Michael Stephens | June 11, 2013

Ryan Avent wonders why, with unemployment too high and inflation too low — even by the Federal Reserve’s own previously articulated standards — there is so much talk of “tapering” coming from members of the Open Market Committee (talk of slowly drawing down the Fed’s asset purchases).

Avent mentions the possibility that considerations other than inflation and employment are guiding policymakers’ decisions: in this case, the concern that the current monetary policy stance is generating financial instability (by blowing up asset bubbles, according to the theory). Narayana Kocherlakota, head of the Minneapolis Fed, has occasionally been associated with this view, but if his April speech is any indication, his position has much more nuance to it.

For what it’s worth, a paper by James Galbraith, Olivier Giovannoni, and Ann Russo looked back at the Fed’s behavior from 1969 to 2003 to determine what really drives changes in Fed policy. The paper made waves by revealing an apparent partisan bias in monetary policy during election years, but the main findings were, if anything, more disturbing. In addition to Fed policy playing a causal role in increasing inequality, the authors found an important behavioral change after 1983:

… contrary to official claims, the Federal Reserve does not target inflation or react to “inflation signals.” Rather, the Fed reacts to the very “real” signal sent by unemployment, in a way that suggests that a baseless fear of full employment is a principal force behind monetary policy. … [A]fter 1983 the Federal Reserve largely ceased reacting to inflation or high unemployment, but continued to react when unemployment fell “too low.” continue reading…

Comments

Michael Stephens | June 7, 2013

Today in the Guardian, Philip Pilkington notices the British Labour party potentially inching away from their scaled-down proposal for a “job guarantee,” an idea fleshed out by Hyman Minsky:

Minsky’s theories of financial instability suggested that capitalist economies were prone to serious downturns in which huge amounts of the labour force would find themselves unemployed. What’s more, this would lead to large shortfalls in demand for goods and services which would further exacerbate such downturns. The result was a vicious circle that would become worse and worse as the financial system evolved into an increasingly fragile entity and households and businesses became increasingly mired in debt. …

While progressive taxation and unemployment benefits went some way toward both protecting workers and propping up demand during downturns, it did not, according to Minsky and his followers, go nearly far enough. They believed that governments should offer a job to anyone willing and able to work and then pay for these jobs by engaging in increased deficit spending …

Read the whole thing. Pilkington notes that the original Labour proposal differed from Minsky’s “employer of last resort” in both its scope (limited to the long-term unemployed) and its compulsory nature (the ELR is meant to be voluntary, in Minsky’s original formulation), but the proposal did at least represent a departure from the Conservative government’s fixation with the budget deficit and an attempt to do something about the long-term unemployment crisis.

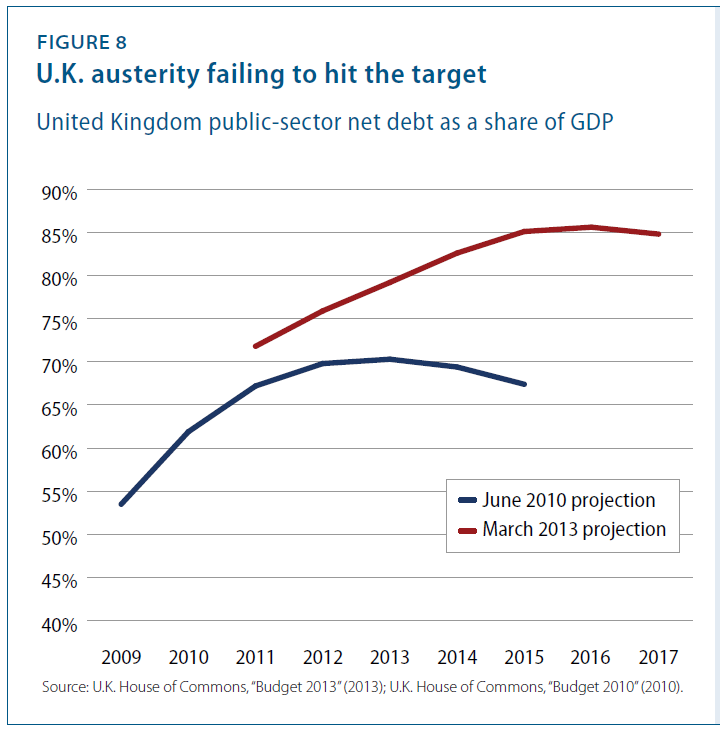

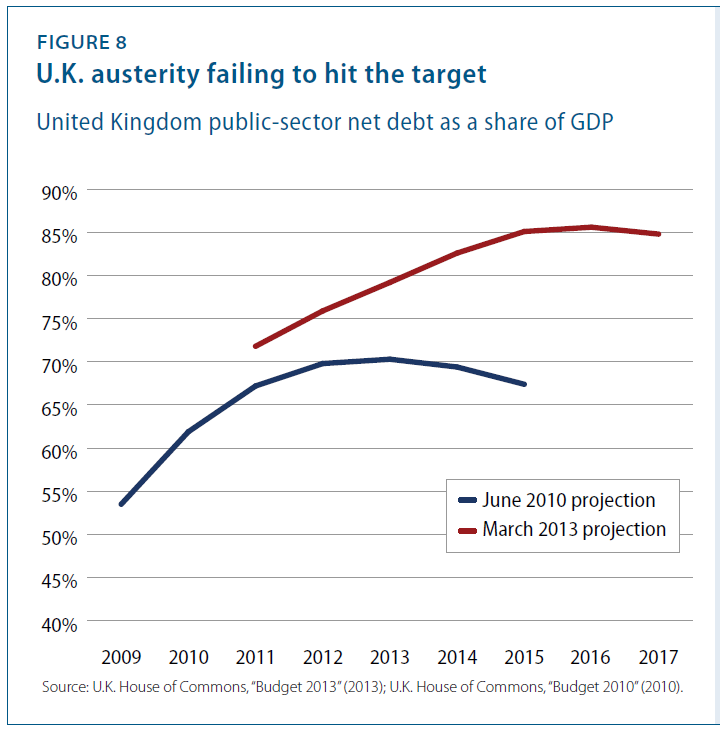

Pilkington now sees Labour leaders positioning themselves closer to the ruling Conservatives’ pro-austerity stance. That may or may not be a shrewd political move, but in terms of policy, what recent economic events have made austerity look more attractive? The UK just posted a blistering GDP growth number of 0.3 percent (thus barely avoiding its third slide into recession in the last five years), and as Michael Linden illustrates (pdf) with the figure below, since Cameron’s austerity measures were imposed in 2010, the UK’s projected debt-to-GDP ratios have gone up instead of down. Assuming the goal was to reduce the debt ratio, and not simply reduce government spending for its own sake, austerity seems to be failing:

Comments

Michael Stephens |

The US Senate investigation of JPMorgan Chase’s Chief Investment Office (CIO), and more specifically of the operations of its Synthetic Credit Portfolio (SCP) unit — otherwise known as the “London Whale” trades — concluded with the release of their full report in March. The report alleges that the CIO operated without a clear mandate and that its hedging activities were inappropriate. Neither of these claims, says Jan Kregel, gets to the real problem with the London Whale episode:

The problem arose when JPMorgan Chase created the equivalent of a shadow bank that funded the SCP’s short positions through what was in effect a Ponzi scheme. Further, while proprietary trading was involved in the losses, the real problem was that the bank was allowed to operate across all aspects of finance and the difficulties that this creates for efficient macro hedging. If we are to reduce systemic risk, not only must banks provide regulators with more detailed information on their balance sheet hedging, but it is also necessary to rethink the 1999 Financial Services Modernization Act, as it has led to banks that are too big to fail, manage, or regulate.

Read the rest here.

Comments

Michael Stephens | June 6, 2013

Annie Lowrey recently renewed the ongoing discussion over whether the Federal Reserve’s attempts at reviving the economy through quantitative easing (QE) are exacerbating inequality. The abbreviated version of the argument is that QE operates mainly through boosting asset prices, leading to gains in stocks and housing that largely benefit those at the top. If that’s the case (Lowrey quotes Josh Bivens suggesting that one would also have to weigh any potential reductions in the unemployment rate from the Fed’s easing), it’s bad news for those who care about inequality, because for the next three years, monetary stimulus is the only game in town (it will be interesting to see whether Republicans continue to be skeptical of fiscal stimulus if they win the White House in 2016).

Turning to fiscal policy, Ajit Zacharias, Tom Masterson, and Kijong Kim did a preliminary estimate (pdf) of the likely distributional impacts of the American Recovery and Reinvestment Act (ARRA). They found that the Recovery Act would have a positive impact on employment (largely “palliative,” given the rapid rate of job loss at the time) and little overall effect on inequality. A fiscal stimulus skewed more toward expenditure and less dominated by tax cuts than the Recovery Act could have a greater positive impact for low-income households and individuals.

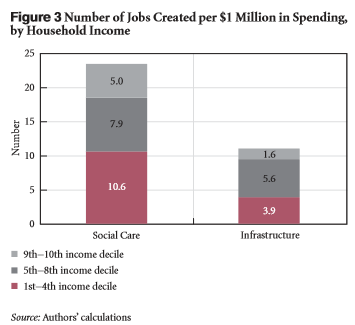

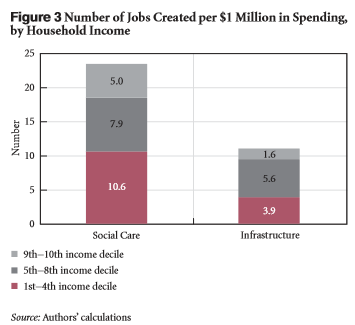

This is particularly the case if those expenditures come in the form of direct job creation — and even more so if we also consider projects in areas beyond infrastructure and green energy. Along with Rania Antonopoulos, Zacharias, Masterson, and Kim studied (pdf) the potential benefits of a direct job creation program in the social care sector (early childhood education and home-based care). They found that such a program would not only have a greater employment impact when compared to investment in infrastructure, but would also be particularly beneficial for households at the bottom of the income distribution.

Comments

Michael Stephens | June 5, 2013

This is how we came up with the official poverty line for the United States, back in the early 1960s: essentially, we put together a very basic diet, figured out the monetary value, and multiplied by three. If a family has less income than that number, adjusted for inflation, they’re poor.

There are numerous problems with this measure, and the Census Bureau has since come up with an alternative, the Supplemental Poverty Measure (SPM), which they started reporting in 2011. But there’s one very important item that’s left out of both the official and supplemental poverty measures: time. What does time have to do with poverty, you might ask? The extent to which you find yourself tempted to ask that question is partly a reflection of how much we still take unpaid work and its products for granted in economic analysis, and more generally.

Many of the products of household labor, like edible meals and basic healthcare and sanitation, are among those things absolutely essential to attaining a bare bones standard of wellbeing. Providing these products and services in adequate amounts takes time. If we don’t have the time to do this work ourselves, it’s often possible to buy substitutes on the market (housekeeping, day care, and so on), but either the time for unpaid work or the money to purchase substitutes needs to be accounted for. The outputs of unpaid household work can’t simply be taken for granted when we’re trying to measure people’s ability to secure the basics. Yet all around the world, we do just that when we put together our official poverty statistics.

A research team led by Ajit Zacharias, Rania Antonopoulos, and Thomas Masterson has been examining how the depth and breadth of poverty change when we take the demands of unpaid work seriously — how this changes who is counted as poor, and how poor they are considered to be. Their alternative measure is called “LIMTIP,” the Levy Institute Measure of Time and Income Poverty. In a recent interview, Rania Antonopoulos explained why LIMTIP is a crucial tool for figuring out how widely our formal and informal economies are delivering a meaningful chance at a decent life: continue reading…

Comments

Michael Stephens | June 3, 2013

Announcing two upcoming conferences, organized as part of the Levy Institute’s international research agenda and in conjunction with the Ford Foundation Project on Financial Instability, which draws on Hyman Minsky’s extensive work on financial governance, the structure of financial systems to ensure stability, and the role of government in achieving a growing and equitable economy:

Rio de Janeiro, Brazil

September 26–27, 2013

Among the key topics the conference will address are: designing a financial structure to promote investment in emerging markets; the challenges to global growth posed by continuing austerity measures; the impact of the credit crunch on economic and financial markets; and the larger effects of tight fiscal policy as it relates to the United States, the eurozone, and the BRIC countries.

(see here for list of participants)

Athens, Greece

November 8–9, 2013

Topics to be addressed include: the challenges to global growth and employment posed by the continuing eurozone debt crisis; the impact of austerity on output and employment; the ramifications of the credit crunch for economic and financial markets; the larger implications of government deficits and debt crises for US and European economic policies; and central bank independence and financial reform.

(see here for list of participants)

Comments

ShareThis

ShareThis