Help Is Not on the Way

An update on the distressing state of fiscal and monetary policy in the United States and Europe:

Chairman of the Federal Reserve to Congress: “I’d be much more comfortable, in fact, if Congress would take some of this burden from us ….”

Congress to Bernanke: No thanks. And while we’re on the subject, we would be much more comfortable, in fact, if you’d just stop carrying the load entirely. Kindly leave the economy in the ditch right there. Or as Binyamin Appelbaum put it in his NYTimes report:

Republicans on the committee pressed repeatedly for Mr. Bernanke to make a clear commitment that the Fed would take no further action to stimulate growth. “I wish you would look the markets in the eye and say that the Fed has done too much,” Representative Kevin Brady of Texas told Mr. Bernanke. Democrats, by contrast, inquired politely after the Fed’s plans and showed surprisingly little interest in urging the Fed to expand its efforts.

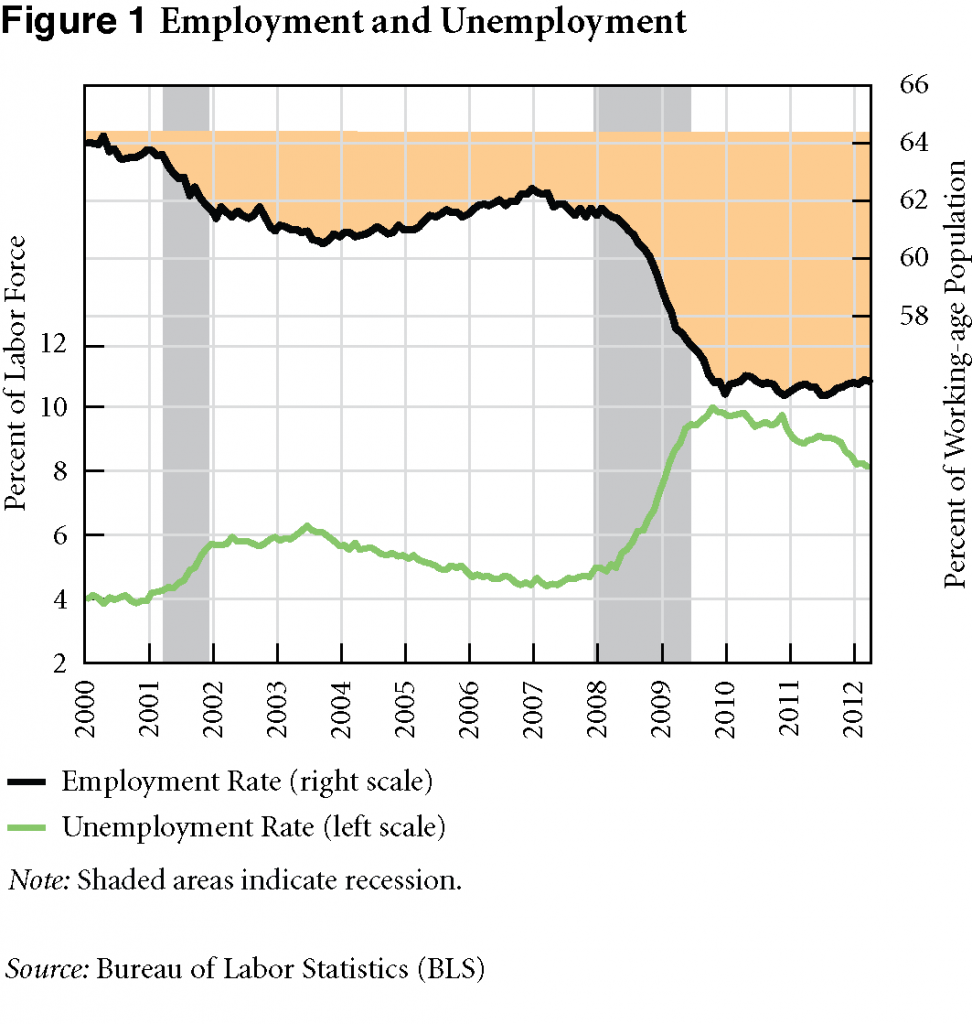

Perhaps the private sector can muddle through on its own? Here’s a graph from the Levy Institute’s Strategic Analysis showing employment and unemployment rates going back to 2000:

To fill the gap in the employment rate represented by that orange area, according to the macro team “the nation needs to find jobs for about 6 percent of the working-age population, or roughly 15 million people. Since the working age population has been growing on average by 2.4 million people per year, or 205,000 each month, job creation that barely reaches a threshold of that number multiplied by the current employment-population ratio of about .59 will not narrow the gap.” Last month the economy generated an estimated 69,000 new jobs. You don’t need your calculator to figure out that won’t narrow the gap.

And how are things in Euroland? Well, here’s the Washington Post‘s Ezra Klein on Mario Draghi, head of the European Central Bank:

He can print money. He can lower interest rates. He can fund banks. He can comfort investors. He is perhaps the only person on the planet who, with a few words, could mostly end the euro zone’s crisis. But he refuses to say those words. And that’s because he doesn’t want to end the crisis. He wants to keep it going. To be fair to Draghi, he’s not just a sadist. His view is that if the ECB steps in to save the day, the euro zone won’t make the structural reforms necessary for its future. Pain and terror are leverage to force member countries to make tough decisions …

What about fiscal policy? Ireland recently approved the EU’s proposed new “Fiscal Compact,” which sets incredibly tight budget limits backed by stiffer penalties. This is Yanis Varoufakis’ assessment of the Compact:

Suppose that every European citizen adopts the fiscal compact as her or his guiding principle and puts its implementation above all else in life. If Spain, Italy, Portugal, Ireland, France, Greece, Germany etc. (i.e. countries with debt well above 60% of GDP) were to reduce their debt by the specified 5% per annum, this would mean that all these nations should turn an average 2.8% primary deficit to something akin to 6% primary surplus. Suppose we could do it (which, of course, we cannot). Were we to succeed in this endeavour, the result would be a very deep recession equal to at least -4.5% in terms of average Eurozone-wide ‘growth’. In a period when a banking crisis is in full swing, the Periphery is in free fall, US growth is tittering of the verge, China is slowing down etc., engineering such a recession via this piece of ‘legislation’ is the macroeconomic equivalent of committing suicide.

And again, markets are showing no willingness to withstand this policy beating. C. J. Polychroniou:

Greece has been in recession since 2008 and its GDP has experienced an unprecedented decline for a European economy in peacetime, shrinking by 4.5 percent in real terms in 2010 and by 7 percent in 2011; the Greek central bank predicts that GDP will fall by an additional 5 percent in 2012. Salaries, wages, and pensions have been cut by as much as 35 percent, taxes of all sorts are being levied on individuals (a property tax, a “solidarity” tax, big sales tax increases), the official unemployment rate has skyrocketed to over 20 percent, poverty and homelessness are widespread, and there has been a sharp increase in suicides.

ShareThis

ShareThis