment and there is not a natural tendency of the economy to gravitate towards full employment. The full employment equilibrium envisaged by neoclassical economics is just a special case.

The world of DSGE models is exactly the opposite. They are supply-side full-employment models at heart; the general state is one of full employment. The introduction of (ad hoc) rigidities—usually in the labor market—allows them to derive some Keynesian results in the short run as a special case. However, in the medium run the economy always returns to full employment or to its natural rate of unemployment. This is not just an esoteric theoretical issue. In the projections of the CBO for the US economy (or the projections of the troika in the European periphery countries), which are derived with DSGE models, demand effects vanish after a couple of years and the economy reverts to a supply-side-determined equilibrium.

Also, the fact that the failure to reach full employment is due to rigidities means that removing these rigidities would boost employment and growth. For example, the policies applied in the eurozone, and especially in the European periphery, are justified with this kind of theoretical argument. Using their DSGE models, the so-called troika (the IMF, the European Commission, and the European Central Bank) on the one hand recognizes the dampening effect of austerity in the short run, but on the other hand—in line with the theory—is pushing for structural reforms that will remove the rigidities and allow the economy to move towards full employment. In reality, of course, things do not work like that, and that is why these models have failed miserably—not only to predict the crisis but also to predict the effect of austerity policies after the crisis.

Finally, unlike the Keynesian SFC theory, DSGE models provide a very minor role (if any) for finance. There is the so-called dichotomy between the real and the financial side of the economy. The financial complications do not really matter for the real outcome of the economy; and the real outcome is determined by the famous representative agent. Robert Barro famously writes in his Macroeconomics textbook that “the primitive environment of Robinson Crusoe contains the essence of choice problems that arise in complicated market economies.” In that sense, it was no accident that the DSGE models ignored the situation in the financial markets or the build-up of private debt in the 1990s or the 2000s—it was exactly the opposite.

ShareThis

ShareThis

Austrians predicted the crash and explained why it would happen. And it happened for the reasons they said it would.

What amazes me is how much better simple common sense and some basic knowledge of accounting works than just about every economic theory. The 2000 crash was easily predicted based on lack of revenues backing stock prices. The 2008 crash was easily predicted based on stagnant incomes and rising debt. You didn’t need to know DSGE or anything else. All you needed was some willingness to ask where the money was coming from and what it was being spent on.

Since I live on my investments rather than performing a socially useful function, I know that the salient fact is that there has been a massive capital glut since the early 1990s. I haven’t even had to think for the last 25 years. All I’ve had to do is assume that there is too much money out there chasing too little return due to lack of demand. I’m not particularly smart. A reasonably clever dog could have done as well as I have. I’m sure that most economists are smarter than most reasonably clever dogs, so it is not surprising that a number of them have predicted the last few crises.