Draghi’s Liquidity Bluff Will Be Called

by Joerg Bibow

Mario Draghi’s pledge to do “whatever it takes” to save the euro has been widely hailed as a watershed event. Both the markets and euro politics have since been operating on the premise that the euro’s survival is ensured. Unfortunately, that is not a safe assumption at all. Not only because even agreement on the Single Supervisory Mechanism, the easiest element in any banking union-to-be, proved to be anything but easy. But even more so since concentrating energies on preventing future crises is somewhat premature anyway, as long as the current one remains largely unresolved. The point is that the policy strategy that has been adopted for overcoming the crisis, with or without any ECB liquidity promise in support of government bonds (i.e. Outright Monetary Transactions), is doomed to fail. The underlying causes of the crisis have been thoroughly misdiagnosed, and the medication ill-conceived as a result, while reforms of the flawed euro policy regime are so ill-designed as to ensure the euro’s final demise.

The ultimate fear of the Maastricht regime’s designers was that fiscal profligacy of nations lacking Germany’s legendary “stability culture” could usher Euroland into hyperinflation. The Bundesbank’s worst nightmares seemed to come true when Greek budget deficit (ratio) numbers were revised strongly upwards in 2009. So the ill-named pact that has so far failed to deliver on either stability or growth was further strengthened, with fiscal discipline henceforth to be anchored in national law. Irrespective of the collateral damages already endured, the big austerity stick will keep on bashing the Euroland economy for years to come.

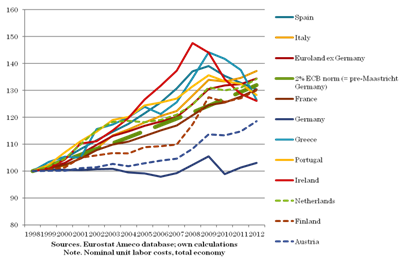

This ignores the key flaws in the Maastricht regime of the EMU and the true causes of the crisis. One original sin was to put no one in charge of minding the store of the giant integrated euro economy. No demand management was foreseen in good times, no lender of last resort in bad. Predictably, the Euroland economy has proved prone to protracted domestic demand stagnation and conspicuous reliance on exports for its meager growth, while crisis management has been by trial and error; and errors with no end it would seem. The second original sin was to forget what fifty years of European monetary cooperation were all about, namely to forestall the risk of beggar-thy-neighbor currency devaluation. The euro provided the coronation of that very endeavor in the sense that exchange rates disappeared with national currencies. But this only meant that under the EMU trends in national unit labor costs have taken on the role of determining intra-union competitiveness positions alone. The golden rule of monetary union therefore requires that national unit labor cost trends stay aligned with the common inflation rate that union members have committed to – when they didn’t.

It is a well-known fact that Germany’s unit labor cost trend departed from the 2 percent stability norm, settling for zero under the euro regime. As Germany turned űber-competitive, its euro partners lost competitiveness just the way they would have in case of 20 percent deutschmark devaluation in pre-EMU times. Alas, the EMU has actually complicated matters as diverging unit labor cost trends essentially dealt the currency union an asymmetric shock that undermined the “one-size-fits-all” monetary policy. With wage repression and mindless austerity suffocating German domestic demand, the ECB’s stance became far too tight for the former “sick man of the euro.” By contrast, set to suit the average of the euro aggregate, the ECB’s stance became far too easy for other euro members, nourishing property market bubbles and growing current account imbalances as a result. Prior to the crisis, Germany’s soaring current account surplus was concentrated in Europe, about two thirds with its euro partners. Lending flows from Germany were instrumental in allowing intra-area divergences to persist and imbalances to build up. Herein rests the source of Germany’s exposure to solvency problems in the euro periphery.

While these basic facts should be well-known by now, their official reading pins the blame solely on debtor countries. Somehow everyone but Germany lost competitiveness. And somehow fiscal profligacy was the main villain in all this. A sober reading of these facts suggests requirements for crisis resolution that squarely defy the strategy currently pursued by the euro authorities.

Essentially there are three parts to properly resolving the euro crisis, and one vital precondition. The first is symmetric internal rebalancing, the second is dealing with the area’s debt overhangs, and the third is to turn the flawed euro regime into a viable one by fixing the original flaws. Crucially, crisis resolution will be difficult, if not impossible, without robust GDP growth. For in a shrinking economy not even a balanced budget will prevent the public debt ratio from rising further, while interest rates cannot be low enough when even nominal GDP growth is turning negative.

Mindless fiscal austerity is self-defeating when inflicted on a deleveraging private sector and fiscal multipliers large when neither monetary conditions nor exports can provide much relief. Pursued simultaneously across the continent, European countries are deflating each others’ key export markets, implicitly relying on extra-regional exports to make up for their suicidal pursuits. By forcing adjustment solely upon debtor countries, where debt overhangs are naturally concentrated, their solvency problems are made only worse. Resisting upward wage realignment, Germany is pushing its partners, including France, into debt deflation.

Structural reform is no offsetting growth strategy at all. It worked for Germany, and only with a long delay, because Germany was going it alone while the world economy was strong. Germany needed an external surplus of 7 percent of GDP to finally balance its public budget. Today, the world economy can barely tolerate a repeat of that feat for Euroland as a whole. In short, the euro remains firmly on track for breakup. It is only a matter of time until Mr. Draghi’s liquidity bluff will be called.

ShareThis

ShareThis

A masterful summation. I love it when things are outlined clearly.

The euro is above all a political project is it not? I hear prominent French politicians and bankers saying yet in spite of all these difficulties, in ten years time the euro will still be here and there will be more countries in it.

Germany sees itself as an exporting country/powerhouse and will do everything within it’s power to maintain it’s edge. Quite how it is maintaining this edge when the euro is so high and it’s european trading partners are so depressed, I can’t see.

Even from a German perspective it makes sense to reflate and drive down the value of the euro doesn’t it? It is either that or drive down the value of German wages.

If the Germans have the power in this matter, then it seems to me that the reflation necessary for the eurozone to remain in one piece can only happen when the German electorate wakes up and realises that it has been duped. That there will be no future reward for their hard work, only more real wage decreases.

Strengthening Euro May Reignite EU Crisis (http://bubblesandbusts.blogspot.com/2013/01/strengthening-euro-may-reignite-eu.html):

If actual economic improvement is not forthcoming in the next few months, Joerg Bibow may be correct in claiming that Draghi’s Liquidity Bluff Will Be Called