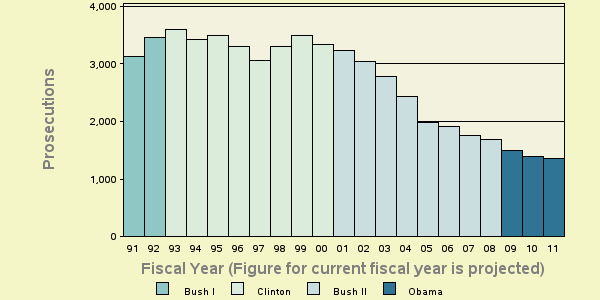

Financial Fraud Prosecutions Down 60% Over Last Decade

(Down 57.7 percent to be exact.)

Sure, Wall Street has returned to claiming its 40 percent share, or so, of all corporate profits, while receiving little more than a regulatory slap on the wrist (which lobbyists are currently working to bring down to a light effleurage), but at the very least, at the end of the day justice will be served for all those in financial institutions and all along the mortgage financing food chain who were engaged in fraud. So there’s that.

What’s that you say, Syracuse University? Oh, never mind:

Figure 1: Criminal Financial Institution Fraud Prosecutions over the last 20 years

(Via Catherine Rampell at Economix, who notes that this isn’t the result of some sort of generally more lax approach to federal criminal prosecutions over the last decade—prosecutions for other crimes have almost doubled over the same time span.)

Just to rub it in, read this paragraph from Randall Wray’s policy brief, “Waiting for the Next Crash,” and then take another look at that graph:

… policymakers must recognize that the activities leading up to and through the crisis were riddled with fraud. Fraud, at multiple levels, became normal business practice—from lender fraud and foreclosure fraud to the practice of duping investors into buying toxic securities with bait-and-switch tactics, while simultaneously betting against those securities using credit default swaps. Every layer in the home finance food chain was not only complex but also fraudulent, from the real estate agents to the appraisers and mortgage brokers who overpriced properties and induced borrowers into terms they could not afford, to the investment banks and their subsidiary trusts that securitized the mortgages, to the credit rating agencies and accounting firms that validated values and practices, to the servicers and judges who allowed banks to steal homes, and on to the CEOs and lawyers who signed off on the fraud. Once a bank has made a “liar’s loan,” every other link in the chain must be tainted. And that means every transaction, every certification, every rating, and every signature all the way up to that of the investment bank CEO is part of the cover-up.

Update: Or, read Matt Taibbi.

ShareThis

ShareThis