Confusion in Euroland

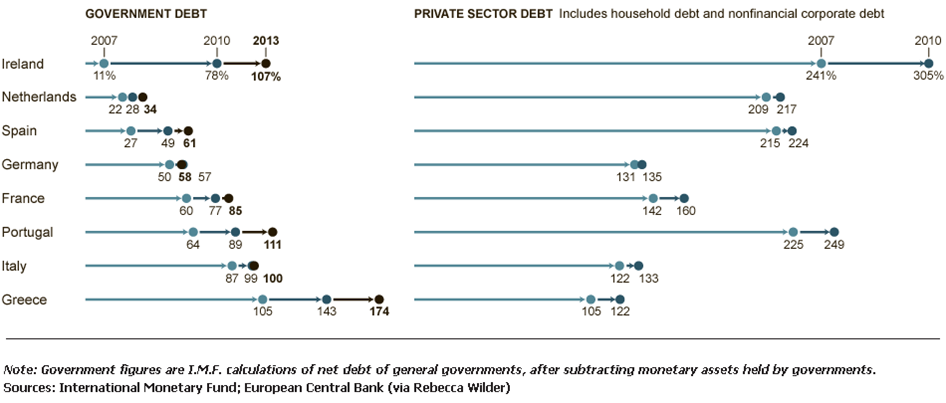

In a new one-pager, Dimitri Papadimitriou and Randall Wray team up to offer their take on the confusion that seems to afflict many approaches to the eurozone crisis. Government spending did not cause this crisis, they argue, and austerity will not solve it. Wray and Papadimitriou include this chart showing both government and private debt ratios for key EMU nations. They note that prior to the crisis only Italy and Greece were substantially beyond the 60 percent Maastricht limit for government debt. But if you look at private sector debt, every one of these countries had debt ratios above (well above, for most) 100 percent of GDP. (click to enlarge)

The problem, in other words, goes well beyond Mediterranean profligacy. “There was something else going on here;” they write, “something that has been in the works for the past 40 years: a general trend in the West of rising debt-to-GDP ratios. While government debt is part of this trend, it is dwarfed by the rise in private debt. Taking the West as a whole, government debt grew from 40 percent of GDP in 1980 to 90 percent today, while private debt grew from over 100 percent to roughly 230 percent of GDP.”

Moreover, tackling the crisis through austerity is bound to fail as long as policymakers continue to be oblivious to balance sheets. The only way that austerity in the periphery will not cripple economic growth (and therefore worsen the private debt problem) is if there is a substantial reduction in current account deficits in the periphery. But this is only possible if Germany reduces its current account surplus—and there is no evidence that key policymakers will make this happen. That leaves us, say Wray and Papadimitriou, with deflation as the only mechanism for restoring competitive balance. In other words, it leaves us with an approach that makes default, and the collapse of the EMU, more likely.

Read the one-pager here.

ShareThis

ShareThis