Employment in Greece

From a peak of 4.5 million workers in 2008, Greece has already lost 500,000 jobs. Our first chart shows that the country is already in its worst condition since the beginning of the century in terms of the share of the working age population who have a job (our projections are based on the last monthly data for 2011).

It is hard to see how laying off another 150,000 workers from the public sector, as requested for a new international loan, will help Greece to recover.

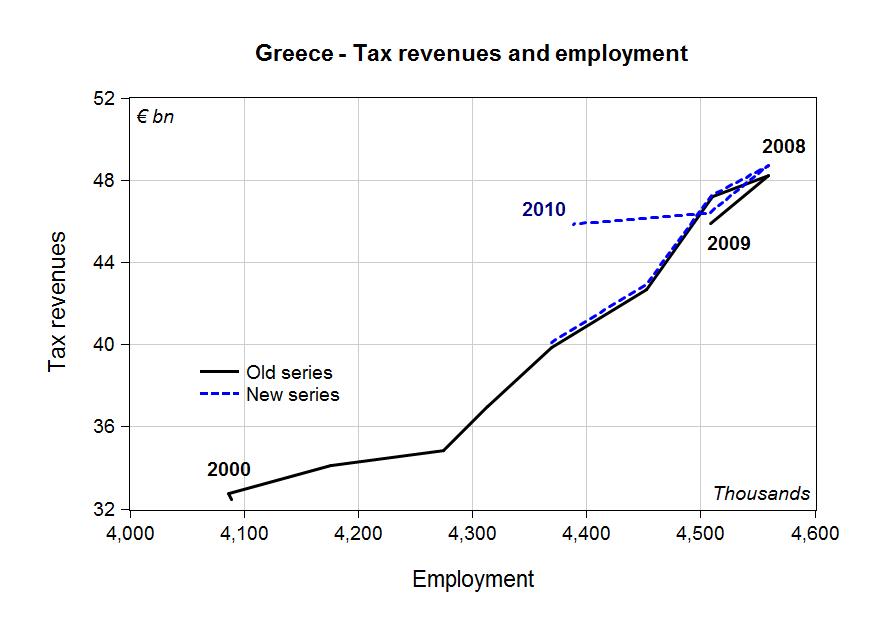

In the next chart we compare government tax revenues to employment, where tax data are from the sectoral accounts of Greece. Although the recent data revision to sectoral accounts are less pessimistic than the former release, we should expect the fall in employment to produce a corresponding fall in government revenues, with adverse effects on government deficits and debt.

What Greece needs are policies to create jobs.

(all data from El.Stat.)

ShareThis

ShareThis

Can’t the ECB just give Greece some money in return for, say, the works of Plato and Aristotle? Or how about for coming up with the Olympics? It could be like a royalty payment 🙂

I know that a Greek default is bad in that it seems to make it OK for others to default. But what’s the result?

The banks can be nationalized for a few days and the Greeks keep their money. It’s not like the Greeks are going to be able to pay their debts given any foreseeable scenario.

This keeps more money in the hands of the Greeks, which is what needs to happen anyway. Should the Greeks play the game and attempt to pay their debts by impoverishing themselves and just hope that the Germans are magnanimous enough to send them some fruit cake at Christmas? When will all these people realize that not everyone can be a net exporter? Net importers that don’t control their own currency are by definition in trouble, no?

I agree: it is foolish to think that all countries in the Eurozone become net exporters to get out of trouble. Who would be willing to become the net importer?

Either the Euro area establishes new mechanisms to offset structural imbalances, and meanwhile the ECB allows rolling over the debt of Greece and other countries in trouble, or the sooner the euro experience is over, the better?