UK Debate and the Facts Moving in Opposite Directions

Today in the Guardian, Philip Pilkington notices the British Labour party potentially inching away from their scaled-down proposal for a “job guarantee,” an idea fleshed out by Hyman Minsky:

Minsky’s theories of financial instability suggested that capitalist economies were prone to serious downturns in which huge amounts of the labour force would find themselves unemployed. What’s more, this would lead to large shortfalls in demand for goods and services which would further exacerbate such downturns. The result was a vicious circle that would become worse and worse as the financial system evolved into an increasingly fragile entity and households and businesses became increasingly mired in debt. …

While progressive taxation and unemployment benefits went some way toward both protecting workers and propping up demand during downturns, it did not, according to Minsky and his followers, go nearly far enough. They believed that governments should offer a job to anyone willing and able to work and then pay for these jobs by engaging in increased deficit spending …

Read the whole thing. Pilkington notes that the original Labour proposal differed from Minsky’s “employer of last resort” in both its scope (limited to the long-term unemployed) and its compulsory nature (the ELR is meant to be voluntary, in Minsky’s original formulation), but the proposal did at least represent a departure from the Conservative government’s fixation with the budget deficit and an attempt to do something about the long-term unemployment crisis.

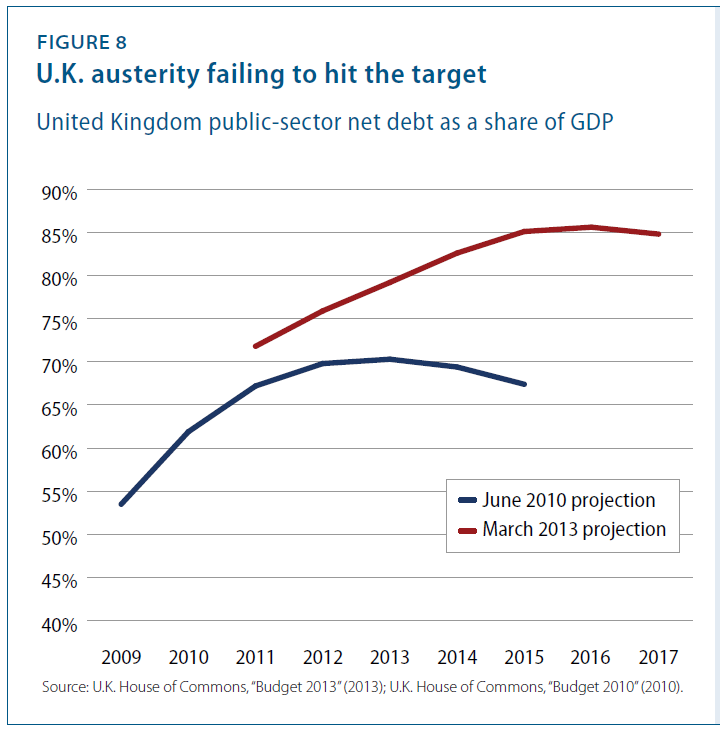

Pilkington now sees Labour leaders positioning themselves closer to the ruling Conservatives’ pro-austerity stance. That may or may not be a shrewd political move, but in terms of policy, what recent economic events have made austerity look more attractive? The UK just posted a blistering GDP growth number of 0.3 percent (thus barely avoiding its third slide into recession in the last five years), and as Michael Linden illustrates (pdf) with the figure below, since Cameron’s austerity measures were imposed in 2010, the UK’s projected debt-to-GDP ratios have gone up instead of down. Assuming the goal was to reduce the debt ratio, and not simply reduce government spending for its own sake, austerity seems to be failing:

ShareThis

ShareThis