Can We Afford the Usual?

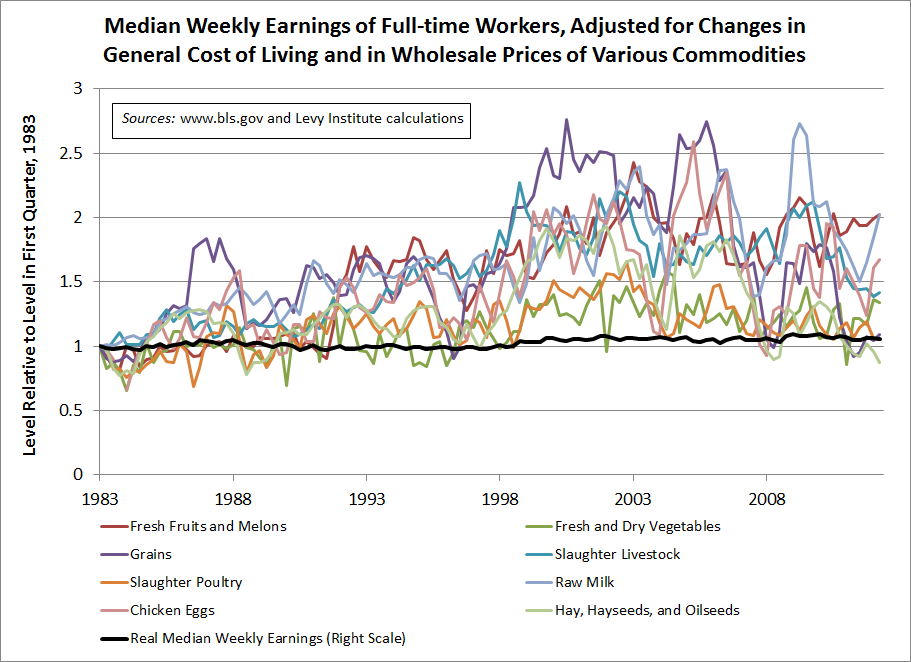

With yesterday’s quarterly BLS data release on “usual weekly earnings” out, I have once again constructed some “alternative” measures of real wages, based on price indexes for food commodities at the wholesale level. The commodity-based indexes are depicted in the figure above with lines in various colors. Compared to the more typical measure of real, or inflation-adjusted, earnings, which is seen in black, the food-commodity wages may be of interest in different contexts: for consumers who spend relatively large portions of their budgets on food, for example, or to those following the debate over the unfortunate SNAP (food stamp) cuts in the farm bills recently passed by the Senate and the House Agriculture Committee (see this earlier post). Inflation at the wholesale level is sometimes a harbinger of similar trends in prices paid by consumers at retail stores, so the series shown above may be most helpful as indicators of possible future trends in the standard of living. Along these lines, the Financial Times reports that prices for food commodities will be higher this decade than last, according to two major forecasters. The cited reasons for the expected rise in food-commodity prices include an expected upward trend in the price of oil, climate-related crop failures, and demand from emerging economies.

It is best, given that the data are not seasonally adjusted, to look at changes compared to the second quarter in another year. Also, since the commodity-price indexes are rather volatile, changes over fairly long periods are most informative. The second-quarter “real” wage results, relative to the second quarter of 2010, are: in terms of a broad BLS price index, -1.5 percent; fresh and dry vegetables, +10.6 percent; fresh and dry vegetables, +24.0 percent; grains, -38.6 percent; slaughter livestock, -16.0 percent; slaughter poultry, -3.2 percent; raw milk, -4.6 percent; chicken eggs, -14.5 percent; and hay, hayseeds, and oilseeds, -33.1 percent. The results for the past year have been a bit better, with five of the eight commodity-wages rising, along with the BLS’s broad real measure, which has risen .3 percent over its second quarter 2011 level.

Update, July 20: I forgot to point out that the run-up in grain prices that I mentioned in Spring and Fall 2011 posts appears to have ended (see purple line) in the data shown in the figure; meanwhile however, certain grain prices are in fact rising rapidly again. As a matter of fact, the Financial Times reported again on commodity prices today, this time on its front page. In a report noting that soybean and corn prices reached record highs in commodities markets yesterday, it observes that the world is facing a new “food crisis,” owing largely to the drought currently affecting crop yields in the United States.

ShareThis

ShareThis