Michael Stephens | February 15, 2012

April 11–12, 2012

Ford Foundation, New York City

A conference organized by the Levy Economics Institute of Bard College with support from the Ford Foundation

This Spring, leading policymakers, economists, and analysts will gather at the New York headquarters of the Ford Foundation to take part in the Levy Institute’s 21st Annual Hyman P. Minsky Conference. This conference will address, among other issues, the challenge to global growth represented by the eurozone debt crisis; the impact of the credit crunch on the economic and financial markets outlook; the sustainability of the US economic recovery in the absence of support from monetary and fiscal policy; reregulation of the financial system and the design of a new financial architecture; and the larger implications of the debt crisis for US economic policy, and for the international financial and monetary system as a whole.

Visit the Levy Institute website for more information and online registration.

A list of participants is below the fold. continue reading…

Comments

Michael Stephens | February 14, 2012

C. J. Polychroniou refers here to the fact that private sector salary cuts are part of the “rescue package” recently approved by the Greek Parliament. Asked to comment at the Foreign Policy blog, Dimitri Papadimitriou explains why this attempt at internal devaluation won’t work.

In an interview for Bloomberg Radio Papadimitriou also stresses that these measures are politically untenable (although approved by the Parliament, whether they will actually be implemented is another question). In the interview Papadimitriou goes on to say that European policymakers are merely trying to shield the rest of the eurozone from Greece so that the beleaguered country can eventually be shown the door. While policymakers’ rhetoric suggests they are unequivocally committed to ensuring that Greece remains in the Union, Papadimitriou argues that their actions suggest otherwise. Without any serious investment in kickstarting Greek growth—Papadimitriou references what was done with East Germany following reunification—what we’re looking at here are not serious attempts to keep the eurozone intact.

Listen to or download the Bloomberg interview here.

Comments

Michael Stephens |

C. J. Polychroniou has a new one-pager that starts off by noting the asymmetries in the approaches taken by governments in the US and Europe to the 2007-08 crash and its aftermath: featuring bold public interventions to save the banking and financial systems but relatively limited measures for the millions of unemployed. He then turns his sights to the latest 130 billion euro Greek “rescue” package and, in the context of a series of such packages and their accompanying austerity demands, Polychroniou suggests that Greece is being pushed too far:

It is high time for Greece to put an end to the EU farce that has now turned into a real tragedy. The nation should refuse to accept another lethal injection and threaten immediate default. At this juncture, there is no other way out.

Read it here.

Comments

Gennaro Zezza | February 13, 2012

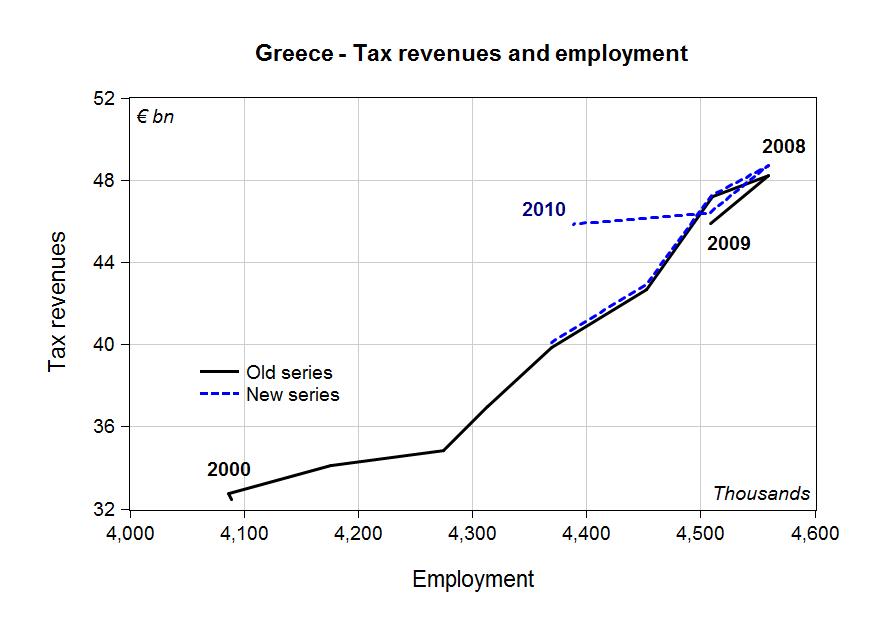

From a peak of 4.5 million workers in 2008, Greece has already lost 500,000 jobs. Our first chart shows that the country is already in its worst condition since the beginning of the century in terms of the share of the working age population who have a job (our projections are based on the last monthly data for 2011).

It is hard to see how laying off another 150,000 workers from the public sector, as requested for a new international loan, will help Greece to recover.

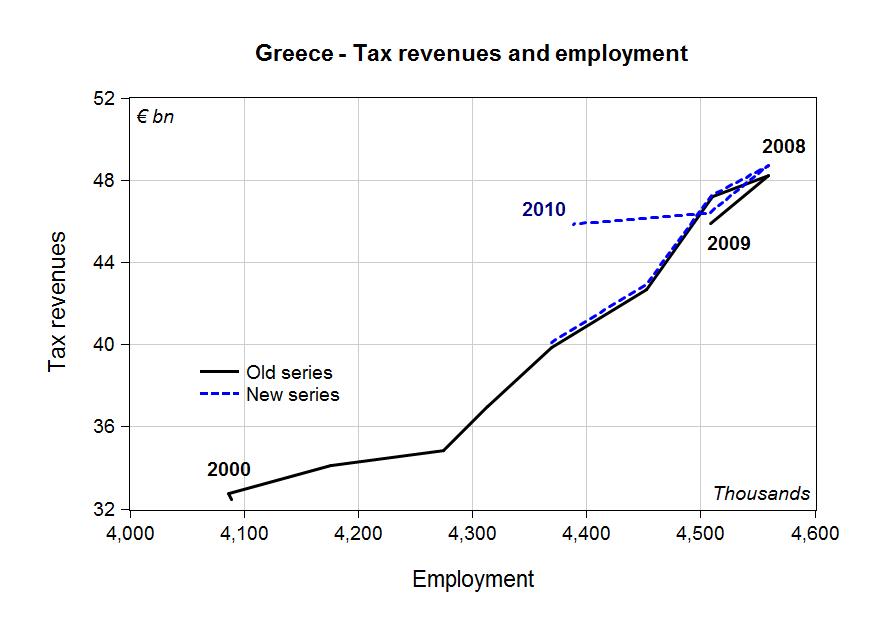

In the next chart we compare government tax revenues to employment, where tax data are from the sectoral accounts of Greece. Although the recent data revision to sectoral accounts are less pessimistic than the former release, we should expect the fall in employment to produce a corresponding fall in government revenues, with adverse effects on government deficits and debt.

What Greece needs are policies to create jobs.

(all data from El.Stat.)

Comments

Michael Stephens | February 10, 2012

No matter what happens on Sunday, when the Greek parliament is scheduled to vote on the latest bailout package, on Monday Greece will wake up in the grip of an employment crisis (20 percent unemployment, with a near 40 percent youth unemployment rate). In the Huffington Post Dimitri Papadimitriou tells us what we can (and can’t) do about it.

Depending on the Greek private sector alone to produce enough jobs to stave off these socially corrosive levels of unemployment is unrealistic. Drawing from a report on the Greek labor market recently produced by the Levy Institute, Papadimitriou lays out the case for direct public service job creation. As Papadimitriou points out, Greece is currently experimenting with a similar, small-scale version of the idea:

… a better option is being tried on a small scale: A labor department direct public service job creation program with an initial target of 55,000 jobs. Participants are entitled to up to five months of work per year, in projects — implemented by non-governmental organizations — that benefit their communities. A similar, streamlined, Interior department program, this one without NGO participation, will generate up to 120,000 openings.

This approach is the Greek government’s best shot at slowing the nosedive in employment, and at circumventing further catastrophe. The plans have been designed to specifically address and avoid the nepotism, corruption, and favoritism that plague poorly conceived ‘workfare’ schemes. With proper targeting, monitoring, and evaluation as the projects move along, the outcomes should be impressive

Read the whole thing here at HuffPo.

Comments

Greg Hannsgen |

(Click to enlarge.)

See the blue line in the upper half of the figure above? That line shows the portion of personal income made up of wage and salary disbursements, as a percentage of total personal income. (As the figure notes, I’ve subtracted social insurance contributions such as Social Security taxes. Also, employer contributions to Social Security, private pensions, etc., have been completely ignored in my calculations.) I have been looking into the possible effects on consumer spending of changes in the composition of income. Please click on figure if you want to see a larger version.

Comments

L. Randall Wray | February 9, 2012

(cross posted at EconoMonitor)

Yves Smith at Naked Capitalism has long been skeptical of the negotiations by the State Attorneys General and the banksters over the foreclosure frauds (see here). And while I had held out some hope that California and New York would either refuse to join, or would insist on good terms, today’s announcement of the settlement makes it clear that the banksters had their way. I expect that the US Attorney General, Eric Holder and HUD Secretary Shaun Donovan played important roles in making sure the bank frauds would only get little slaps on the wrist.

Some of the details are not clear, but apparently the 750,000 people who had their homes stolen from them will get a mere $2000 a piece in compensation. That is how this Administration values homeownership. Yep, a bankster can take your home and you might get two thousand bucks–and with that you can pay first and last month’s rent on a cheap, run-down apartment if you are willing to live in a low rent city.

It also gives you some idea of the cost of buying out 49 states: $2.75 billion. Yep, that is all that the states get out of this settlement. They’ll look the other way and let you move in, completely destroy property records and proceed to steal the homes of your citizens while destroying your economy and tax revenues–and for under 3 billion measly dollars you can buy off their chief prosecutors.

What about underwater borrowers? Well after crashing the real estate markets, the worst of the banksters have agreed to provide $3 billion for relief. How far underwater are homeowners? $700 billion. So far. continue reading…

Comments

Michael Stephens |

To provide a little more perspective on the news of the just-announced Greek bailout agreement, I point you to this CNN Money piece from yesterday in which Dimitri Papadimitriou notes how abysmal the underlying economic growth trends remain (Greek employment depends a lot on shipping, which is faring poorly) and reminds us that the package, containing some brutal measures like a 25 percent cut in the minimum wage, would still need to be approved by the Greek parliament:

“It’s a cautious euphoria because investors are only looking at the short-term. Of course, there should be an agreement between the troika and the Greek government,” Papadimitriou said. “But you can’t assume that a Parliament that is in disarray will approve more austerity measures.”

Voting on the package in the Greek parliament is scheduled for Sunday. Stay tuned.

Comments

Michael Stephens |

Well then. Apparently not everyone agrees that the Federal Reserve is having trouble balancing its dual mandate. Rather, I should say that not everyone agrees about the nature of the imbalance. From the Boston Globe‘s reporting of Ben Bernanke’s appearance in front of the Senate Budget Committee, we find this:

“It seems to me that you care more about unemployment than about inflation,’’ said Senator Charles E. Grassley, Republican of Iowa.

“I want to disabuse any notion that there is a priority for maximum employment,’’ Bernanke responded.

Bernanke deserves credit here for refraining from hitting himself over the head with a frying pan in response. (Is this just a cynical form of “working the ref” or does the Senator really believe it? If the latter, what more could possibly disabuse him of this notion?) I suggested yesterday that you “don’t need to look very hard” to see that the Federal Reserve is doing much better at keeping inflation in check than at controlling unemployment—but you do need to look.

I’ll outsource the rest to the The Economist (where Ryan Avent performs the literary equivalent of hitting himself over the head with a frying pan):

During the second half of 2010, annual inflation stood at its lowest level in over half a century. Unemployment, by contrast, peaked at 10.0%. Only once in the post-war period did the jobless rate rise above that level. Only twice in the postwar period has the country experienced a recession that brought the unemployment rate above its current level, at 8.3% […] I’m left to muse that Mr Grassley must say good-bye when he enters a room and hello when he leaves, and wears his shoes on his head.

Comments

Michael Stephens | February 8, 2012

The latest chapter in the “why was the original stimulus so small?” story is a memo from December 2008 that reveals Larry Summers’ assessment as to why the stimulus (ARRA) had to be limited to around $800 billion—about half of what was necessary, in Summers’ estimation. There are various conclusions you can draw from this memo, but the aspect I’d like to focus on is this: Larry Summers’ suggestion that $225 billion of “actual spending on priority investments” is all that the government could get out the door over a two year time span (and so the rest had to be made up of tax cuts, aid to states, etc.).

Let’s grant for the sake of argument that Summers is correct about this “shovel ready” figure. The question is: what can we do about it? If you’re looking for short-term results, the answer is probably “not much.” Even things like speeding up environmental impact assessments for infrastructure projects wouldn’t have much effect (at the link, Brad Plumer tells us that only 4 percent of highway infrastructure projects even require such environmental reviews).

But looking ahead, there is more we could and should be doing. Back in 2009 Martin Shubik sketched out a plan in a Levy Institute policy note for creating a “Federal Employment Reserve Authority“—a kind of Fed for employment (yes, I know: the Federal Reserve is the “Fed for employment.” But you don’t need to look very hard to see that the sides of the dual mandate aren’t equally weighted). Among other things, the FERA would maintain state branches that are charged with keeping updated and prioritized lists of potential public works projects (with a preference for self-liquidating projects) and providing constant monitoring and evaluation so that financing can be put in place as soon as unemployment reaches a particular trigger level in that region. Regional public investment would respond to objective employment conditions. continue reading…

Comments

ShareThis

ShareThis