Michael Stephens | February 7, 2012

“…while Europe’s leaders haven’t hit upon a way to forestall a years-long span of catastrophically high unemployment and falling living standards, they do appear to be really really really really committed to saving banks.” That’s Slate‘s Matthew Yglesias, who notes that this (seemingly exclusive) focus among European elites on saving their banks likely ends up protecting the US economy from eurozone contagion more effectively than would policies focused on growth and easing the plight of those whose wellbeing depends on the “real” economy.

The reason is that, as Gennaro Zezza points out here, the US economy is not overly exposed to a slowdown in European growth; not overly exposed, that is, compared to the fallout from a European financial panic. As Dimitri Papadimitriou and Randall Wray indicate, US finance is still entwined with the fate of European finance; at least in part due to the roughly $1.5 trillion invested in European banks by US money market mutual funds.

In other words, comparatively speaking, the US economy will not suffer much from European policy elites’ apparent relative disinterest toward the fate of their people, but may dodge a bullet if current efforts to save the European banking system work out. (At least in the short run. In the longer run, Ryan Avent is probably right to worry that this LTRO stuff may just amount to sweeping serious problems under the rug: “…when failure is never allowed the system becomes more brittle and the cost of a blow-up, which probably isn’t avoidable for ever, rises.”)

Comments

Gennaro Zezza | November 1, 2011

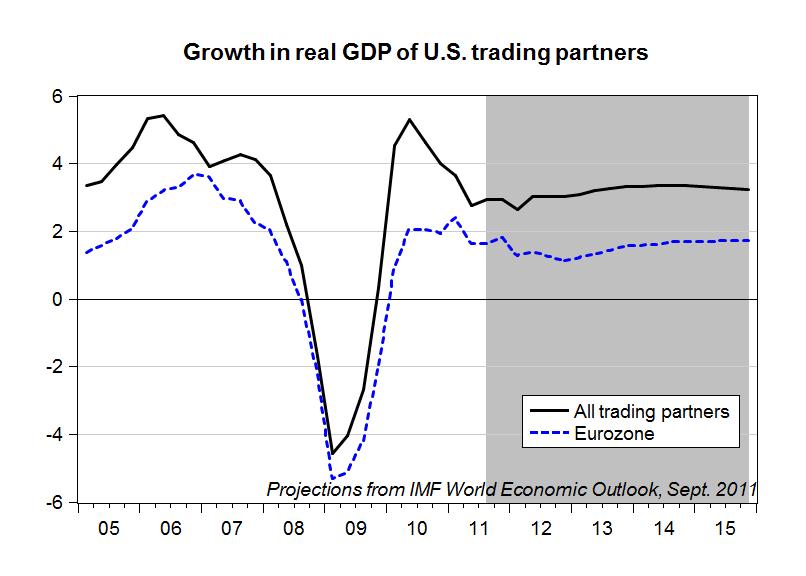

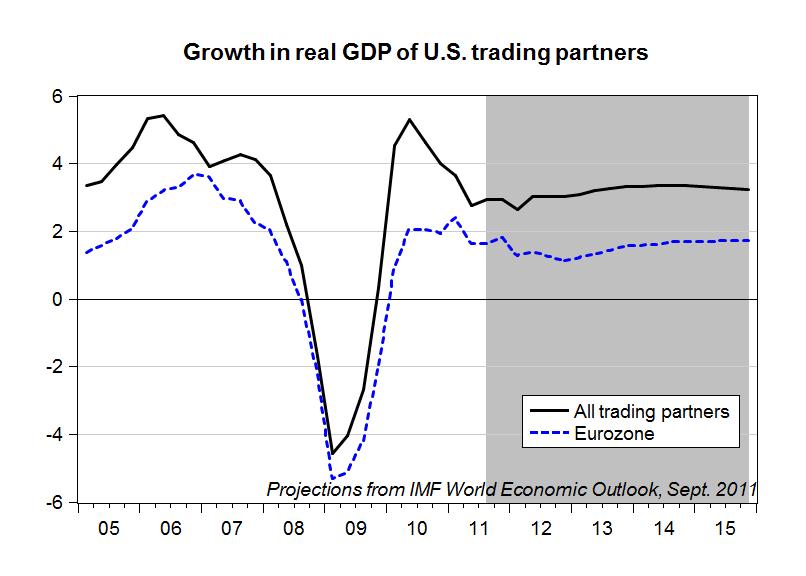

This post provides our latest update of the quarterly figures for the real and nominal GDP of U.S. trading partners (1970q1-2016q4), which were presented a few years ago in a Levy Institute working paper and have now been updated to the second quarter of 2011, with predictions up to 2016 based on the latest IMF World Economic Outlook.

The database has been requested over the years by other researchers, so we decided to put it up on our web site. It is, and will be, available here: http://www.levyinstitute.org/pubs/gdp_ustp.xls

Our index for the annual growth rate in the real GDP of U.S. trading partners, reproduced above, now shows that no boost in U.S. exports from accelerating growth in the rest of the world can be expected. More specifically, according to the IMF the eurozone will not contribute much to global growth, and if fiscal consolidation in Southern European countries will indeed be implemented, we expect a further slowdown in the area. Given that the eurozone accounts for roughly 16 percent of U.S. exports, the impact on the U.S. economy of a European slowdown, through trade, will not be dramatic — certainly not as dramatic as the potential negative impact on financial wealth if the eurozone sovereign debt crisis spirals out of control.

Comments

Greg Hannsgen | July 1, 2011

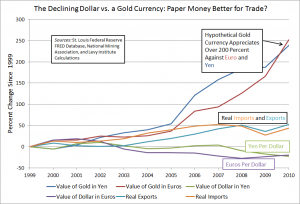

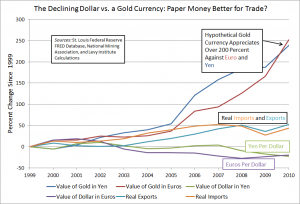

(Click figure to enlarge it.)

(Click figure to enlarge it.)

Some “gold bugs” advocate a return to the gold standard, which the United States officially abandoned in the early 1970s. The annual data in the chart above show that the price of gold has risen sharply in both euros and yen since 1999. Meanwhile, the dollar itself has fallen against both of the currencies, as shown by the lines near the bottom of the chart. Easy monetary policy has played a role in this drop. But a weakening currency has been one factor behind the recent increase in U.S. exports. The latter grew more than imports in percentage terms over the period shown in the figure. But nonetheless, both imports and exports grew by over 40 percent. It would have been difficult to increase exports at all with U.S. goods and services priced in a surging gold-backed currency.

It goes without saying that the price of gold could possibly fall rather than rise in coming years. But dealing with a commodity money whose value can abruptly change in ways that harm the economy is always a severe drawback of a currency backed by gold. Of course, if the United States had adopted a gold-backed currency in 1999, U.S. wages, prices, etc. would likely have behaved much differently than they did. Hence, one cannot be sure what the outcome of a switch to the gold standard would have been. But these other changes could also easily have been detrimental to the health of the U.S. and world economies.

Comments follow:

continue reading…

Comments

ShareThis

ShareThis