Waiting for Export-led Growth in Greece

The policy strategy being imposed on Greece by its international lenders depends on the success of something called “internal devaluation”: in the absence of being able to devalue its own currency, Greek wages have been cut in the hopes that this generates an export-led economic recovery. So, how is this going? As Dimitri Papadimitriou, Michalis Nikiforos, and Gennaro Zezza explain in a new One-Pager, not very well.

The authors observe that Greece has succeeded in increasing the sort of “competitiveness” required by this strategy: it has lowered its relative labor costs more than any other country in the eurozone except for Germany. Furthermore, Greece’s net exports have expanded since 2009.

Mission accomplished? Not quite. One problem, the authors point out, is that 71 percent of Greek export growth since 2009 has come in the form of an increase in the value of trade related to its oil refineries — which is to say, in an area that has little to do with internal devaluation (and depends on volatile factors like changes in oil prices). Most of the increase in net exports came from a decline in imports (a result of the neverending recession).

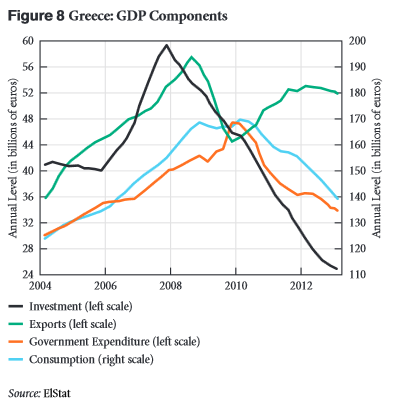

But most important of all, the gains from net exports have not come close to offsetting the dramatic plunge in domestic demand, as you can see here (this figure comes from their July strategic analysis):

Now, perhaps we just need to give the troika’s (EC/IMF/ECB) strategy more time. Perhaps exports will eventually pick up across the board (beyond refined petroleum products) and on such a scale as to generate a recovery. As this recent headline from Ekathimerini indicates, we shouldn’t be holding our breath: “Greek exports post worst performance in three years.” And the model developed by Papadimitriou, Zezza, and Nikiforos — based on the stock-flow approach of Wynne Godley recently featured in the New York Times, and tailored specifically to the Greek economy — suggests that it would take a very long time just to discover whether there’s anything to this theory of internal devaluation.

Meanwhile, the costs of sticking with the troika’s program look (socially and politically) unsustainable: the authors project that if Greece continues with current policies, it may be looking at an unemployment rate around 34 percent by 2016. (By comparison, the EC/IMF predict that if everything goes according to plan — and it is notable that, year after year, the Greek economy has consistently performed worse than their projections — unemployment will be “only” 20 percent in that year.)

Dimitri Papadimitriou, Michalis Nikiforos, and Gennaro Zezza’s new One-Pager: “Waiting for Export-led Growth: Why the Troika’s Greek Strategy Is Failing” (pdf).

See also “The Greek Economic Crisis and the Experience of Austerity,” a Strategic Analysis.

For more details on their model, see this technical paper: “A Levy Institute Model for Greece.”

ShareThis

ShareThis