The IMF’s Puzzling Current Account Projections

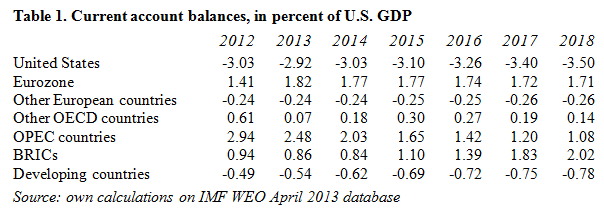

The following table has been computed using data from the latest (April 2013) IMF World Economic Outlook database, with IMF estimates starting in 2013 for most countries.

In my view, these projections are based on heroic assumptions and wishful thinking. The eurozone is supposed to improve its position, even though the current account balance of Germany is supposed to drop substantially (from 1.52 percent of US GDP in 2012 to 0.93 percent in 2018): Greece, Italy, Portugal, and Spain are all supposed to move from a current account deficit in 2012 to a surplus from 2013 onwards, and France is also supposed to reduce its current account deficit.

It therefore seems that the IMF is assuming some equilibrating process inside the eurozone, but overall this area will either be importing less from abroad (while keeping its exports constant) or exporting more. In the former case, the eurozone will impart a deflationary impulse to its trading partners. In the latter case, which area is supposed to absorb the additional eurozone exports? Looking at the table, the candidates are either the United States, which is projected to see its current account deteriorate even further, or developing countries.

If export-led growth from China – the only country in the BRICs for which the IMF projects an improvement in its current account – and the eurozone must rely on additional demand from developing countries, plausibly out of borrowing, global imbalances will trigger a new round of financial instability worldwide.

The other puzzling feature in IMF projections is the substantial fall in the current account of OPEC countries. Is the IMF hoping for a permanent shift of the world economy away from oil products, and therefore a fall in the price of oil? If this is the case, I would expect a fall in the US current account deficit, rather than an increase. But given the permanent turmoil in the Middle East, hoping for a consistent drop in the price of oil may be wishful thinking.

ShareThis

ShareThis